Bihar poll’s fiscal reckoning: Weak tax revenue, flat capex constrain promises

The state is facing a persistent problem with generating adequate internal resources as own tax revenue ratio remains alarmingly low

Promises of unprecedented job creation and welfare schemes before this week’s Bihar polls are in direct contrast to the state’s fragile economy.

An analysis of Bihar’s budget data reveals that despite exhibiting robust GDP growth that matches the national average, the government’s capacity for sustained capital expenditure (capex) remains severely constrained by low tax revenues.

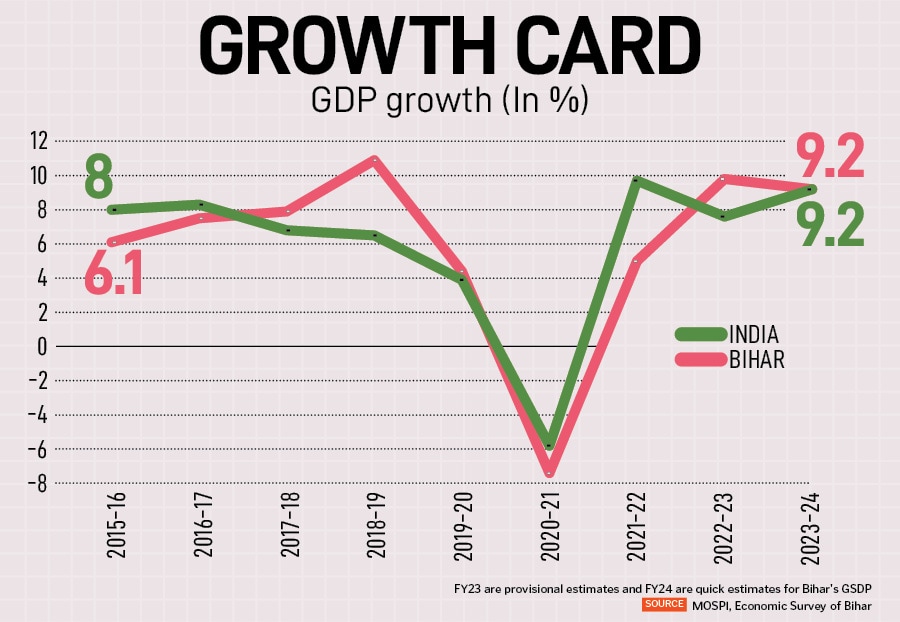

Bihar’s gross state domestic product (GSDP) growth rate was an estimated 9.2 percent in FY24, matching the all-India figure. This is in stark contrast to a decade ago when the state’s growth rate lagged the country figures. This growth, which is highly concentrated around the capital city of Patna, has not been sufficient to solve the core economic issues of unemployment and mass migration, which are key in the ongoing electoral context.

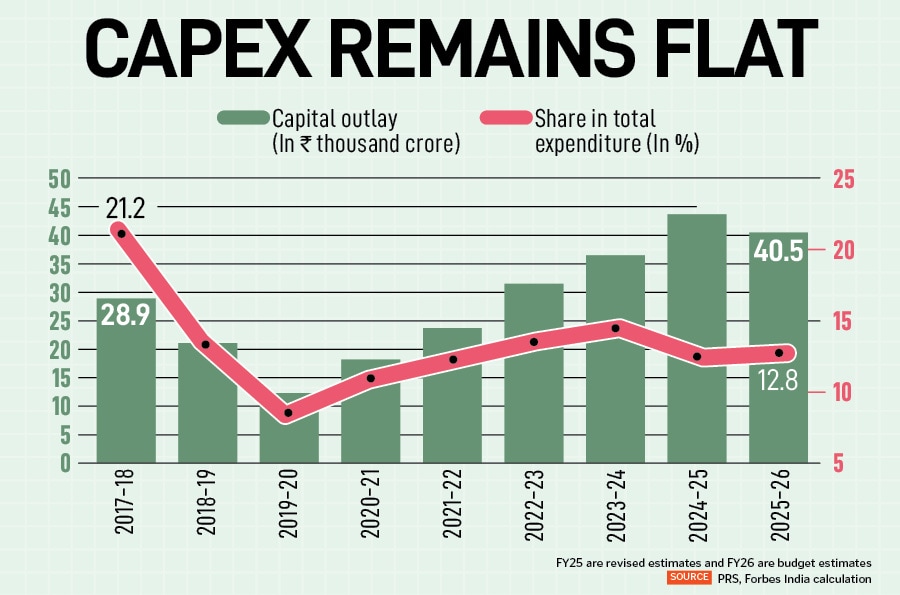

Even as Bihar has considerable headroom for development spending, its capex ratio (relative to total expenditure) remains stagnant. Though capex (in absolute figures) has increased by 51 percent from FY18 to Rs43,700 crore in the FY25 (revised estimates), its share in the total expenditure of the state remains largely flat. In fact, in the last four years the capex ratio has remained between 12 percent and 14 percent, marking a sharp decline from the 21 percent ratio recorded in FY18. In the meantime, the average capex spends for states across the country increased from 12 percent to 15 percent in FY25.

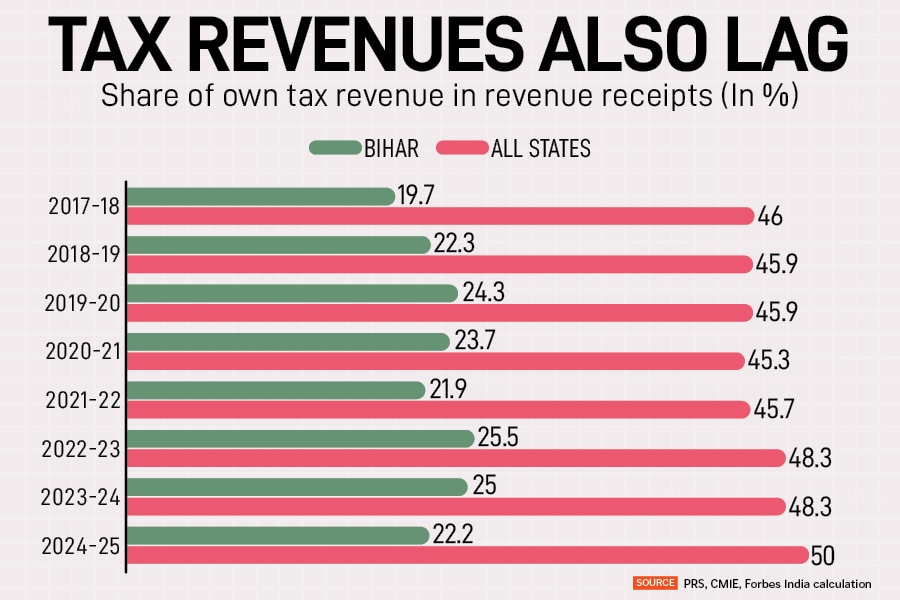

The state is also facing a persistent problem with generating adequate internal resources. Bihar’s own tax revenue (relative to revenue receipts) is alarmingly low and has failed to cross 30 percent in recent years. In FY25, it is projected at 22 percent, a sharp contrast to the average for all states which is budgeted at 50 percent.

Even when seen relative to the size of its economy, Bihar’s tax revenues will just be 5.4 percent of its GSDP in FY26 compared to a 6.8 percent average across all states. This massive gap underscores the state’s dependency on central transfers for funding nearly three-quarters of its budget.

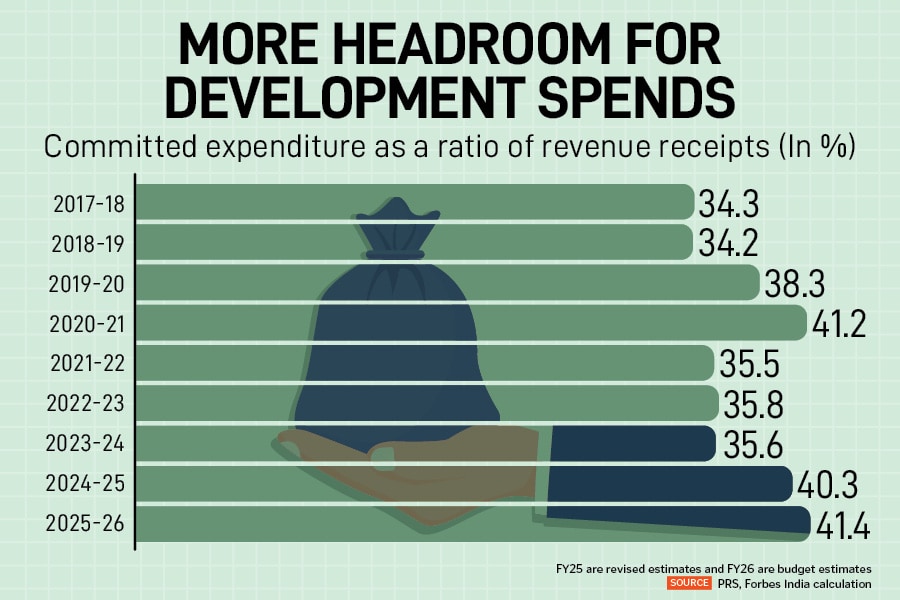

This is even as Bihar has considerable scope for development spends since its committed expenditure remains lower than most states. This fixed cost, which covers salaries, pensions and interest payments, is estimated to increase to 41 percent in FY26 (budget estimates) of total revenue receipts from 34 percent in FY18. In contrast, states like Assam, Himachal Pradesh, Kerala, Punjab and Tamil Nadu are expected to spend more than 60 percent on committed expenses, significantly limiting their government’s policy flexibility to fund new, discretionary projects or massive social schemes.

A closer look at Bihar’s committed liabilities shows a notable trend; it is increasingly dominated by employee costs. The share dedicated to salaries is likely to surge from 41 percent in pre-pandemic FY20 to approximately half of all committed expenses by FY26. The relative share of interest payments and pensions has contracted in the same period.

The ambitious promises made by the ruling alliance and the opposition during the campaign trail will fail to take off unless the state manages a fundamental shift in its economy by improving revenue generation.

First Published: Nov 06, 2025, 14:28

Subscribe Now