Team India jersey remains hot property despite five sponsor exits

Despite its fifth mid-season title sponsor exit, Indian cricket’s reach and visibility will allow the BCCI to command a higher premium for its next deal

At the Asia Cup beginning September 9, defending champion India will field a side that will wear an unusual look—the team led by Surya Kumar Yadav will go on to play without a sponsor’s logo on the front of the jersey. The team’s lead sponsor, fantasy sports platform Dream11, which started its association with the Board of Control for Cricket in India (BCCI) in 2023, exited its Rs 358-crore, three-year contract mid-season following the government’s ban on real money gaming. The board has released a tender to invite new sponsors to last till the 2028 cycle, setting a deadline of September 16 for the bids to come in.

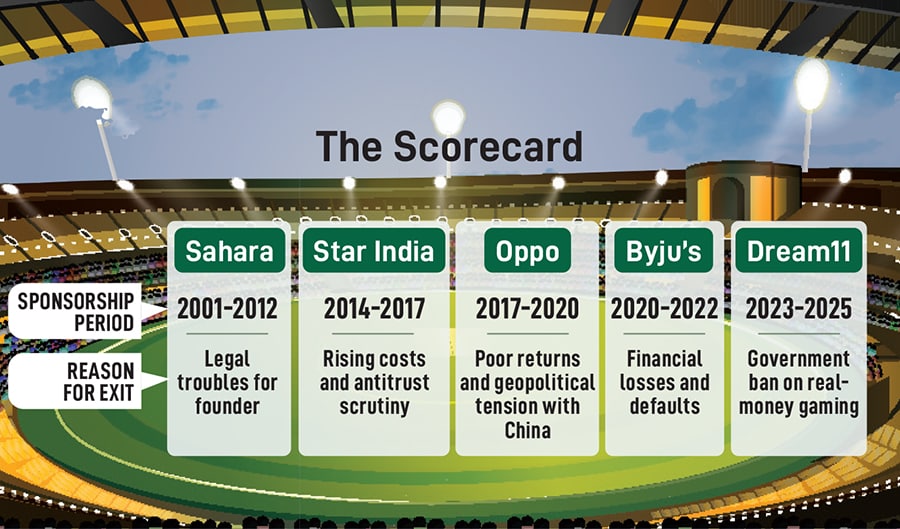

It’s not entirely unusual in global sports for teams to take the field without a lead sponsor. For example, English football club Chelsea has started the current season of the Premier League without a matchday shirt sponsor. But the BCCI title sponsorship, or the lack of it, is complicated by extraneous circumstances. Dream11 is also the fifth in a line of marquee sponsors—after Sahara, Star India, Oppo and Byju’s—to have opted out over issues ranging from financial losses, rising costs or government stance.

However, Bhairav Shanth, co-founder of sports marketer ITW Universe, feels the ramifications aren’t as significant as they are made out to be. “If India makes it to the final of the Asia Cup, it will play seven matches without a front-of-shirt logo. This has emerged out of a force majeure-like situation, so it’s out of everyone’s control. Since we are expected to have a new sponsor by September 16, the women’s ODI World Cup to follow and the men’s series against West Indies will all have a title sponsor,” says Shanth.

Besides, none of this is likely to take the sheen out of sponsoring the Indian cricket team. According to reports in the media, the BCCI is seeking a 10 percent increment over previous sponsorship values—with a base price of Rs 3.5 crore for a match, compared to Rs 3 crore for its deal with Dream11—and is expected to land it. “That front-of-shirt slot is probably the most prestigious property in world cricket right now,” says Shiv Burman, the founder of sports marketing agency Burman Sports. “Cricket is the second-most popular sport in the world and much of it is because of India. For the BCCI to set a 10-15 percent price hike seems quite sensible,” he adds. Shanth concurs. “The last auction took place two years ago, so if you account for inflationary changes, the incremental reserve price is a fair expectation for the BCCI,” he says.

While social media is busy connecting the dots about the ‘curse of the BCCI sponsorship’ that has run five sponsors out, Burman casts it aside. “The exits aren’t correlated. The board has strong agreements and processes in place,” he says. “Sponsoring the Indian cricket team gives a brand visibility to 1.5 billion people; besides, few other properties in world sports offer such brand awareness and brand recall as Indian cricket. So, no, such social media conjectures won’t stop marketers from stepping forward.”

What also comes with the sponsorship is a bouquet of 130-odd matches, and lucrative deliverables, including access to a host of top-flight cricketers, that can move the marketing needle for brands. “For example, Dream11 had cast Virat [Kohli] and Rohit [Sharma] in their ads. I don’t know how often brands can land such superstars together for their campaigns,” says Shanth. “If such deliverables are used smartly, brands will be in a position to make this the centre of their entire marketing campaign for the year.”

India’s upcoming cricket calendar, studded with top-tier tournaments, also makes the title sponsorship a prized catch. While the women play in the ODI World Cup beginning September 29, the men take on powerhouses like Australia and South Africa later this year, culminating into the T20I World Cup to be jointly hosted by India and Sri Lanka early next year. India is also the defending champion in the tournament. The full cycle is also expected to include the men's ODI World Cup in 2027. “T20 is clearly India’s favourite format, and to be a title sponsor for a team in a tournament that’s going to be played at home is a factor most brands will like to cash in on,” says Burman. “Besides, when you look at the full calendar, there are enough reasons why a number of brands will be angling to step into those shoes.”

First Published: Sep 08, 2025, 11:35

Subscribe Now