India’s private equity machine powers up

ChrysCapital’s $2.2 billion fund and renewed global interest signal a structural shift in India’s private equity sector

This was a week of unusually large signalling in India’s private equity (PE) landscape.

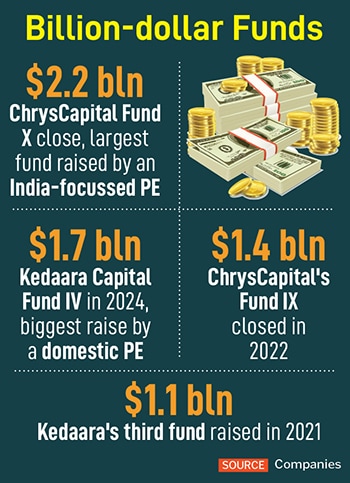

On Wednesday, ChrysCapital, the country’s biggest homegrown PE firm, closed its latest fund at $2.2 billion, the largest PE fund raised by an India-focussed manager. The development highlights Indian funds can now attract capital at a scale historically reserved for global buyout houses.

Earlier this week, KKR’s global co-chief executive Scott C Nuttall said the firm expects to invest between $90 billion and $100 billion globally in 2025, and that the India portfolio “will increasingly resemble the firm’s global profile over time”. India—along with Japan—is KKR’s best-performing market in Asia with the strongest returns, he during an interaction in Mumbai.

The ChrysCapital close sets a new benchmark for domestic firms. The earlier record was with Kedaara Capital, which raised a $1.7 billion fund in 2024.

It’s not just the domestic firms that are changing the investment landscape. Global PE firms, too, are ramping up investments and top-level hiring in the country.

Seven global funds now have Asia PE heads or co-heads based in Mumbai. These include Amit Dixit at Blackstone and Gaurav Trehan at KKR. Five years ago, there were none.

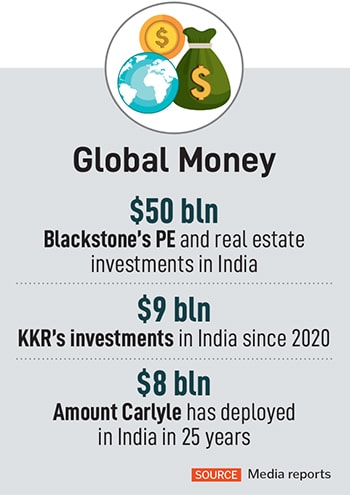

Blackstone, which has about $50 billion worth of PE and real estate investments in India, has singled out India as its best investment market in the world. And KKR, which has invested $9 billion in equity in India since 2020, said it is eyeing new sectors in the country.

The shift by global PEs reflects a macro reallocation. Since China is no longer absorbing capital at its historic pace, investors are diversifying. And India offers good investment rationale: It has high GDP growth rates, its stock market has been booming of late and deal activity has increased.

India was Asia-Pacific’s top performer in 2024—the only country with double-digit growth in both deal value and count, according to Bain & Company’s Asia-Pacific Private Equity Report 2025.

India stood out even in terms of exits. It was the region’s largest exit market last year by value and count, supported by a vibrant IPO market.

In emerging and growth markets, India captured nearly 41 percent of PE capital inflows this year, ahead of China’s 34 percent.

Also Read: ChrysCapital closes new fund with record $2.2 billion raise

India’s growth hasn’t been a straight line for investors. The sharp correction in the startup market has hit major backers, including Prosus, General Atlantic and the SoftBank Group. Companies such as Byju’s, PharmEasy and Oyo Hotels rode the boom until early 2022, but then saw their valuations collapse or, in some cases, business models break.

Another near-term risk is the US tariff policy. However, until there is clarity on that, both domestic and global PEs are betting that India will outperform other markets.

(With inputs from Bloomberg)

First Published: Nov 06, 2025, 11:02

Subscribe Now