AU SFB : The first to receive RBI’s nod to transition into a universal bank

Any SFB which gets a universal banking licence in the future needs to pay very close attention to diversification, geographically or portfolio wise

In August, AU Small Finance Bank received an in-principle approval from the Reserve Bank of India (RBI) to become a universal bank. AU will now be the first small finance bank (SFB) in the country to transition into a universal bank. The bank’s top management attributed the milestone to their “robust business model, sound governance, and enduring commitment to financial inclusion.”

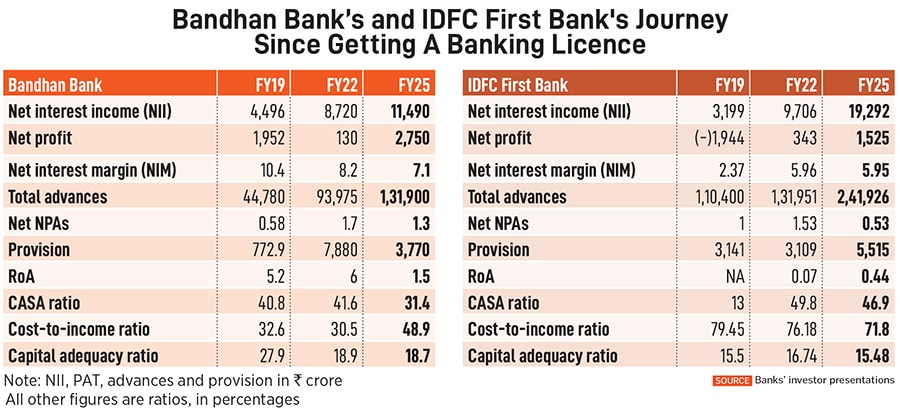

The last time RBI granted universal banking licences was in 2015, to Bandhan Bank and IDFC First Bank. Bandhan was originally a microfinance institution, while IDFC First was formed out of infrastructure financing firm IDFC Ltd. It later merged with NBFC Capital First to become IDFC First Bank.

Between 2014 and 2016, the RBI initiated the AQR (asset quality review) programme to deal with a high level of impaired loans in public sector banks. Some of these large stressed assets were pushed towards and resolved by the National Company Law Tribunal (NCLT).

“Banks which last got a universal banking licence, Bandhan Bank and IDFC First Bank, were both experiments. Over a 10-year period, both have seen limited success,” says Krishnan ASV, analyst (institutional equities), HDFC Securities. “In terms of shareholder returns, both have not delivered well, showing muted profitability. IDFC First has never delivered double-digit RoE (return on equity) in the past decade.”

IDFC First Bank’s managing director and CEO V Vaidyanathan has been good at scaling up the business “but has drawn a blank when it comes to profitability”, Krishnan adds. “Bandhan, on the other hand, tried to scale up too fast geographically and made plenty of mistakes in its micro-banking portfolio.”

Nitin Aggarwal, head-BFSI (institutional equities) at Motilal Oswal Securities, says both these banks “are in different trajectories of growth and earnings, from a technology stack and loan book viewpoint”. Bandhan Bank has gone through a stressful period in its core microfinance business since 2021-22. “This has led to the bank pursuing a more diversified growth while reducing exposure to microfinance. We expect Bandhan’s operating performance to stabilise in the second half of FY26,” Aggarwal tells Forbes India.

“Both the banks did not grow or emerge profitable at expected levels initially, given the difficult macro environment,” Aggarwal says, adding that they will see a recovery in earnings post Q2FY26.

Bandhan Bank stock has seen valuation de-rating over the past few years and maintains a ‘neutral’ investment rating, so does IDFC First trading at 1.2x P/B F27 earnings.

However, it is equally important to acknowledge that 10 years is too short a period in an institution’s lifecycle.

Several other lenders have continued to report sluggish earnings over the past two to three quarters, due to the microfinance crisis. This is a customer franchise which is more vulnerable, with low predictability of outcomes. “Large banks shy away from disproportionate exposure to microfinance, despite it being a high-margin business. These are collection-intensive businesses with exposure to a customer segment where cash flows are usually volatile,” Krishnan says. It is also an ecosystem which is politically-sensitive. Hence, over time, banks and NBFCs need to diversify away from this business.

What will boost confidence in Bandhan and IDFC First Bank? “Predictability of strategy, stability in portfolio and the ability to avoid big accidents are the key points which investors and stakeholders look for,” Krishnan says.

Also, a bank needs to be prudent with its risk appetite and risk management, and needs to think long term. ICICI Bank, for instance, had to calibrate its growth aspirations post-the global financial crisis (2009-12) and post-AQR (2018-21) when the bank needed to rebalance its mix on both sides of the balance sheet.

AU will need to focus on how to scale up the liability franchise and strengthen underwriting skills specially in the unsecured lending business (both MFI and credit cards), which de-grew 23 percent y-o-y. “The challenge to improve RoA (return on assets) will continue; however, with moderation in unsecured slippages and lagged recovery in margins, we expect RoA to improve over the coming years,” says Motilal Oswal’s Aggarwal.

It will need to hire talent to run new businesses and further scale up the franchise as it transitions into a universal bank, even while its technology and digital investments will continue to be important.

Any SFB which gets a universal banking licence in the future needs to pay very close attention to diversification, geographically or portfolio wise. Ujjivan SFB and Jana SFB await a clearance from the RBI for a universal banking licence.

Whatever be the RBI’s plans to bring more universal banks into the Indian ecosystem, one needs to ask: Are there too many banks or too few? “If the argument is that there are too few banks, then ideally there should have been a limited case for consolidation among PSU banks. The other reality is that nearly 70 to 80 percent of the power rests with four to five largest banks, which makes the argument for lower entry barriers more compelling,” says Krishnan.

First Published: Sep 25, 2025, 11:42

Subscribe Now(This story appears in the Sep 05, 2025 issue of Forbes India. To visit our Archives, Click here.)