Kotak Mahindra Bank hits a six with 811

There has been a spurt in consumer base with the digital banking account campaign

Image: Adnan Abidi / Reuters

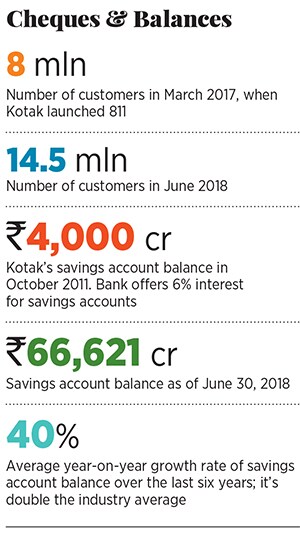

It took Kotak Mahindra Bank, India’s second largest by market capitalisation, eight years to acquire its first million customers. The next 2 million came in just four years, thanks to the 6 percent savings account offer it rolled out in October 2011 when the Reserve Bank of India deregulated savings interest rates.But if 6 percent gave Kotak its ‘aha’ moment, 811 could be its ‘gaga’ moment. 811, Kotak’s digital banking offering named after the date when demonetisation was announced, has seen phenomenal growth since its launch last March. “Our total customer base has increased from 8 million in March 2017 to over 14.5 million in June 2018,” says Virat Diwanji, president (branch banking and retail liabilities). With 811, Kotak intends to make banking more accessible by offering features such as zero balance savings account, zero charges on digital transactions, and paperless account opening.

Kotak, reckon fintech analysts, has been smart enough to attract consumers after demonetisation. “Six percent definitely helped the bank increase its customer base,” says Anil Joshi, founder and managing partner at Unicorn India Ventures. “811 has only accelerated the process.” The next challenge for the bank is to ensure a robust digital system for a safe and seamless transaction.

First Published: Aug 14, 2018, 16:20

Subscribe Now