Businesses invest time and money simply to make the right recruitment but continue to get it wrong. Interview-as-a-Service (IaaS) startups claim to simplify hiring, reduce expenses and provide top-notch talent at speed

Rahul Arora never wanted to participate in Shark Tank. The founder was sceptical that appearing on the reality television series would benefit his B2B startup, Intervue, in any way.

“I had that notion because people can directly purchase from D2C brands after seeing their Shark Tank pitch, and I felt that it wouldn’t affect B2B [startups] much because across a large enterprise who would watch a Shark Tank episode and say that I want this product,” Arora says.

Turns out, he was wrong. The reluctant entry into the show led to a significant deal with Aman Gupta, an angel investor and co-founder of boAt Lifestyle, who invested ₹1.5 crore for 2 percent equity in Intervue, an Interview-as-a-Service (IaaS) startup.

Like a dozen other IaaS startups in the country, Intervue works to simplify the hiring process—the most time-consuming activity for companies today—by offering a fully outsourced solution.

![]()

Talent acquisition has been one of the most persistent problems for tech companies for years—established enterprises and small independent firms alike—precisely because identifying, vetting and securing the right kind of talent for any company is a significant drain on resources that requires considerable logistical bandwidth, expertise and time.

For Rana Chakrabarti, general manager at Wipro, some of the main challenges while hiring have been the “closure of a high volume of candidate screening and technical evaluation, volume of skill demand, and the availability of the technical panel”.

This is where FloCareer stepped in. “Essentially, the whole pitch was around productivity—how to let your team focus on their core business rather than spending hours and hours on interviews,” says Mohit Jain, co-founder of FloCareer, an IaaS startup that now helps Wipro streamline its hiring.

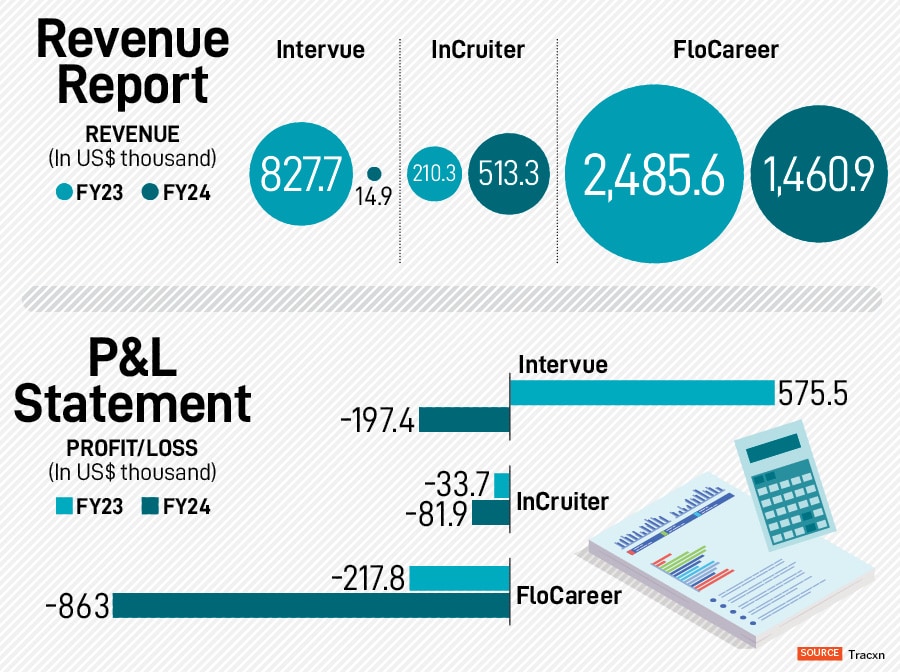

Though still in its nascent stages in India, IaaS startups see an opportunity to considerably alter how Indian businesses, particularly those in tech, acquire talent. “So, we measurably solve for three things here: Time, cost and resources,” says Anil Agarwal, who co-founded InCruiter in 2018.

IaaS startups are modernising HR recruitment by combining expert interviewers with AI (artificial intelligence) tools, allowing companies to secure better hires faster.![]()

Mohit Jain, Co-founder and COO, FloCareer

The Hiring Headache

Intervue was born from Arora’s experience as an engineering manager at Deutsche Telekom, where he struggled with the process of hiring his team.

“Even after taking a lot of interviews, we were selecting only one candidate out of 30. That’s when we realised that a lot of time goes into interviewing at the technical level,” he says.

But this was before the pandemic struck in 2020. As Covid forced people to work from their living rooms, the IT sector boomed with a massive influx of funding and an unprecedented demand for tech talent.

“That’s when companies started realising they needed to have such services in the market,” says Agarwal, who co-founded InCruiter in 2018.

![]()

The demand for skilled professionals in India, particularly in tech, vastly outstrips the supply of readily available, thoroughly vetted candidates. Neeti Sharma, CEO, TeamLease Digital, explains that this mismatch is because roles driven by tech, automation and platform work need higher skills, which are often missing in the Indian candidate pool.

“There’s also a mismatch between where talent is and where demand is geographically. Sectors that need high-volume talent like tech, BFSI, ecommerce, health care, and advanced manufacturing are feeling the most pressure,” she says.

Companies are spending an exorbitant amount of time and money on interviews, only to often end up with the wrong fit or lose out on talent due to slow processes.

“Let’s say you need to hire 50 people, which means that you will need to interview at least 500 people in a month. Which basically means [taking] 20 to 25 interviews a day. And all of them must be quality interviews. For freshers, this number can go higher. Companies like Amazon and Flipkart have a 50:1 ratio [interviewees-to-position ratio],” Jain explains.

While the tech industry continues its robust growth, there is a broader shift underway in the employment ecosystem. Even as Nasscom estimates the tech industry added almost $283 billion in revenue in FY25 and projects it will clock the $300 billion milestone in FY26, the future of its nearly six million employees face significant disruption. This AI transition is a double-edged sword for tech hiring. Though the Ministry of Electronics and Information Technology projects India’s AI workforce demand will surpass one million in 2026, an IT giant like TCS is initiating substantial layoffs as part of a ‘future-ready’ realignment focussed on adopting GenAI and consolidating senior management roles.

Jain explains that in the last seven to eight years, companies have started hiring more experienced professionals because AI has absorbed many junior positions. This has led to a world where “weird technology combinations” are required for each job role. “Today, companies want a data science engineer with cloud engineering,” he says.

![]()

But this shift is not sector-specific. From just catering to IT services companies a few years ago, Jain adds that “today, we are doing similar interviews for Nike, Pepsi, General Mills and T-Mobile”.

Arora believes these changes will only fuel the need for more engineers. He says while companies are laying off workers in one department, they are hiring in another. “AI is building newer jobs in green tech, robotics, manufacturing and health care, which were not penetrated as deeply before. The data engineers of today will become AI engineers of tomorrow. And those are the ones who are going to migrate,” he adds.

Could the AI transformation wave, coupled with the ongoing skills gap, create a fertile ground for these services to scale and expand?

The IaaS Engine

IaaS startups operate on a simple premise: Provide a pool of seasoned, domain-expert interviewers who conduct initial technical and behavioural assessments on behalf of their clients, who often —though not always—happen to be from the tech industry. This isn’t merely about vetting CVs though; it’s about deep-diving into candidates’ abilities, problem-solving skills and potential, using standardised, objective frameworks across all levels of recruitment, from entry-level to C-suite roles.

“We are human-led and AI-assisted. If you upload [CVs of] 100 candidates, these candidates are individually paired with human engineers who are working in other companies, who take these interviews [depending on their convenience], and these interviews are AI-assisted,” explains Arora, who has seen his client roster expand 20 times to 500 clients in the last five years. Intervue simultaneously assesses candidate coding skills in real time using its integrated development environment (IDE), which is compatible with more than 50 programming languages. Like other IaaS startups, this IDE is specifically tailored to its operational requirements.

Once the interview is complete, a detailed feedback report is delivered to the client in two hours, allowing the next round of interviews to begin almost immediately—a standardised operational framework across the entire IaaS ecosystem. And this way, the entire hiring process, which would typically take months, is wrapped up in three to six weeks. Apart from India, these startups serve clients across geographies in America, Europe, the Middle East and South Asia.

![]()

For Hershel Mehta, co-founder and partner at 2am VC, the venture capital backer of Intervue, the primary metric that validates this model is simple: “Interviews completed.” Mehta explains, “It’s a simple yet powerful reflection of product-market fit and real value creation for engineering teams.”

Interviewers, therefore, form the backbone of the IaaS model. Unlike traditional in-house recruiters, an IaaS interviewer is a vetted industry professional who is often a senior software engineer, a technical lead, or a domain architect from a top-tier tech company. They are frequently classified by the firms as either ‘freelancers’ or ‘gig workers’, depending on the company’s internal categorisation and legal structure.

Their key qualifications are thorough domain knowledge—for instance, in Python, DevOps or Data Science—and significant real-world experience, which allows them to conduct highly relevant and practical evaluations like live coding or system design.

Clients and investors are seeing tangible results from these services. At Wipro, for instance, outsourcing hiring to an IaaS startup helped optimise efforts by 60 to 70 percent, which ensured “continuity of billability for our own associates”, according to Chakrabarti.

Similarly, “a deep focus on automation, ability to retain sticky enterprise clients and the resilience shown by the founding team through different market cycles” were the key factors that led Eklavya Gupta, founder and CEO of Recur Club, to invest in InCruiter.

![]()

But how do traditional staffing agencies maintain relevance and revenue when IaaS providers are seizing control of the critical candidate screening and evaluation phase?

Sharma says even as these IaaS platforms work well for standardised, high-volume hiring, most clients still rely on staffing partners for relationship-driven and outcome-based delivery.

“IaaS startups have added a new layer to the hiring ecosystem, but they haven’t replaced what staffing firms do or will do. In fact, many staffing firms use IaaS as a complement to speed up parts of the process,” explains Sharma.

She adds that staffing is far more strategic than just screening candidates; it is also about workforce strategy, compliance engagement and retention—things where human expertise matters. “Companies are using IaaS for pre-screening so recruiters can focus on engagement and workforce planning,” she says.

The IaaS business model typically involves a per-interview fee or a subscription model for ongoing hiring needs. As these startups scale, many are investing heavily in AI-powered tools to aid in interviewer allocation, candidate matching and cheat-proof assessment. Platforms commonly price their interviews at ₹2,000-2,500, allocating ₹1,400-2,000 to the interviewer who conducts the session. “Pricing strategy can be there, but pricing cannot be your USP,” says Arora.![]()

Anil Agarwal, Co-founder and CEO, InCruiter Image: Nishant Ratnakar for Forbes India

The Roadblocks

For all their promise, IaaS startups face two major challenges—data security and funding.

The platforms handle highly critical and sensitive data: Candidate performance records, proprietary interview content and confidential client data.

![]()

So, building a network with a high-quality, reliable security framework is extremely important in ensuring data privacy and confidentiality for clients, candidates and interviewers.

India currently lacks a single, comprehensive statute specifically dedicated to AI regulation. Instead, its legal AI framework is evolving and relies on a patchwork of existing laws, new data protection legislation and forward-looking advisories from the government.

“We are complying with all kinds of regulations, Indian and global (like the EU’s data privacy and security law and ISO 42001, the first global AI Management System Standard),” says Agarwal. And until India’s Digital Personal Data Protection Act comes into full force, Agarwal says the company regularly conducts its own security checks and vulnerability assessments.

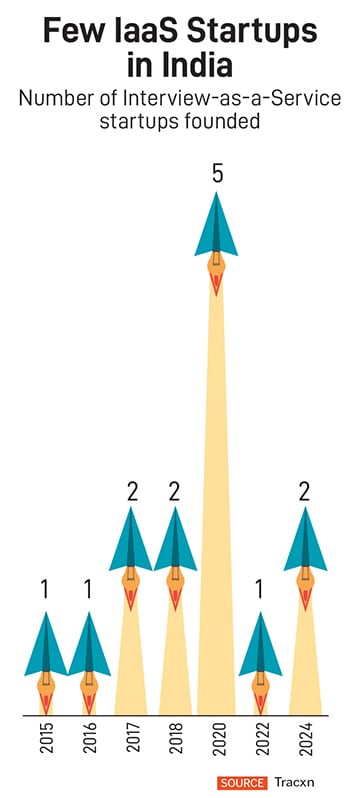

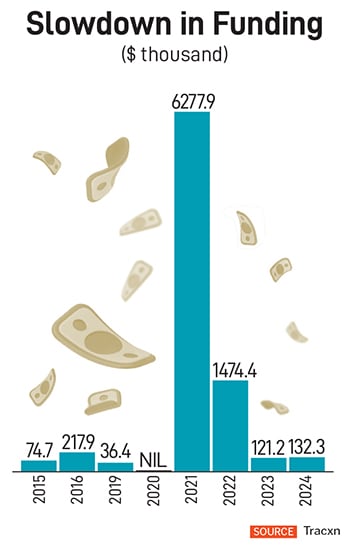

As these companies have agreements with their clients on data security, Arora explains that “all the data is encrypted. Customers can request deletion of the data at any point in time”. Another critical challenge is funding. The funding winter of 2023 hit the startups within this segment hard. From a high of $6.3 million in 2021, IaaS startups in India raised only about $132,300 in 2024.

“I have seen a lot of companies struggling to survive in the market,” says Agarwal. As external funding sources evaporated, the resulting company layoffs and hiring freezes also significantly destabilised the IaaS job market. Where these firms collectively employed over 150 people during the 2021-2022 hiring boom, their staff has since been reduced to fewer than 50 in 2025, according to startup data tracker Tracxn.

“Layoffs basically happened in 2023 because of market correction,” Jain concedes. According to Mehta, the biggest risk for competitive hiring startups like Intervue is maintaining their differentiation as they scale.

As companies become more comfortable with outsourcing non-core functions, the demand for skilled professionals will only intensify. IaaS providers may not be a complete replacement for staffing just yet. Instead, the platforms are becoming a crucial and integrated layer that complements and enhances the entire hiring process.