Digital payments: Next wave of growth to come from small cities, towns, finds Ke

Survey highlights the dominance of UPI in making digital payments, but merchants remain concerned about managing cash flows and prefer cash payments

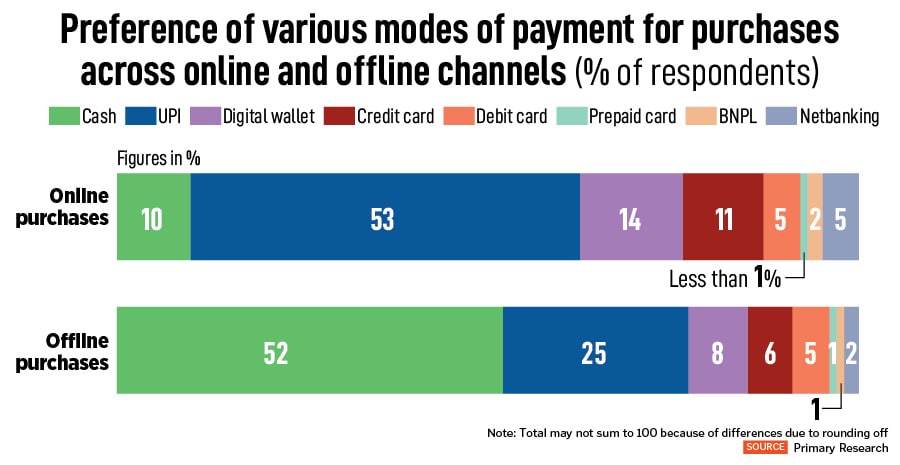

India’s push towards the adoption of an economy of less-cash and more-digital solutions continues relentlessly. A latest Kearney India and Amazon Pay India report on ‘How urban India pays’ shows that 90 percent of respondents favour digital payments for online purchases, while nearly half extend this preference to brick-and-mortar stores.

As of FY24, the Unified Payments Interface (UPI) continues to be the most popular, with a 68 percent market share of retail digital payments in India, valued at $3.6 trillion. Aadhaar-enabled payments system (AePS), BHIM, IMPS and others constitute 23 percent, followed by credit cards with 6 percent and debit cards with just 2 percent.

The survey spanned 120 cities, 6,000 consumers and over 1,000 merchants across India, and was conducted in the first quarter of 2024, at a time when regulatory action against some fintechs was at its peak.

The study forecasts that the next wave of growth will emerge from small cities (with populations of 5 lakh to 15 lakh) and towns (with population of less than 5 lakh). “The next wave of growth in digital payments will be fueled by increasing penetration in segments with lower degrees of digital payment usage [DDPU], such as consumers in lower income groups and smaller towns, along with enhancing the value of spending via digital modes of payment in the higher DDPU segments by addressing their concerns," the Kearney report says.

The DDPU uses three metrics: Volume (digital transaction frequency), variety (diversity of categories for digital payments), and openness (awareness and receptiveness toward emerging digital payment methods). The DDPU analysis indicates that income level is the most influential factor affecting digital payment usage.

Shashwat Sharma, partner and financial services leader at Kearney India, said that one of the concerns revealed from the survey was the “apprehension around digital financial fraud and double debit, hence the hesitancy of consumers to use the system. Also, parts of urban India still don’t have the proper infrastructure for [payments] through mobile phones."

Sharma’s colleague Nidhi Tiwari, who co-authored the report said: “Around 65 percent of merchants said they were not comfortable with digital payments because they needed cash to manage their daily spends." So being a cash-flow issue, merchants often still ask consumers to make payments in cash 60 percent of merchants said they prefer cash for immediate receipt of payment, and 47 percent prefer cash to avoid internet connectivity issues. The cash flow concerns for smaller merchants are likely to lessen as more merchants use digital solutions and as its penetration into the country deepens.

Sharma’s colleague Nidhi Tiwari, who co-authored the report said: “Around 65 percent of merchants said they were not comfortable with digital payments because they needed cash to manage their daily spends." So being a cash-flow issue, merchants often still ask consumers to make payments in cash 60 percent of merchants said they prefer cash for immediate receipt of payment, and 47 percent prefer cash to avoid internet connectivity issues. The cash flow concerns for smaller merchants are likely to lessen as more merchants use digital solutions and as its penetration into the country deepens.

Retail digital payments have grown over the past five years to $3.6 trillion in FY24, from $300 billion in FY18. By FY30, they are likely to double to $7 trillion, the report says, based on Reserve Bank of India data.

Also read: 73 percent users will stop using UPI if transaction fee is charged: Survey

Ahmedabad, Pune, Indore, Jaipur, Lucknow, Patna, Bhopal, and Bhubaneswar—despite their relatively lower retail potential compared to the top metros—demonstrate a digital payment adoption comparable to that of larger metros, Sharma and Tiwari said.

India could see a sharper growth in using more credit solutions to make digital payments. For India, this share is about 6-8 percent which, for developed Western countries is about 20-25 percent. India’s consumer spending through credit solutions is starting to change from the so-called dopamine effect of spending towards leisure, entertainment and travel to small-volume spending which replaces day-to-day cash transactions.

Vikas Bansal, CEO of Amazon Pay India, said:" With digital transactions penetrating smaller towns and to street vendors, we are at an inflection point." Bansal said Amazon Pay India will stay focussed on improving the convenience for the consumer, experience and the speed in transactions. “I often get asked about how we will improve market share. The digital space and opportunities in India are so large, it is not just about one player or one sector."

First Published: Jul 09, 2024, 18:10

Subscribe Now