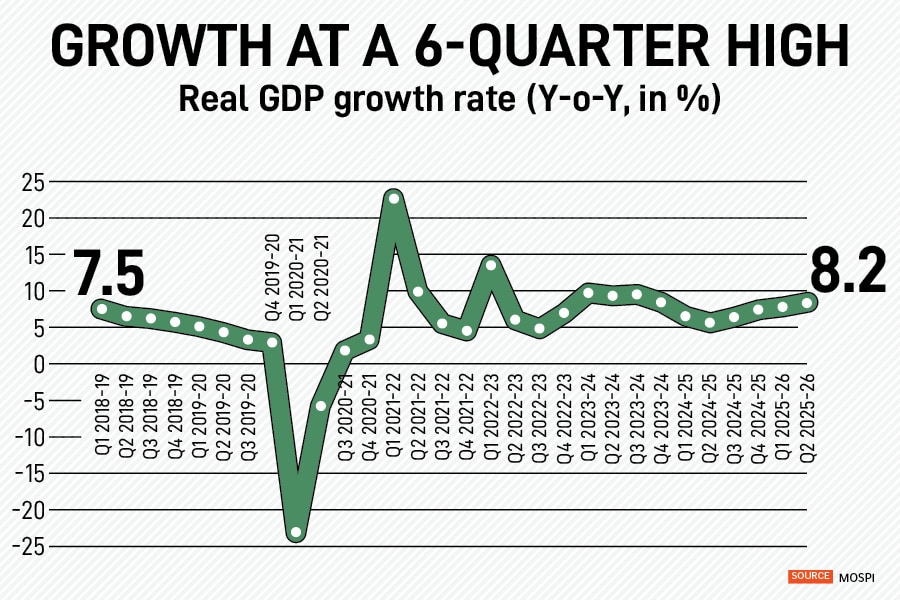

India’s GDP rises to a six-quarter high of 8.2%

But experts say adverse base, US tariffs, and limited government spending could dampen growth

The Indian economy expanded at a rate of 8.2 percent in the second quarter of the current financial year despite market anticipation of some slowdown, according to government data released on Friday. This growth figure, which is a six-quarter high, significantly exceeds the Reserve Bank of India’s (RBI) estimate of 7 percent for Q2 FY26. This marks the third consecutive month in which growth has exceeded 7 percent, following rates of 7.4 percent in Q4 FY25 and 7.8 percent in Q1 FY26.

Some experts believe the strong growth rate of 8 percent achieved in H1FY26 could be dampened by an adverse base, the looming threat of US tariffs, and the reduced availability for government capital expenditure relative to budget estimates.

“Nominal GDP growth continues to be low at just 0.5 percent higher than real GDP growth. But with inflation picking up in Q4 there will be a move to normalisation,” says Madan Sabnavis, chief economist at Bank of Baroda. He adds that this will also mean that the fiscal deficit ratio of 4.4 percent will become more challenging to meet as the budget was drawn on growth of 10.1 percent.

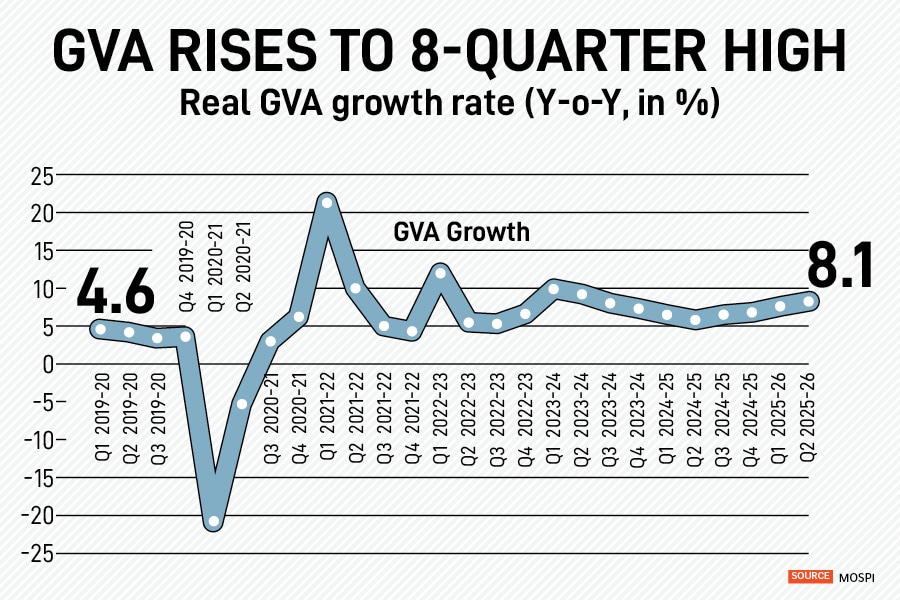

Meanwhile, the gross value added (GVA) also rose to an eight-quarter high of 8.1 percent compared to a 7.6 percent growth seen in the April-June quarter. The manufacturing and financial services sectors were key contributors to the rise in GVA.

The services sector grew by 9.2 percent in Q2FY26, a slight dip compared to 9.3 percent in the previous quarter which was its highest growth rate in two years. The sector previously grew at a high of 12.5 percent in the first quarter of FY24.

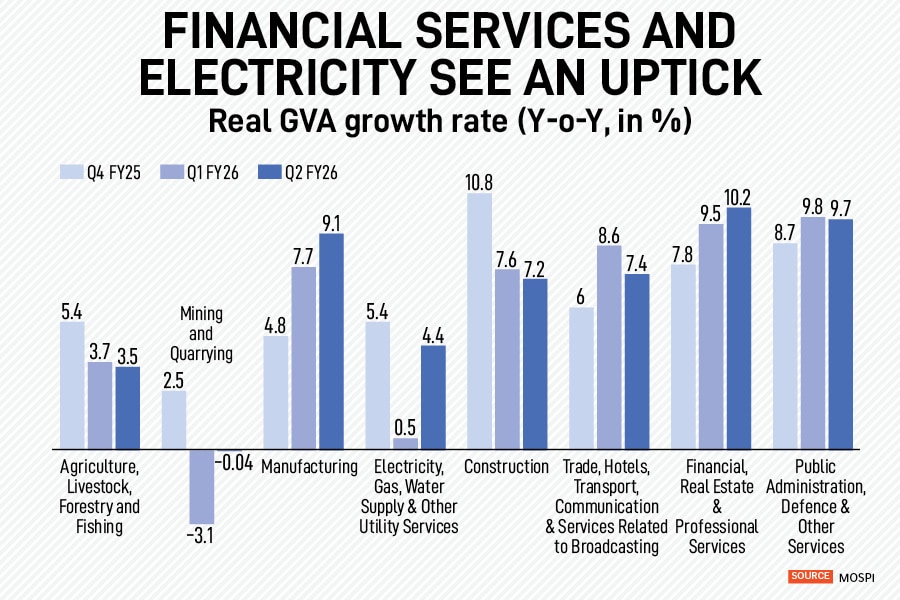

Within the services sector, financial, real estate and professional services expanded at 10.2 percent primarily boosted by banking.

However, Aditi Nayar, chief economist ICRA Ltd, describes the 9.7 percent growth seen in the public administration, defence and other services segment as ‘surprising’ as the government’s “non-interest revenue expenditure had contracted by a sharp 11.2 percent (YoY) in the quarter, as against the 6.9 percent uptick seen in Q1 FY2026” and believes that sectors like health, education, recreation and other personal services are likely to have outperformed in the quarter.

Meanwhile, the manufacturing sector recorded its strongest growth rate since Q4 FY24, driven by robust corporate performance and a favourable base effect. It expanded by 9.1 percent in the July-September quarter which was higher than a 7.7 percent print in the last quarter.

Nayar explains that this growth in manufacturing was “aided by an uptick in volume growth as reflected in the manufacturing IIP data, as well as a favourable base”.

The electricity, gas and water supply segment picked up at 4.4 percent in this quarter, a significant rebound after its worst performance since Q2FY21 in Q1FY26. Moreover, growth in construction, trade, hotels, transport, communication and broadcasting services exceeded 7 percent.

Agriculture and forestry declined for the third straight month to a low of 3.5 percent compared to 3.7 percent in Q1 FY26, which experts say aligned with expectations. A good kharif harvest is expected to reflect in the print for Q3 FY26.

Experts believe the US tariff impact is set to intensify, becoming starker in October and November. Meanwhile, Dr Anish Shah, Group CEO & MD, Mahindra Group believes that despite significant external headwinds the manufacturing and service sector have shown "extraordinary adaptability and momentum" which strengthens confidence heading into FY26. Conversely, Sabnavis believes that the positive momentum from the GST push serves as a strong counterbalance, potentially negating the tariffs and driving further gains.

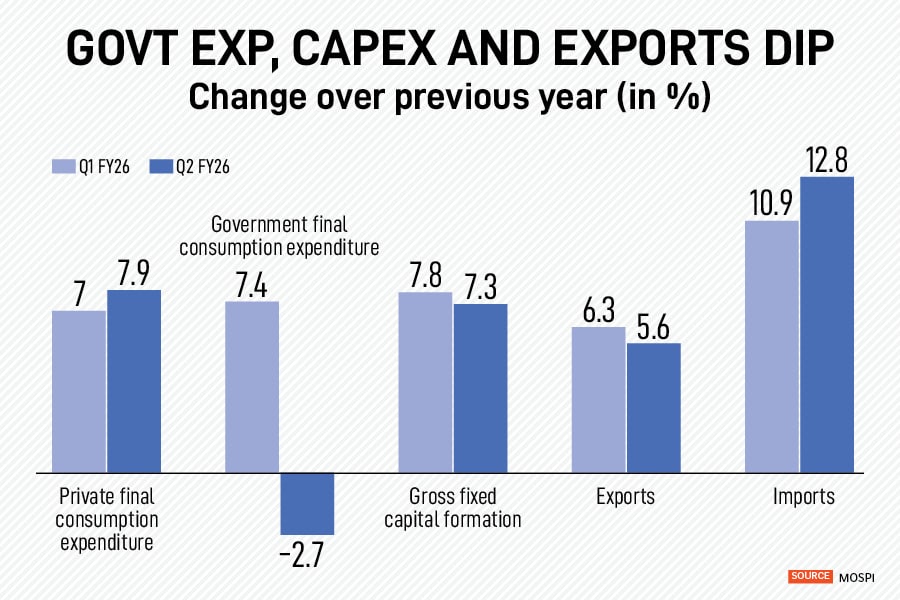

Growth in private consumption picked up from 7 percent in the previous quarter to 7.9 percent in Q2FY26 even as government expenditure contracted on “weak government revenue spending”.

However, lower growth in nominal consumption of 9.4 percent against 10 percent last year is “not a concern” as this phase was pre-GST 2.0 and is expected to pick up in Q3 and Q4 this fiscal, according to Sabnavis.

While growth in exports dipped, imports rose by 12.8 percent in this quarter.

Nayar says the latest GDP print has eased the pressure for a rate cut in the December 2025 MPC review, even though CPI inflation hit a series low in October 2025.

First Published: Nov 28, 2025, 18:53

Subscribe Now