Food price uptick lifts retail inflation to 0.71 percent in November

Core inflation remains steady above 4 percent signalling firm underlying price pressure

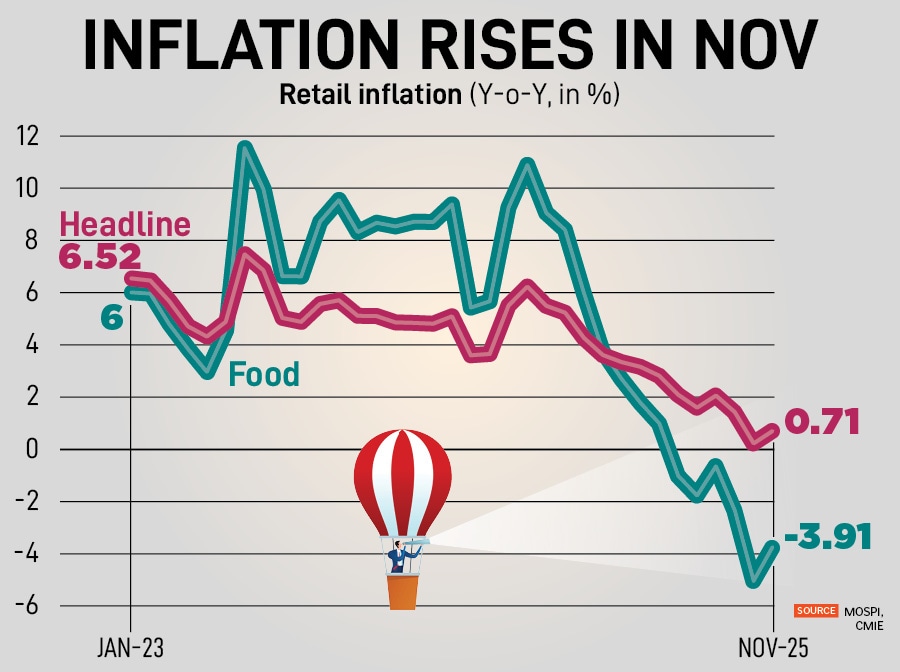

India’s retail inflation saw a modest uptick in November 2025, rising to 0.71 percent from a record low of 0.25 percent in October 2025. The shift was primarily driven by a significant narrowing of the deflation in food prices, according to government data.

A note from the Ministry of Statistics & Programme Implementation (MOSPI) highlights that the November rise in prices is mainly due to increase in inflation of vegetables, egg, meat and fish, spices and fuel and light.

The consumer food price index (CFPI) inflation stood at -3.91 percent in November, an increase from the -5.02 percent recorded the previous month. Food prices have now remained in negative territory for six straight months, beginning in June 2025. Inflation in food has shown a dramatic swing in the last year, from a peak of 10.9 percent in October 2024 to the deep deflationary phase ongoing this year.

According to Madan Sabnavis, chief economist at Bank of Baroda, the factors consistently pushing inflation down remain the same: Base effect and decline in prices of vegetables and pulses. “In particular, potatoes, onions and tomatoes have witnessed decline leading to food inflation falling by 3.9 percent,” he adds.

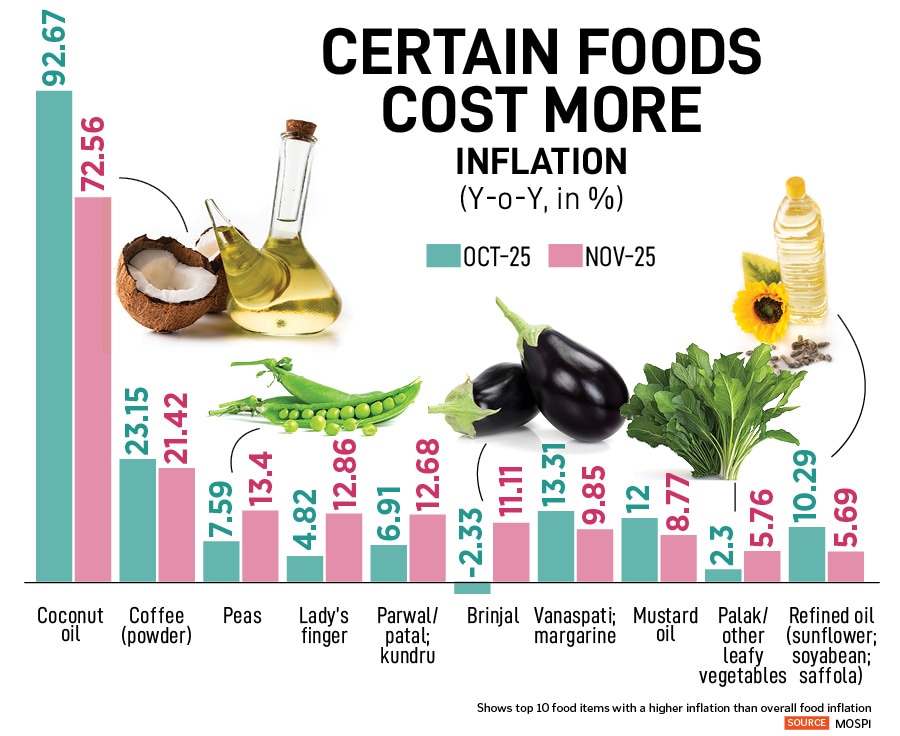

However, specific items in the food segment saw sharp price increases contributing to the narrowing deflation.

For instance, coconut oil, despite seeing moderation, registered a staggering year-on-year rise of 72.6 percent in November, down from 92.7 percent in October. Similarly, coffee powder inflation was 21.4 percent. Notably, fresh vegetables and pulses saw significant hardening: Peas (13.4 percent), lady’s finger (12.9 percent), and brinjal (11.1 percent) all moved into double-digit inflation, with brinjal reversing a deflationary trend of -2.3 percent from October. Edible oils, including mustard oil (8.8 percent) and vanaspati/margarine (9.9 percent), also continued to exert upward pressure on prices.

The inflation print for eggs, meat and fish saw an uptick in November to 2.6 percent from 1.7 percent in the previous month. Inflation in milk and its products was 2.5 percent in the same month.

Retail inflation for oil and fats was 7.9 percent and for fruits it was 6.9 percent in November. In contrast, vegetable inflation saw a minor increase from -27.6 percent in October to -22.2 percent in the latest month.

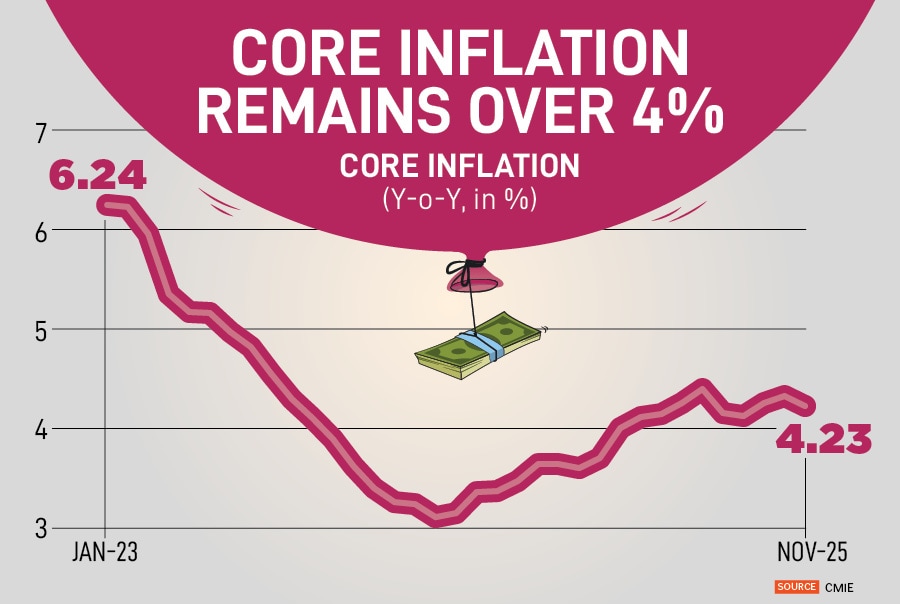

In contrast to the food prices, core inflation, which excludes the volatile food and fuel components, showed stability. After briefly dipping to a recent low of 3.1 percent in May 2024, the core inflation rate has been on a gradual upswing and stood at 4.2 percent in November 2025. This marks the tenth consecutive month where core inflation has held above the 4 percent mark, indicating that underlying demand and non-food price pressures remain firm.

Sabnavis believes the November inflation print met expectations and is forecast to trend upwards in the fourth quarter (Q4). He notes that this expected inflation rise, combined with moderating GDP growth in Q3 and Q4, will likely prompt the RBI to implement another rate cut at its February policy meeting. Last week, the RBI cut the repo rate by 25 basis points to 5.25 percent and revised its FY26 inflation forecast downwards to 2 percent from 2.6 percent earlier.

First Published: Dec 12, 2025, 17:48

Subscribe Now