The SaaS killer

Anthropic’s new Claude update exposes the fragility of services-heavy Indian IT industry

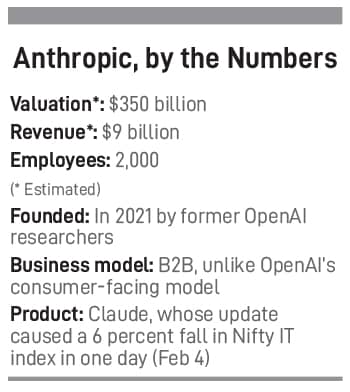

A product update from Silicon Valley doesn’t usually rattle Dalal Street. This one did.

On January 30, Anthropic rolled out industry-specific tools for its AI assistant Claude, including a legal-focussed offering that can draft contracts, review clauses, flag risks, cite precedents and adapt to firm-specific templates.

The market reaction was that of shock. Shares of major Indian IT services companies fell, reflecting investor concern that a single AI product release could replace an entire sector that has taken decades to build. The tremors were not confined to India, with the development sharpening scrutiny of software companies in the US as well.

At the heart of the concern in India is the business model that underpins much of $282 billion IT industry. Over the past two decades, Indian companies have grown by handling the back-office work—implementing, customising and maintaining enterprise software, much of it delivered through software-as-a-service (SaaS) platforms. These services created steady, predictable revenue.

Tools like Claude challenge that structure. Work that once required teams of people can increasingly be handled by a single AI tool.

“India has been here before,” says S Anjani Kumar, a partner at Deloitte India. “In the late 1990s, the IT services and BPO boom helped us. We built a massive services industry, but we missed the bus on IT products.”

He sees a similar inflection point now. “Today, we’re at a similar cusp. There will be AI services, but there will also be AI products and that distinction matters,” he says.

That distinction is what's worrying investors. The stock market sell-off is also a critique of the cash-rich Indian IT’s lack of innovation.

Listed Indian IT firms have the pressure to deliver quarterly results and near-term guidance in what is popularly called the QSQT mindset (quarter se quarter tak, which translates to ‘from one quarter to the next’). These firms are disciplined, efficient and deeply focussed on margins and dividend payouts. What they have invested far less in is research and development (R&D) that could produce original platforms capable of competing with AI-first products.

“Where we are at risk is repeating history by not building AI products. That’s the bus we should not miss this time,” warns Kumar.

The episode raises two questions that investors are now asking openly. First, can Indian IT companies afford to ignore this risk? Probably not. Second, can publicly traded companies which are scrutinised every quarter realistically plan for a five- or 10-year technological shift? Experts say they can, but only with unusual patience from both management and shareholders.

Does this mean the end of SaaS? Not immediately. But it does threaten the current version that has limited innovation. As Sridhar Vembu, founder of SaaS major Zoho, puts it: An industry that spends vastly more on sales and marketing than on engineering and product development was always vulnerable. “The venture capital bubble and then the stock market bubble funded a fundamentally flawed, unsustainable model for too long. AI is the pin that is popping this inflated balloon,” he wrote on X.

First Published: Feb 12, 2026, 11:55

Subscribe Now