How the camel milk trend may save the camels

As the camel population falls drastically in India, increasing the demand for its milk products can help revive their numbers and the livelihoods of their herders

There was a time, not so long ago, when the only mode of transport across the deserts of western India was the camel. Able to effortlessly traverse the hostile terrain and weather, hundreds of thousands of these animals, for centuries, hauled people and goods across Gujarat and Rajasthan, while ploughing farmlands, and lugging farm produce and equipment in the neighbouring states of Punjab, Haryana, Uttar Pradesh and Madhya Pradesh.

Then came the highways—just between 2014 and 2018, Rajasthan built 4,116 km of highways at an expenditure of `13,614 crore—bringing in their wake buses, trucks and tractors. The camel, considered to be as integral to western India’s landscape as the sand dunes, rapidly found itself irrelevant and unwanted, and herders began to feel the burden of sustaining large numbers of animals.

“When the camel no longer served the purpose of transportation, the herders began to abandon their animals because they were not able to make any income to sustain them,” says Ilse Kohler-Rollefson, founder of Camel Charisma, which is based in Sadri, Rajasthan, and has been working with herders to promote alternative means of livelihoods through camel-based products. “In order to make money, some herders clandestinely sold camels for meat. No one talked about it, because it went against their social norms. But not having any other source of income meant they had to close their eyes to tradition.”

With the intention of stopping this illegal slaughter, the Rajasthan government declared the camel as the state animal in 2014, and stopped its sale to other states. “Traditionally, the Raikas—who have been camel herders for centuries—would not sell their animals for slaughter. Male camels were sold at the Pushkar cattle fair as draught animals for neighbouring states, and they would fetch good prices. But the effect of the government decision was a dramatic drop in prices: From `10,000 to `15,000 for a male camel, prices fell to `1,000. This has been a disaster for the Raikas,” says Sundeep Bali, a photographer and artist who has been documenting the life of the Raikas for several years, and who works closely with People For Animals (PFA), in Sirohi, Rajasthan. “As highways began to crisscross the state, they began to disrupt the traditional migration routes of the Raikas you cannot cross multiple highways with 3,000 animals.”

The combined effect of these developments has meant the population of camels in India has seen a dramatic decline, compared to a time when Rajasthan alone was home to 7.56 lakh camels in 1983. According to the 20th Livestock Census, the camel population in the state fell by a staggering 34.69 percent between 2012 and 2019. In 2012, there were 3.26 lakh camels in Rajasthan, which declined to 2.13 lakh in 2019. In Gujarat, the population fell from 30,000 to 28,000, in Haryana from 19,000 to 5,000 and in Uttar Pradesh from 8,000 to just 2,000.

Along with camel populations, what has come under threat are the livelihoods of communities such as the Rabaris, Fakirani Jats, Samas, and Sodhas who have been herders for generations. Pastoralists by nature, they usually move with their herds within stretches of about 250 km to 300 km so the animals can feed on a vast variety of vegetation. Their routes and stops vary with the seasons, and the availability of water and food for the animals. “The Raikas, who are a sub-segment of the Rabaris, have immense knowledge of these animals, their behaviour and feeding habits. They believe they were created by lord Shiva to take care of camels,” says Bali. “This is the bond they share with the animals. And camels in India are not feral, they are domesticated animals. They cannot survive in the wild on their own.”

PFA, Sirohi, has the largest camel rescue centre in the country, and has been playing a significant role in their vaccinations and medical treatments. Bali, who helps raise awareness and funds, says it is always much easier to raise money for the benefit of cows, but not camels. “I have seen how difficult it is for the herders to plan their journeys across hundreds of miles over several months, whether it is to states like Madhya Pradesh, where the animals were taken to graze, or to the Pushkar fair. And then if they are not able to sell any animals, and make any money, it is very difficult for them.”

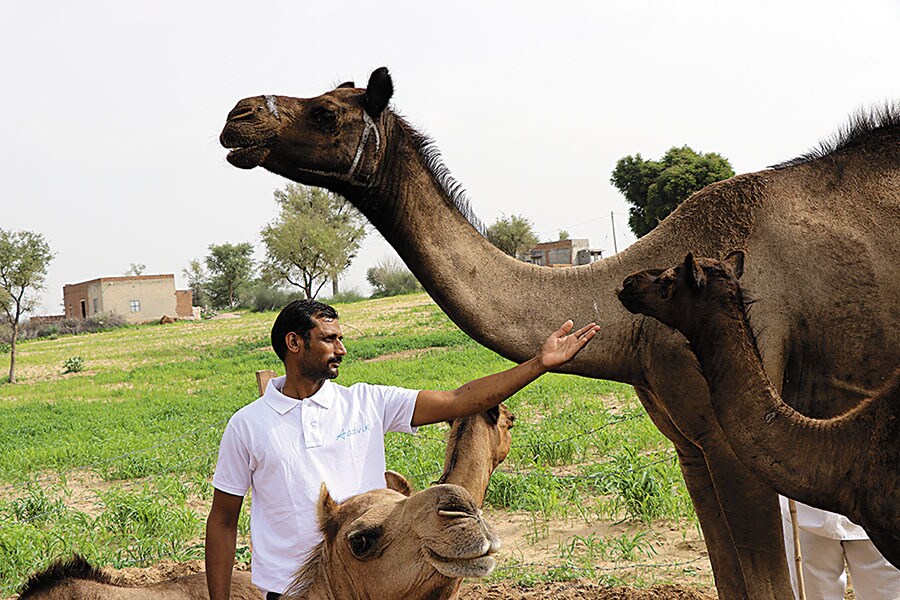

After highways were built, camels were no longer used as means of transport and herders struggled to sustain them

After highways were built, camels were no longer used as means of transport and herders struggled to sustain them

Recognising this struggle for survival, Kohler-Rollefson, a veterinary doctor from Germany, started Camel Charisma along with Hanwant Singh Rathore, a native of Jodhpur. “It was in September 1990 that I came to India,” remembers Kohler-Rollefson. “I had not expected to stay for so long.” The aim was to sell camel milk products that could be a source of income for the herders. “We sell frozen camel milk, which is packed in ice and sold directly to customers. Our clients are usually parents of autistic children, cancer patients or those with food allergies. We have also developed camel cheese, which has a very good taste, and a longer shelf life, and is, therefore, easier to ship. We feel it has a lot of potential as a heritage health food.”

The milk of Indian camels is vastly different from those of, say, their Middle Eastern counterparts. Since they are reared by pastoralists, camels in Gujarat and Rajasthan are not kept in stalls (like in the Middle East) and are not fed standard fodder, which is given to milk-producing cows and buffaloes in India. Instead, the animals roam vast tracts of land, feeding on a wide range of naturally growing vegetation, which often has medicinal properties. This diet ensures that camel milk is three times richer in vitamin C and richer in many macro- and micro-minerals (such as iron, zinc, copper, sodium, magnesium, manganese and potassium) when compared to cow milk. It has lower lactose levels, and is therefore more easily digested by those who have lactose intolerance its lactoferrin content helps prevent arthritis, while its naturally occurring insulin (like peptides) helps manage diabetes. It also has beneficial effects on children with autism.

These properties have been instrumental in establishing a global market for camel milk. According to IMarc, a US-based market research company, in 2019 the global market for camel dairy products reached a value of $5.98 billion, and is expected to see moderate growth in 2020-25. “The price of camel milk is significantly higher compared to traditional cow milk, owing to the fact that camel milk production is lower than cow milk, and camel breeding costs are also higher compared to that of cows. Its immense health benefits, however, significantly outweigh the higher prices,” the company says.

However, despite these beneficial properties and its potential as a marketable product, camel milk was not procured and sold commercially. “It was common among camel herders to drink the milk, but not in other households. This is because there is an abundance of other livestock, with cows being the most common,” says Hitesh Rathi, co-founder of Aadvik Foods. “Camel milk is also slightly salty, which may not be to everyone’s liking.” Divyesh Ajmera, founder of DNS Global Foods, says that traditionally milk is procured by local dairies on the basis of its fat content. “Camel milk is low in fat, and therefore would not fetch a high price,” he says. “Measuring fat content is not the right way to sell the product measuring nutrients is.”

.jpg) Camel Charisma sells frozen camel milk and camel cheese, which they position as a heritage health food

Camel Charisma sells frozen camel milk and camel cheese, which they position as a heritage health food

Therefore, it remained a milk that was commonly consumed by the herders themselves, and was sold in small eateries and tea stalls in Rajasthan and Gujarat. Ajmera says that only after leaders of the herder communities met the government authorities, did the latter take up the issue of listing camel milk as fit for human consumption, and in December 2016 the Food Safety and Standard Authority of India (FSSAI) determined the standards of camel milk to be sold commercially. This paved the way for entrepreneurs—such as Rathi and Ajmera—to start procuring and selling the milk at a commercial level.

In 2018, the Gujarat Cooperative Milk Marketing Federation (Amul) also entered the category by teaming up with the Kachchh Camel Breeders’ Association, Kutch Union and Sahjeevan Trust for the procurement, processing and marketing of camel milk. So far they have about 60 camel milk producers, holding around 2,000 camels, as member of village-level dairy cooperative societies.

Herders who are now selling camel milk are benefitting from the extra income, and are more willing to keep an increasing number of animals. For instance, Sawant Devasi is a herder in the Gandhinagar area of Gujarat, and is now supplying about 55 litres every day to Aadvik Foods. “Before I started supplying milk to Aadhvik, I had only 15 camels. Now that I am getting a steady income, and there is a steady demand for the milk, I have bought more camels and have a total of 35,” says Devasi.

Aadvik procures camel milk from about 200 herders in different locations across Gujarat and Rajasthan, and collects between 800 and 1,000 litres a day. The liquid milk is sold to the end consumer in the frozen form, or it is freeze-dried and sold in the powder form. DNS Global Foods also sells camel milk in the freeze-dried form. “This technique is not popular in India, although it helps preserve the nutrient content of the food because no heat is used to dry it,” says Ajmera. “However, it is expensive to install and scale up.” The company imports its machine components from Germany, while fabrication and assembly are done in India.

And it is not the supply of milk that both these entrepreneurs are concerned about it is the demand. Because unless that grows, companies will not be able to keep procuring larger quantities of milk every day, and herders will not be able to build a relationship of trust with them. The fact that the price of camel milk is much higher than that of cow milk is also something that dampens consumer sentiments. For instance, a 200 ml bottle of camel milk from Amul costs `25, whereas its cow milk costs around `45 per litre. Similarly, a 200 g pack of freeze-dried camel milk from Aadvik costs `1,662.

Divyesh Ajmera, founder of DNS Global Foods, sells freeze-dried camel milk in the powder form

Divyesh Ajmera, founder of DNS Global Foods, sells freeze-dried camel milk in the powder form

“Between 15,000 litres and 20,000 litres of milk is available every day, and there is a chance of 20x growth,” says Rathi. “The challenge is to create the demand. When we started, people did not know that camel milk is even edible. Today most people have at least learnt of its benefits. Once demand increases, breeders will also start keeping more camels, and then there will be more availability of milk.”

Kohler-Rollefson of Camel Charisma says that while selling camel milk has been good for some herders, the vast majority of them are yet to benefit from it. “I get calls from dozens of herders who want to sell their milk, but there is no demand to absorb the extra supply,” she says. “There should be some government initiatives to create livelihoods, and money should be spent on promoting camel milk, making it known how valuable it is. There are government marketing boards for products such as jute, tea and coffee that promotes them there should be something similar for camel milk. If the demand for this product increases, then things will fall into place.”

She also feels that camel dairying desperately requires social impact investments in order to take off. “The benefits can be enormous—not in terms of financial returns, which will take some time—but with respect to peoples’ livelihoods, camel and biodiversity conservation, as well as a supply of extremely healthy food.”

Ajmera believes that the demand for camel milk is not a fad, and is here to stay. “It is a superfood,” he says. But, at the same time, it will never become mainstream, because we have grown up on cow and buffalo milk and are used to the taste. He, however, feels diversifying the product portfolio so that the milk is used as an ingredient in other products—such as chocolates and ghee—can help increase its demand.

The camel herders of Gujarat and Rajasthan have changed their centuries-old traditions and taken to selling camel milk in order to survive. Whether or not milk consumers will change their tastes to help the camel survive is yet to be seen.

First Published: Oct 09, 2020, 11:25

Subscribe Now