Bittersweet: Losing Out on the Candy Crush IPO

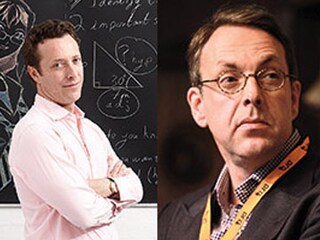

Not everyone involved in the development of Candy Crush Saga will be cashing in on its maker’s sweet initial public offering. At least two people who had a role with King Digital Entertainment will miss out on potential billions. Co-founder and former co-CEO Toby Rowland and early investor Klaus Hommels each sold more than 40 million shares back to the company for about $3 million in 2011, just before the game launched. Had they held on, they would likely be worth nearly $1 billion each, at an expected IPO price of $24 a share.

Rowland told PrivCo, a private-company research firm, “I’d probably have blown it on wine, women and a vanity space programme.” He had thought King Digital couldn’t make him enough money and left it in June 2008 to start MangaHigh.com, which teaches children math with online games. “My equity was diluted down. The company was going to have to be very, very big if I was to have my boat,” he said. Those who stayed, including co-founder and current CEO Riccardo Zacconi and chairman Melvyn Morris, with 31 million and 36 million shares worth perhaps $744 and $864 million, respectively, will certainly have their boats.

Image - Johannes Simon / Getty Images

First Published: Apr 18, 2014, 06:33

Subscribe Now