Indians spend 28 hours on mobile phones every week: Mary Meeker report

Wireless data costs dipped more than 48 percent in India in the last year, latest study says

Image: Shutterstock (For illustrative purposes only)

Image: Shutterstock (For illustrative purposes only)

The report notes that while competition continues between companies trying to capture the Indian online market, the ultimate winners are the consumers.

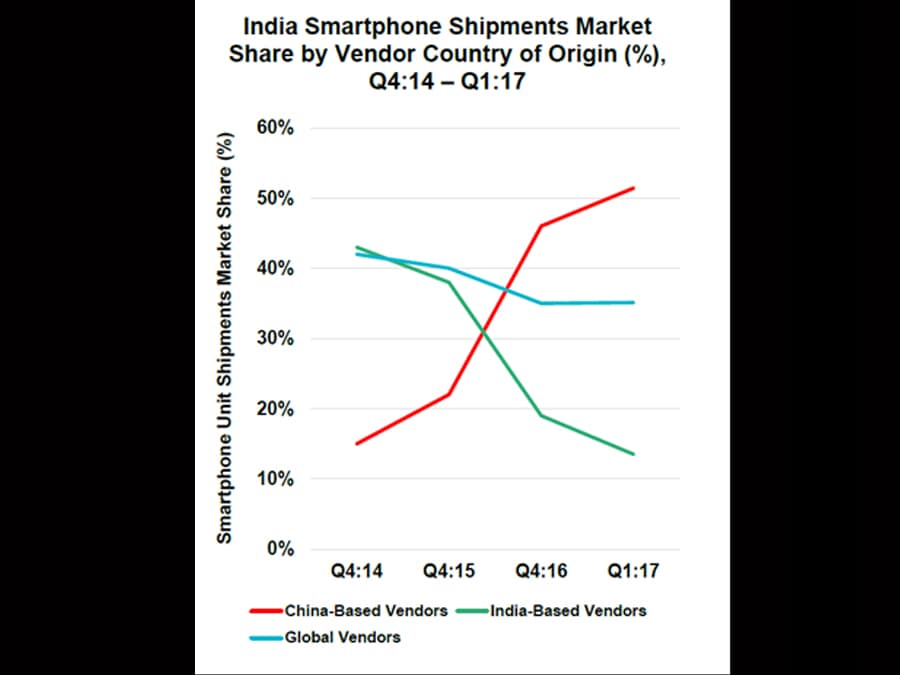

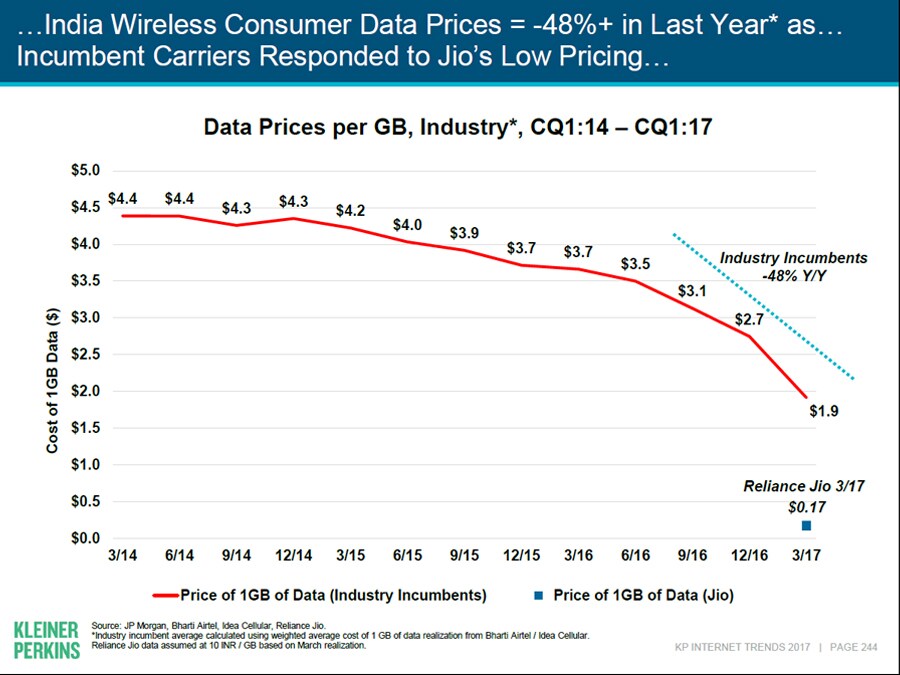

Smartphone shipments in India grew by 15 percent year-on-year, while total mobile phone shipments (smart phones + feature phones) grew by six percent. Within the smart phone market, China-based vendors have enjoyed a strong growth, and India and other global vendors witnessed a drop in their shipments. Wireless data costs have dipped 48 percent in the last year, courtesy the entry of Reliance Jio with a low pricing strategy, and the resultant price wars between telecom operators to counter Jio. By the first quarter of 2017, Jio has already gained 39 percent market share in broadband subscribers. However, the report notes that while there has been a strong growth in the smart phone sales and decline in data costs, it is still unaffordable for the vast majority of 1.3 billion population in the country. It adds that the ongoing Smartphone + Access Price Declines will be key to onboarding the next 200 million users.

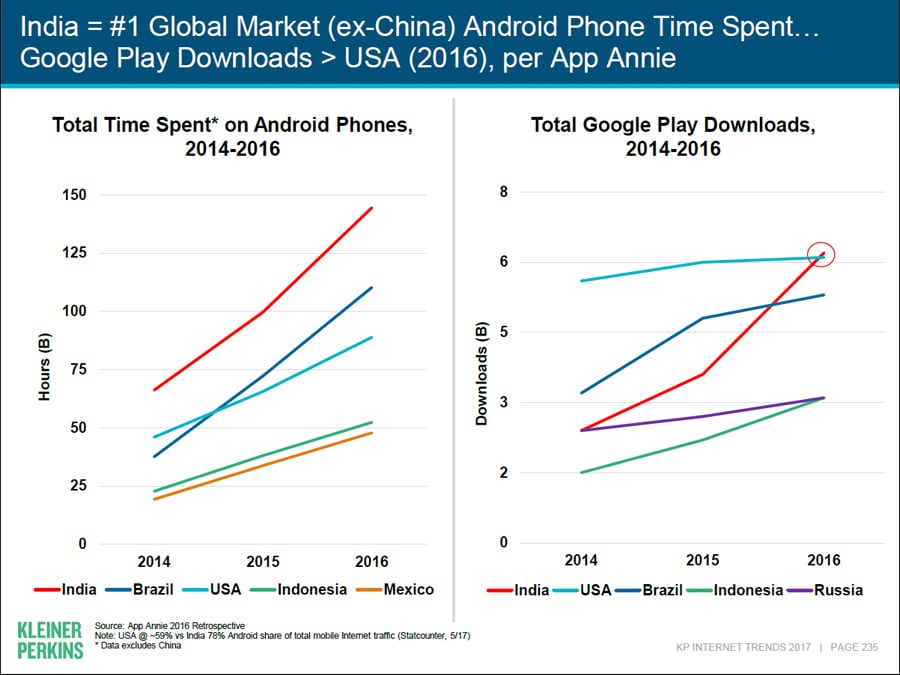

Wireless data costs have dipped 48 percent in the last year, courtesy the entry of Reliance Jio with a low pricing strategy, and the resultant price wars between telecom operators to counter Jio. By the first quarter of 2017, Jio has already gained 39 percent market share in broadband subscribers. However, the report notes that while there has been a strong growth in the smart phone sales and decline in data costs, it is still unaffordable for the vast majority of 1.3 billion population in the country. It adds that the ongoing Smartphone + Access Price Declines will be key to onboarding the next 200 million users. Time spent by Indians on their Android phones is close to 150 billion hours from 2014-2016. India has also surpassed the USA in terms of app downloads, with 6 billion downloads. A sharp spike has been observed since 2015.

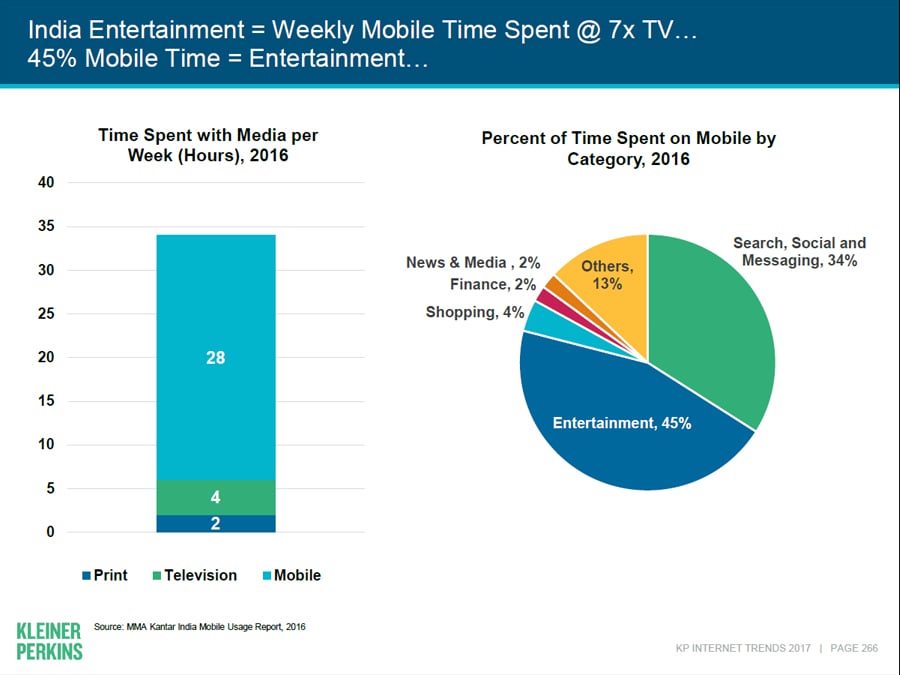

Time spent by Indians on their Android phones is close to 150 billion hours from 2014-2016. India has also surpassed the USA in terms of app downloads, with 6 billion downloads. A sharp spike has been observed since 2015.  Most of these top ten apps are accessed on mobile phones, which is evident in the statistics: 80 percent of Internet usage in India happens on smart phones. India has the second largest mobile traffic in the world, behind Nigeria. Indians spend 28 hours on mobile, 4 hours on TV and 2 hours on print every week. No surprises when it comes to app usage, with Whatsapp leading the top downloaded Android app list. It is followed by Facebook Messenger, SHAREit, Trucaller and Facebook. The only two Indian origin apps in the list are streaming services Hotstar and Jio TV.

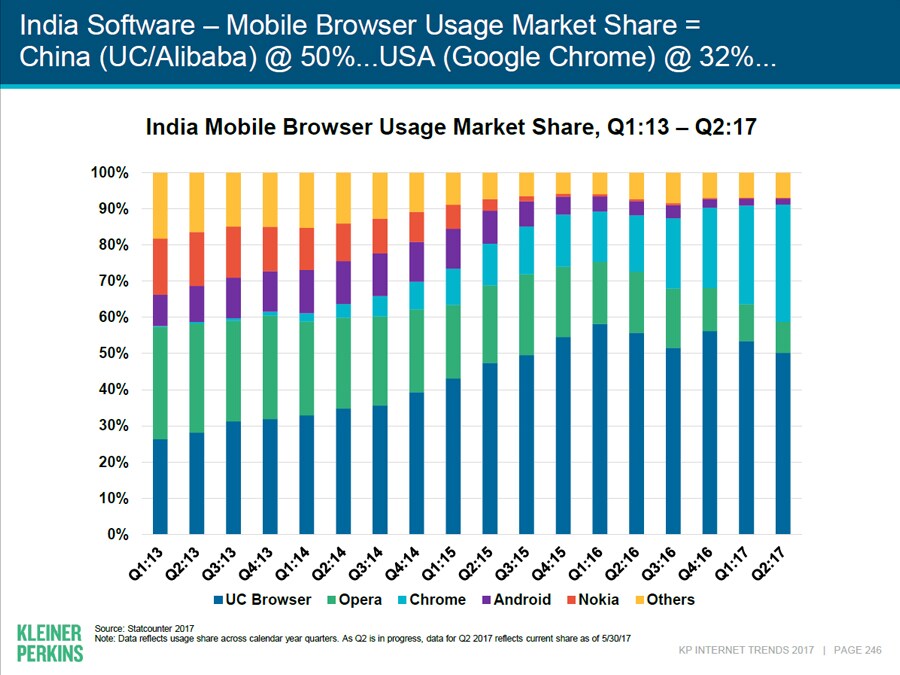

Most of these top ten apps are accessed on mobile phones, which is evident in the statistics: 80 percent of Internet usage in India happens on smart phones. India has the second largest mobile traffic in the world, behind Nigeria. Indians spend 28 hours on mobile, 4 hours on TV and 2 hours on print every week. No surprises when it comes to app usage, with Whatsapp leading the top downloaded Android app list. It is followed by Facebook Messenger, SHAREit, Trucaller and Facebook. The only two Indian origin apps in the list are streaming services Hotstar and Jio TV.  When browsing, 50 percent of Indians still use Alibaba owned UC browser. Google Chrome is the second most used browser, with 32 percent share.

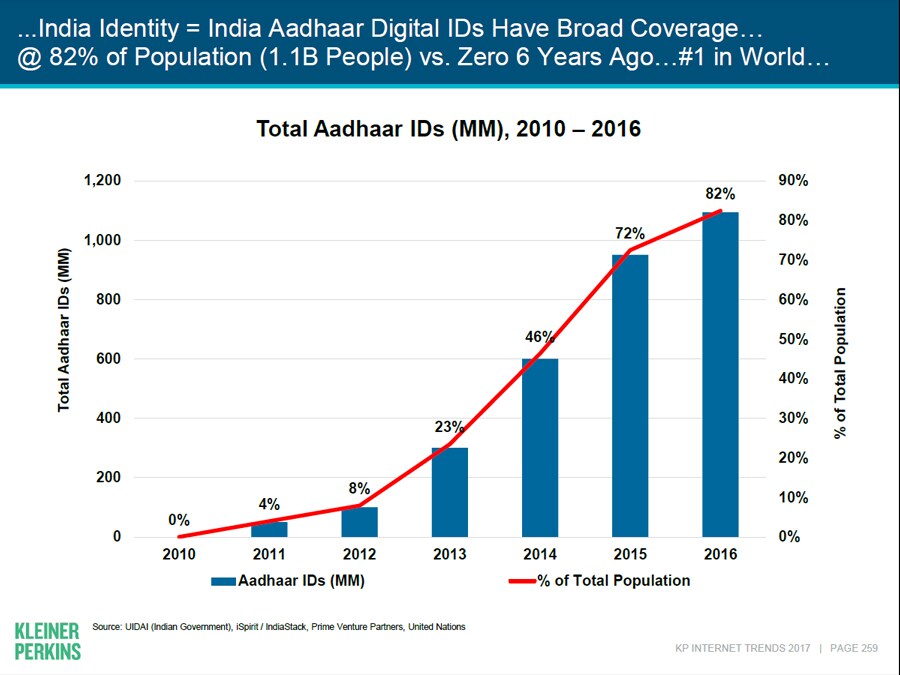

When browsing, 50 percent of Indians still use Alibaba owned UC browser. Google Chrome is the second most used browser, with 32 percent share.  Digital-focused Government policies are also enabling faster growth in internet user base. One of the key initiatives is the Aadhar and eKYC authentication.

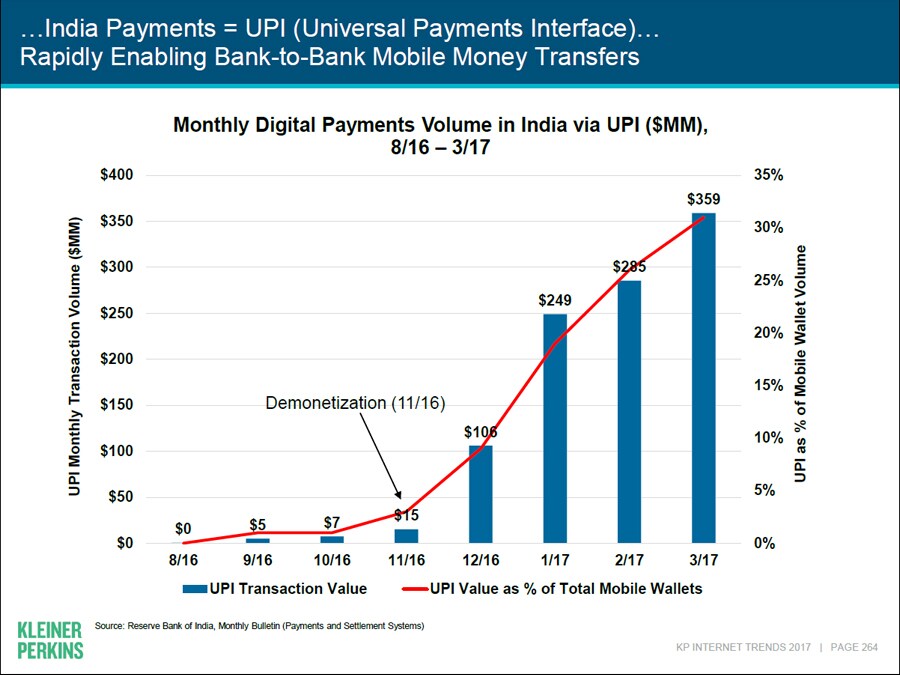

Digital-focused Government policies are also enabling faster growth in internet user base. One of the key initiatives is the Aadhar and eKYC authentication.  In the financial space, payments via UPI (Universal Payments Interface) saw a sharp spike following the demonetisation announced by Prime Minister Narendra Modi on November 8, 2016.

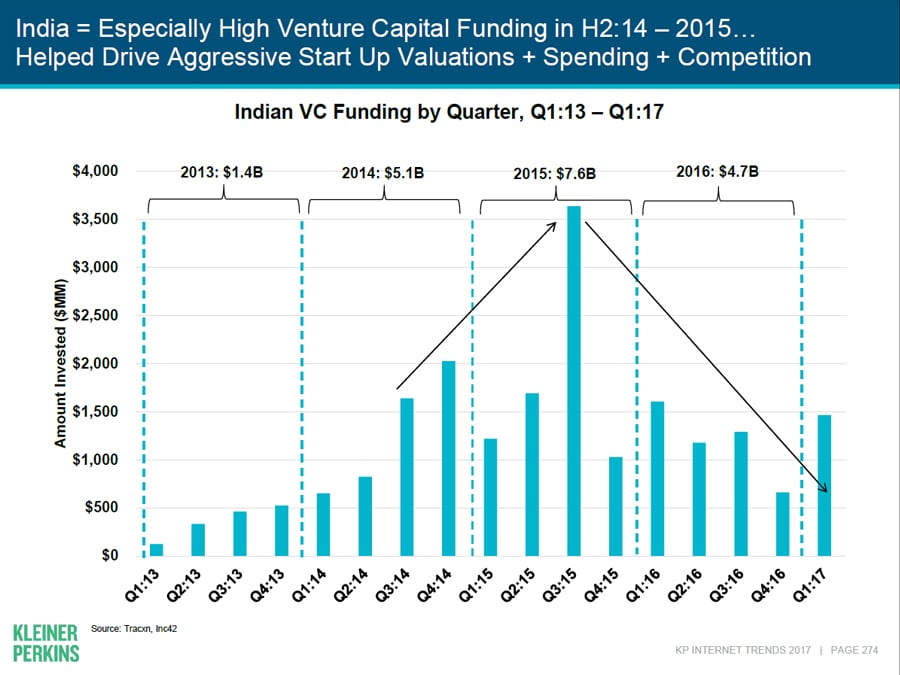

In the financial space, payments via UPI (Universal Payments Interface) saw a sharp spike following the demonetisation announced by Prime Minister Narendra Modi on November 8, 2016. While the growth potential is huge, some the challenges to Internet growth in India include preference of consuming content in local language – 46 percent of Internet users primarily consume local language content, gender disparity, education and job creation. Another major challenge is the fund raising environment, which helps drive startup valuations, spending and competition.

While the growth potential is huge, some the challenges to Internet growth in India include preference of consuming content in local language – 46 percent of Internet users primarily consume local language content, gender disparity, education and job creation. Another major challenge is the fund raising environment, which helps drive startup valuations, spending and competition.

First Published: Jun 02, 2017, 14:33

Subscribe Now