CoD fees, delayed refunds, false scarcity: E-commerce dark patterns explained

The Indian government is taking initial steps to eliminate manipulative and deceptive tactics that are found to be rampant among ecommerce platforms in India

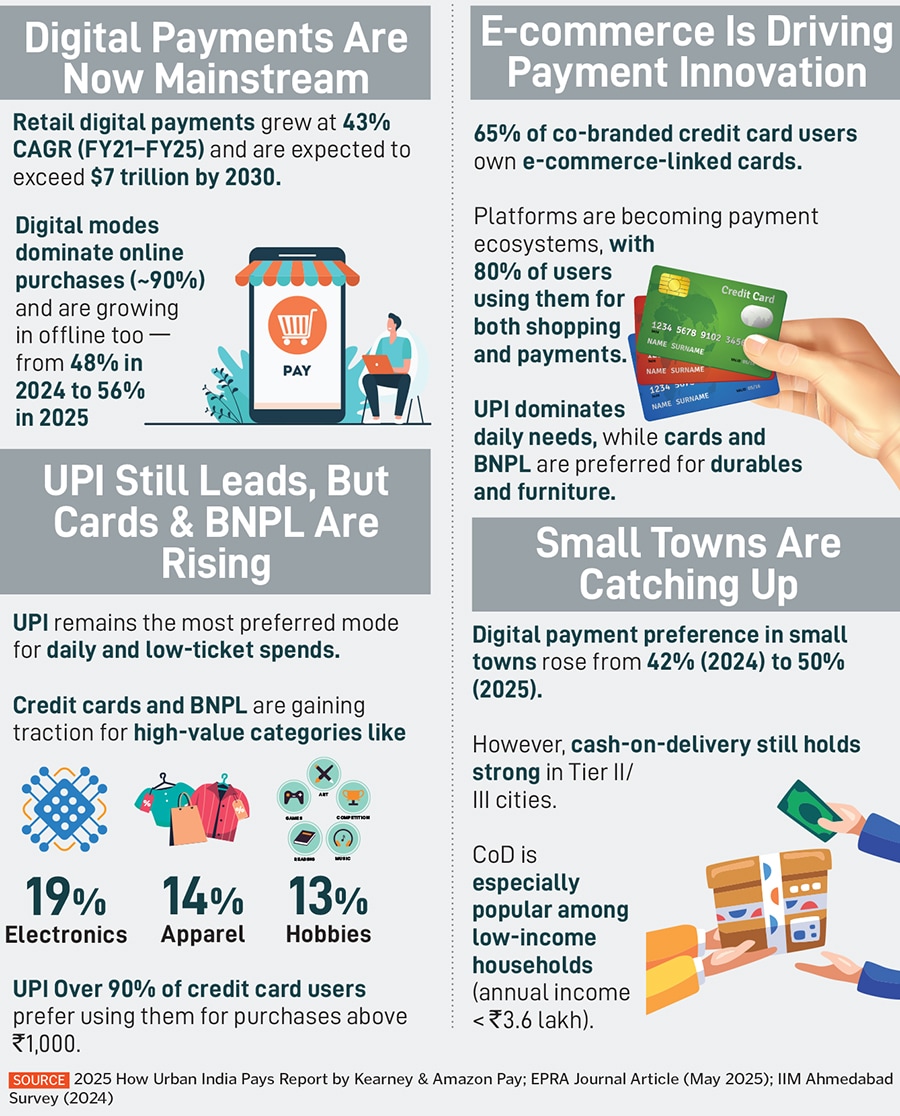

In a country where public trust in online payment methods is still evolving, cash-on-delivery (CoD) remains the preferred mode of payment for millions of shoppers. However, there is a gradual shift taking place towards online payments.

The Ministry of Consumer Affairs has launched a sweeping investigation into e-commerce platforms, including Amazon and Flipkart, for allegedly levying hidden charges on CoD orders and delaying refunds on cancellation of prepaid orders—practices the government has labelled “dark patterns”. These patterns generally refer to designs and payment journeys on digital purchase interfaces that mislead or manipulate users into making choices they might not otherwise make, or insert additional charges and fees that the user may not be aware of while making purchase choices.

Recently, a social media post showing a Flipkart order with multiple ambiguous charges, such as ‘Offer handling fee’ of Rs 99, a ‘Payment handling fee’ of Rs 49, and a ‘Protect Promise Fee’ of Rs 79. The post sparked outrage among social media users, who compared these charges to the infamous ‘Rain fee’ on food delivery apps like Zomato and Swiggy. Forbes India reached out to Flipkart for a comment, but received no response by the time of publication.

Following this, Minister of Consumer Affairs Pralhad Joshi called these charges deceptive, and confirmed that a detailed investigation had been initiated. “Such practices mislead and exploit consumers,” he said, adding that strict action would follow against violators to ensure transparency in India’s booming e-commerce sector.

Despite the digital payments push, CoD remains a lifeline for many, especially in tier 2 and 3 cities. A 2024 IIM-Ahmedabad survey found that 65 percent of Indian consumers preferred CoD for their last online purchase, citing trust and ease of return as key reasons. Currently, platforms are reportedly charging Rs 5 to Rs 10 extra for CoD orders, citing operational costs and high return rates. Consumer groups feel these charges are unfair, especially when not disclosed upfront.

Saahil Goel, MD & CEO of e-commerce enablement platform Shiprocket, highlights the operational considerations involved in CoD transactions. “Cash-on-delivery, while preferred by many customers, is inherently more complex and cost-intensive to manage compared to prepaid transactions,” he says. “The preference for CoD largely stems from consumers’ trust and convenience factors associated with this mode of payment.”

According to industry experts, CoD transactions can cost up to 50 percent more than prepaid ones. To balance this, merchants often encourage prepaid orders through small incentives or discounts, as they help minimise risk and enhance delivery efficiency. “The return-to-origin [RTO] rate for prepaid orders is now under 1 percent, whereas CoD RTO rates can vary between 10 and even 40 to 50 percent,” Goel notes.

The cost variation arises due to several operational factors: CoD deliveries generally require multiple delivery attempts, involve handling and reconciliation of cash, and carry a higher chance of order cancellations or delivery refusals. “Reducing the share of CoD orders leads to fewer returns, fewer failed deliveries, and greater efficiency across the ecosystem,” Goel explains. “The additional CoD fee is designed to encourage more seamless and reliable transactions for all stakeholders.”

Concerns around dark patterns aren’t only about CoD orders, and the probe extends to refund delays on prepaid orders. Consumers have complained that platforms block or delay refunds, effectively holding on to their money and earning interest on it. This has raised concerns about transparency and fair play, especially during festive sales when order volumes spike.

Naveen Malpani, partner and retail and consumer industry leader at Grant Thornton Bharat, sees the government’s investigation as part of a broader push to clean up digital commerce practices. “Over the past year, it [the government] has signalled a clear intent to curb digital practices that mislead or confuse consumers with hidden charges to complex refund flows and manipulative prompts,” he explains.

Also Read: Ecommerce: The new R&D lab for India's consumer companies

Dark patterns include manipulative tactics embedded in the interfaces of ecommerce platforms that influence the decisions of users. For instance, platforms create a fake sense of scarcity or urgency with misleading claims such as “Only 1 left!” or “Offer ends in 2 minutes!”, pushing buyers into making a purchase without proper consideration. Another strategy is to add items to a buyer’s list of purchases without their consent, while ‘roach motel designs’ make it easy for users to sign up for a service or subscription but very difficult to discontinue. These tactics erode user trust and prioritise short-term gains.

In November 2023, the government officially classified 13 such patterns—including drip pricing, false urgency, and confirm shaming—as unfair trade practices under the Consumer Protection Act. A 2024 report by the Advertising Standards Council of India (ASCI) found that 52 of the 53 most-downloaded apps in India used at least one dark pattern.

“Clear and upfront disclosure of CoD fees, transparent communication on refund timelines, and simplified user interfaces can go a long way in strengthening consumer trust and reducing disputes,” Malpani adds. “For platforms, this is also a chance to differentiate on credibility—by embedding transparency into product design and communication rather than treating it as a compliance checkbox.”

For instance, the newest entrant in the quick commerce space, First Club, is following a transparent policy of charging a convenience fee of Rs 19 for deliveries up to Rs 499, claims founder Ayyappan R. “We want to be completely transparent,” he says. “We don’t deliver for orders below Rs 199, we believe from an environment standpoint we should not be sending a rider for such small orders. We are trying to bring back a slightly more planned delivery concept.”

In the long run, proactive alignment with the government’s framework on dark patterns, “will help companies future-proof their operations and bring India’s digital commerce standards closer to global best practices,” says Malpani.

Globally, regulators are cracking down on dark patterns with increasing urgency. In South Korea, amendments to the E-Commerce Act now mandate 30-day prior consent for subscription fee hikes and ban tactics like hidden renewals and gradual cost disclosures, with penalties including business suspensions and fines. In the US, the FTC fined Amazon $2.5 billion for using manipulative designs to enrol users into Prime memberships without clear consent. The UK’s Advertising Standards Authority (ASA) has also banned ads using drip pricing and false urgency, while the EU’s Digital Services Act prohibits practices that impair users’ ability to make informed choices.

These actions reflect a global shift toward ethical digital commerce, and India’s alignment with such frameworks could help elevate its standards to match international best practices.

The Consumer Affairs Ministry has reportedly asked e-commerce platforms to conduct internal audits of their user interfaces and fee structures. While platforms have been asked to conduct internal audits, India currently lacks a formal external audit mechanism. A Joint Working Group under the Consumer Affairs Ministry has been set up to monitor dark pattern violations, comprising officials from key ministries, regulators, law universities, and consumer rights organisations.

If platforms are found guilty of deploying dark patterns or violating refund norms, they could face legal action under the Consumer Protection Act, including monetary penalties, mandatory interface redesigns, and stricter disclosure norms, according to a MediaNama report. In May 2025, the government issued formal notices to 11 platforms for violating dark pattern guidelines. However, no fines have been publicly disclosed yet. Despite a June advisory mandating self-audits within three months, a recent LocalCircles audit found that 97 percent of India’s 290 major platforms still use dark patterns, suggesting limited compliance so far.

First Published: Oct 14, 2025, 12:02

Subscribe Now