How Anurang Jain turned Endurance into a global auto components powerhouse

The billionaire from Aurangabad steadily expanded his scope of offerings while making sure he diversified globally and invested in proprietary technology

Ask Anurang Jain, 63, about the slow-but-certain electrification of the auto industry and he is unperturbed. At Endurance Technologies, the Aurangabad-based auto component company he runs, 96 percent of the parts they make could just as easily fit into an electric vehicle (EV).

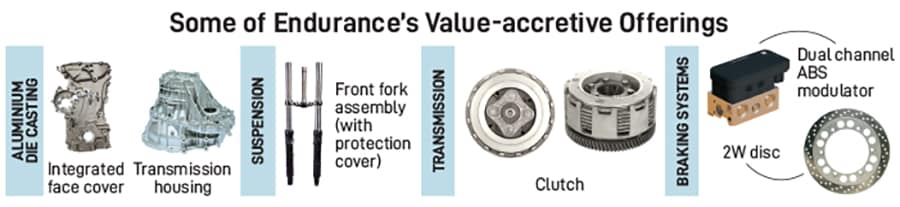

Aluminium die casting, suspension, transmission and braking parts are mainstays at Endurance. The India business has grown at a steady clip and, like several of his Indian peers, Jain has moved to

derisk operations by acquiring global auto parts businesses. Endurance now gets as much as 30 percent of its sales from Europe. This has helped steady the ship at a time of indifferent growth in the Indian auto industry. “We’ve had flat two-wheeler sales since 2019,” points out Jain. He is hopeful that the recent cut in Good & Services Tax (GST) rates could get things moving in the auto sector.Even without the cuts, Jain’s and Endurance’s journey in the auto component space has been one of steady yet measured growth and getting into new businesses while maintaining healthy cash flows. As a result, investors have bid up valuations to 43 times earnings taking its market cap to ₹37,000 crore. Over the last five years, Endurance’s valuations have compounded at 19 percent a year, putting it at among the top performers in the auto comp space. (Others like Bharat Forge, Minda Corp have also done well.) As a result, Jain and family have a net worth of $4.07 billion on the 2025 Forbes India Rich List.

Jain’s story is one of a gritty entrepreneur who took calculated bets and managed to scale in an industry that has been one of the few homegrown successes in both pre- and post-liberalisation India. “We started with ₹25 lakh of capital in 1985,” he says. (Brother Tarang Jain who runs Varroc Engineering was also part of the business in the initial days. The two formally split in 2002.)

The entrepreneur in Jain is on the constant lookout for new ideas. He’s pivoted the business in the past and got into proprietary technology, expanded globally and broadened both his customer and product. And during the course of our conversation in his Aurangabad office, he drops a hint that he may also be looking out for ideas outside the automotive space. For a business that had ₹860 crore of net cash in March, he clearly needs new areas to deploy capital.

Also Read: The Hero’s journey: How the magic is kept alive by Pawan Munjal

In 1985, after having studied at Cathedral School and Sydenham College in Mumbai, Jain was on the lookout for what to do. The family had a connection with the Bajaj family (mother Suman Jain is Rahul Bajaj’s sister and her husband, Jain’s father, had spent his career at Kaycee Industries), but were conscious that they had no business or manufacturing operation of their own. This was something the next generation wanted to correct.

In those days, industries were offered incentives (among others, a 10-year rebate on sales tax became an interest-free advance from the government) to set shop in Aurangabad and Jain chose to start operations there with two high pressure dye casting machines for the Bajaj Auto plant at Waluj, in Aurangabad. Jain uses the phrase “learning years, difficult years” to describe that period. But it was the first decade that laid the foundation for what went on to become a multi-billion-dollar business.

By 1993, Jain realised that they needed their own proprietary technology so as to not be at the mercy of the auto company they were supplying to. Work began on getting their own technology in place for front forks, shock absorbers, clutch assemblies and disc brakes. (The company has 400 R&D engineers and 91 patents.) A tooling plant also helped reduce the time Endurance took to get these products from the design to the manufacturing stage. Importantly, they were able to customise products like a nitrogen gas and oil-filled shock absorber.

Complete list: India's 100 Richest 2025

As he continued to supply to Bajaj, there was also a growing realisation within the company that the business was too dependent on one customer—95 percent of sales went to Bajaj. They had seen the fallout of Bajaj’s slow response to adapt to shift motorcycles from scooters. While Bajaj managed to eventually come up with an iconic range of motorbikes, it underlined for Jain the need to move away from a single customer.

In December2006, Endurance made European acquisitions in Germany, and a year later in Italy. Jain wanted financially strong companies with a good customer base and a product offering he was comfortable with aluminium castings. With this, he joined the list of acquisitive Indian auto part companies that now have a reasonable share of business coming from overseas. In Endurance’s case, 30 percent of revenues come from overseas. “While India remains our core market, we see overseas operations as a good hedge,” says Jain.

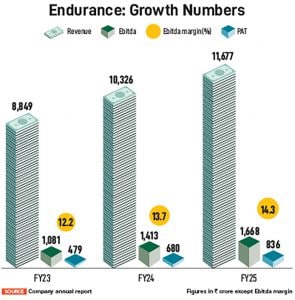

Endurance, which listed in 2016, has seen both its business and market cap compound steadily at 21 percent a year. At 43 times FY25 earnings, the market is giving the business a rich valuation with the expectation that future growth will come. The question to be answered is whether this is a fair expectation.

“The business is well positioned to deliver strong growth across different verticals,” says Aditya Jhawar, auto analyst at Investec Capital. He points to their execution track record in the two-wheeler space and believes that they can replicate this with four-wheelers as well. As of now, Endurance’s exposure to the four-wheeler space would be 5 to 6 percent (by parts) as they mainly do dye castings. This can easily be expanded to suspension and brakes.

Even within the two-wheeler space, there are fair amount of growth drivers left. The most important is the impending introduction of ABS (anti-lock braking system) brakes for two-wheelers regardless of engine size. These new businesses would require an increase in capex and Endurance has now been deploying cash for future growth. In FY24, capex was at ₹835 crore. This rose to ₹1,050 crore in FY25.

While Bajaj continues to be their dominant customer, Endurance now supplies to all the traditional two-wheeler brands, including TVS and Hero MotoCorp. In the electric space, it counts Ather, Ampere and Kinetic as its customers. In four-wheelers, it has larger orders from Hyundai, Tata, Kia and Mahindra, while globally, Stellantis, Porsche, Audi and Mercedes are customers.

Not one to let new opportunities pass by, Jain is also looking for ways to increase his share of business among EV companies. EVs and hybrid make up about €150 million in revenue at present. In 2022, Endurance acquired a 51 percent stake in Maxwell energy. The acquisition gets Endurance expertise in the battery management space—the software that runs the batteries. Jain is aware that, globally, the auto industry is moving towards PACES—an acronym for personalised, automated, connected, electrified and software driven. Indian riders, increasingly, want higher end features.

As Jain looks out into the next decade at Endurance, he points to the fact that the Indian auto market is poised to do well post the GST cuts. Not one to give out growth numbers, all he is willing to say is that growth must be profitable and with a stable set of margins. At Endurance, Ebitda margins have increased in each of the last three fiscal years, from 12.2 percent to 14.3 percent. A pragmatic businessman Jain also knows that the product mix—a key driver of margins—is not in his control.

One thing he is clear on is leverage. “I will not take excessive amounts of debt to grow,” he says. The Lehman crisis in 2008 saw the company struggle as their debt to equity had risen to 4:1 on account of the European acquisitions in 2005 and 2006. Since then, Jain has preferred to use his own cashflows to grow.

At 63, Jain is also aware of the need to induct the next generation into the business. Son Rohan and daughter Rhea have joined, and are being groomed in various responsibilities across the company.

Despite having homes in Delhi and Mumbai, Jain prefers to spend the bulk of his time in Aurangabad. “The life I have here I can have nowhere else,” he says, pointing to his six-acre bungalow that he shifted to in 1992. Its vast lawns, pool, gym, massage room give him the comfort he wouldn’t get in a large city. When needed, videoconference facilities connect him to any of his 14 plants in Europe or 19 in India. (Jain still swears by face-to-face meetings.) One reason why he did so well: No other business interests the family other than Endurance. He plans to keep it this way for the next generation as well.

First Published: Dec 15, 2025, 12:46

Subscribe Now(This story appears in the Dec 12, 2025 issue of Forbes India. To visit our Archives, Click here.)