How Alexion Pharma became Biotech's Entrepreneurial Glory

The pharmaceutical business is not kind to entrepreneurs. It takes more than a decade and hundreds of millions of dollars in venture capital to get from cool idea to marketed drug

A $440,000-a-year treatment for rare diseases turned Alexion Pharmaceuticals into biotech’s biggest entrepreneurial success story and the health care system’s biggest paradox. It also landed them the No. 2 slot on Forbes’ annual list of The World’s Most Innovative Companies

The pharmaceutical business is not kind to entrepreneurs. It takes more than a decade and hundreds of millions of dollars in venture capital to get from cool idea to marketed drug, which is why the founders of Amgen, Genentech and Gilead were gone by the time those companies became big successes. But nestled near a pastoral local farm 40 minutes outside of New Haven, Connecticut, is the exception to that rule. There, an unassuming, self-deprecating doctor named Leonard Bell still serves as chief executive of Alexion Pharmaceuticals, the company he founded after he quit his medical professorship at Yale 20 years ago.

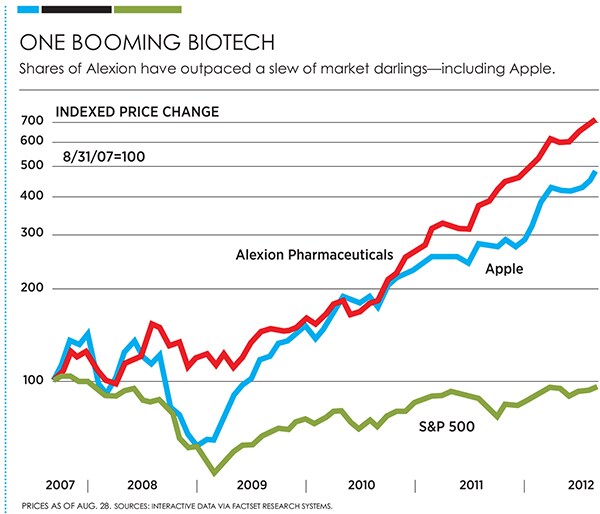

His salvation: Soliris, launched in 2007 to treat a rare cause of anaemia. In 2012, that drug will do more than $1.1 billion in revenue, with Wall Street expecting that figure to double over the next three years. Its current net margin: 22 percent. Alexion shares are up 600 percent since the drug’s approval—outperforming tech darlings such as Apple and Salesforce.com over the same period. The company sports a market capitalisation of $20 billion, and Bell’s stake is worth $179 million. These kinds of statistics underscore why little-known Alexion hit No. 2 in Forbes’ annual ranking of the most innovative companies.

They also point to a paradox in the health care system. Alexion, with 1,100 employees, is a multinational pharmaceutical company with offices in more than 30 countries—but only a few thousand patients the whole world over. Soliris is a blockbuster—and Alexion a juggernaut—because of the drug’s astronomical price: $440,000 per patient per year. Yet, the drug is so effective that private insurers and national health agencies, even sticklers like the United Kingdom and Australia, are willing to pay.

“We focus on patients with absolutely devastating disorders that are also either lethal or life-threatening,” says Bell. “They’re also very, very rare, so they get no attention from anybody. They’re left with no hope, and we only go forward not with treatments that will make it a little bit better but with treatments that will transform their lives.”

There is no doubt that Soliris makes a dramatic difference in patients’ lives. And unlike most drugs, it seems to help almost every patient who receives it. Take, for instance, Joe Ellenberg, a former college wrestler aspiring to join the Ultimate Fighting Championship, the often-brutal mixed martial arts competition. After winning his first nine fights, he got extremely tired while training for his 10th. “I was in zombie mode,” he says. He won the bout, but his stomach hurt and his urine was black. His fiancée convinced him to see a doctor, and after months of tests he was diagnosed with paroxysmal nocturnal hemoglobinuria (PNH), the first disease Soliris was approved to treat. He got the diagnosis over the phone, blithely texted it to his loved ones and went to a practice. He came back to 40 panicked texts and voice mails carrying the terrible news delivered by Google searches: PNH leads to disabling anaemia, does not go away and kills a third of patients within five years.

But because of Soliris, he is not bedridden and waiting to die but back to his training and expecting his first baby. His private insurance pays for Soliris, with the National Organization for Rare Disorders, which gets funding from Alexion, picking up his co-payments.

The results surrounding Soliris’ second approved use, for treating a terrible, one-in-a-million kidney ailment called atypical hemolytic uremic syndrome (aHUS), are perhaps more dramatic. Christian Billingsly, now 17, was three months old when he started projectile vomiting, the first evidence the disease was attacking every part of his body, especially his kidneys, which failed when he was 18 months old. Christian got a transplant kidney from his father when he was a toddler, but that failed in eight months. He lived his life on dialysis, and when his family had to evacuate their Louisiana home because of Hurricane Katrina, he wound up with a terrible infection that made dialysis harder. Christian remains small, with low bone density, but Soliris has stopped the attacks that destroyed his kidneys in the first place, and his dad is hoping a kidney transplant will follow and give him a normal life. Insurance, Medicare and charity paid for his treatment.

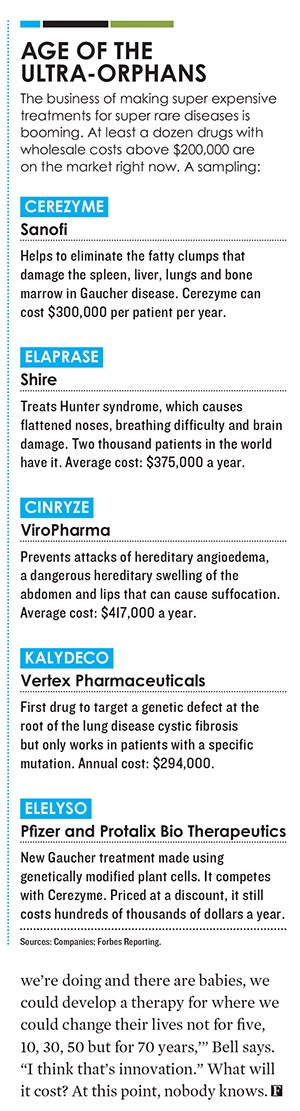

Analysts estimate that the disease could represent many hundreds of millions of dollars a year in sales for Alexion, which underscores the model that the company leverages: There are big profits in solving extremely rare disorders. Soliris is one of at least a dozen drugs whose price for the average patient is greater than $200,000 per year, all of them targeting dangerous, obscure conditions, such as Naglazyme for Maroteaux-Lamy syndrome and Elaprase for Hunter syndrome.

“We know this is the price that has to be charged in order to create a carrot to treat these disease states,” says Douglas Paul, vice president at Medical Marketing Economics in Oxford, Mississippi, a consultant who advises companies on ultra-rare drugs. “One [insurer] told us this is the cost of doing business. This is why you offer insurance, so they do have access to these treatments.”

Treatments for ultra-rare disorders tend to sell surprisingly well in nationalised health care systems, especially if they are highly effective. Outside the US, Bell sees price pressure on drugs for diseases that afflict tens or hundreds of thousands of people—but not for his drugs.

In the US, the Affordable Care Act makes ultra-niche drugs “commercially possible by increasing the number of people covered by insurance”, says Biotechnology Stock Research’s David Miller. “Current and future developers of orphan drugs will strongly benefit from the law.”

In fact, the market for these medicines was created by legislation. In 1983, the US enacted a law giving special protection from competition to drugs for rare diseases. In the preceding decade, only 10 such drugs were approved. Over the next two decades, 282 such medicines followed, according to a 2007 paper in the International Journal of Technology Assessment in Health Care.

That paper warned that the current system may not be sustainable long-term. “As the number of orphan drugs increases, and treatments start getting targeted at smaller subpopulations of patients, we can no longer afford to ignore the cost of these treatments,” says Duke University’s Peter Ubel, one of the study’s authors and a Forbes contributor. “We need to strike a balance.” E Michael Scott, chairman of the board for the National Association of Rare Disorders, counters: “I don’t think we have a good handle on what it costs to treat some of these patients effectively [without drugs]. The costs of hospital visits, surgery and time in the intensive care unit can be enormous.”

Bell says the problem of people not having insurance is unique to the US, and he chafes at it, a feeling he says goes back to his days as a doctor at Yale (where all people were treated regardless of need) but also to his childhood. He remembers slipping and falling on wet grass at a summer camp and cutting his knee on glass. The man who ran the camp carried him to the emergency room, which refused to treat him because he didn’t have his insurance card.

“I mean which six- or seven-year-old has his insurance with him?” says Bell. “And he just put me on the emergency room counter. He was a big guy and he said: ‘You have to treat him.’” They did.

Alexion was founded in 1992 in the ice cream freezer of a Grand Union grocery store. Bell had gone to fetch sweets for his children, along with his friend Steve Squinto, an early employee at the biotech Regeneron in Tarrytown, New York, who was dating Bell’s wife’s best friend. While there, Bell told Squinto he wanted to start his own company by the time they got back to the car, Bell had recruited his friend, who still heads Alexion’s R&D.

“We had a one-year-old, a four-year-old and a seven-year-old, and I was on a tenure-track position at Yale as a physician scientist, and that’s when I left Yale,” Bell says. He had caught the entrepreneur bug from his father, who built homes in New York State, and as a college student, when he and his wife ran a summer restaurant. And he had become fascinated with the most primitive part of the human immune system, a series of enzymes that lurk in the blood like sea mines, primed to explode when they encounter foreign substances. The human body is protected from these enzymes, known as ‘complement’, by its own set of complement blockers. Bell and Squinto thought these complement blockers could be made into drugs to fight rheumatoid arthritis, terrible skin diseases, kidney problems and maybe even the inflammation during heart attacks.

Funding was elusive. After quitting Yale, Bell went to Prudential Securities. That very morning, Centocor, one of the hottest biotech stocks of the time, saw its stock implode after a clinical failure. Worse, within six months it was evident that the complement blockers in the body worked only when they were attached to the surfaces of cells like chain mail armour, and would not make good drugs. By 1995, Alexion was near closure.

It was saved by the strangest of efforts: At the time, many companies wanted to make pig organs that could be implanted into people. Complement would destroy them, though, so US Surgical gave Alexion $5 million to fund an effort to create pigs with human complement blockers. Then the state of Connecticut ponied up for a plant to make biotech drugs in bacteria, and Alexion came up with a fragment of a complement blocking monoclonal antibody against complement. Bell thought it would work after heart bypass surgery to reduce inflammation, complications and repeat heart attacks. A Centocor antibody fragment, Reopro, had just delivered amazing results in heart disease, so Wall Street loved the idea of another one. In 1996, just a year from death’s door, Alexion went public raising $21 million.

The goal was to manufacture the antibody against complement that Squinto’s researchers had designed, sifting through 10,000 candidates. That antibody would become Soliris, which went into production in 1997. It was tested in rheumatoid arthritis and kidney disease and failed. Alexion’s heart drug did no better. The problem, Bell says, is that by looking for big markets, not the right markets, he “kind of went with the crowd thinking as to how to build a business”. Soliris’ success would have to come from someplace else.

Alexion’s work on PNH, the disease that would make Soliris a blockbuster, began in the desperate, deep-in-the-red days. Russell Rother, a scientist at Alexion, was assigned to call Peter Hillmen, a haematologist at Leeds Teaching Hospitals in the UK, to get cells from patients with PNH so he could try to genetically modify them. The project was a dead end but led to a friendship between Rother and Hillmen that paid big dividends.

PNH results almost entirely from the complement system gone awry. Blood cells that lack their complement-blocking armour become the dominant form in the bloodstream, killed by complexes of enzymes aimed at intruders, causing anaemia. Red blood cells usually live for four months, but in PNH patients they die in two days. The blood (and urine) fill up with haemoglobin. Platelets are also harmed, causing blood clots that frequently kill patients. “Russell and I were absolutely convinced this should be a drug that would work in PNH,” says Hillmen.

Hillmen and Rother tried to convince Bell. No dice. The stumbling block was whether such a rare disease could ever be profitable. Hillmen also says there were doubts that he could even deliver enough patients for a clinical trial. Bell says his primary consideration was safety: He was afraid that if the drug worked and the regimen was then stopped, the red blood cells would start instantly being destroyed more catastrophically than normal. Bell says Hillmen is “a physician I would trust my life with” but that he was “so invested in the care of his patients” that he may have wanted to move too fast.Things changed. Genzyme of Cambridge, Massachusettes, saw its drug Cerezyme, for Gaucher disease, hit $500 million in annual sales. And Hillmen had done work showing that patients with severe PNH had few other types of red cells in their blood protecting the PNH cells was the only way to make them better. Bell says he wasn’t satisfied there was a big commercial opportunity, but he did believe that PNH was a disease that would demonstrate whether Soliris had potential. The first PNH study of Soliris, in 11 patients, began at Hillmen’s hospital in 2002.

Every Thursday, Rother and Bell went over the results. Patients required fewer blood transfusions and had less haemoglobin in their blood. But Bell says he was moved by the patients’ stories. One, who was earlier stuck in bed, could visit her boyfriend in another country. One elderly farmer needed to be hospitalised—because he felt good enough to climb into his hayloft for the first time in 20 years, fell and broke a rib. It reminded Bell of how it felt to treat patients. “I never thought I’d be able to feel that again,” he says. The results of that study were published in the New England Journal of Medicine in 2004.

Bell spent 18 months negotiating with the Food and Drug Administration to design the studies that would get Soliris approved. One 87-patient study was placebo-controlled, with only half the patients getting the drug a second study followed another 97 patients, all of them on Soliris. The drug helped every single one. To prepare the documents, Bell, Rother and a handful of others worked 100-hour weeks. Data since have showed that Soliris extends the lives of PNH patients to about as long as those of healthy people. Hillmen says the credit for that should go to Lenny Bell. “Without his personality and drive, there wouldn’t be an Alexion and there wouldn’t be a [Soliris].”

Also unique: Their understanding of markets. Analysts had expected Alexion to price the drug at $100,000 to $200,000, but it launched with a much higher price: $390,000.

Do ultra-rare drugs need to be as expensive as Soliris? Hillmen says he thinks about that issue often as he gives the drug to patients—though he has never seen the UK’s National Health Service decline to give it when it is indicated. “I understand the cost of developing it is very high,” says Hillmen. “But we have to look at these things more carefully, because a lot of people have rare diseases. It’s a lifelong treatment, and they’re developing it for other indications, which can’t be as expensive as the first indication.”

Alexion’s success has become a lure for other companies. Rother is working on a new medicine for sickle cell anaemia at Selexys Pharmaceuticals in Oklahoma City. Martin Shkreli, a New York hedge fund manager, has founded a biotechnology company called Retrophin and is working on a drug to treat muscular dystrophy. He estimates that the annual cost of taking care of a muscular dystrophy patient can be $400,000 a year. “It’s hard to believe,” Shkreli says, “but the math checks out. We should just price our drugs so there’s good bang for the buck, like any other product.”

Earlier this year, when Vertex Pharmaceuticals received approval for the first drug to treat the lung disease cystic fibrosis, it priced it at $294,000 per patient per year. The medicine works only for a few thousand patients who have a particular genetic mutation. The flood of new discoveries resulting from the plummeting cost of sequencing DNA could lead to more such drugs. Scientists have already discovered genes for dozens of rare diseases.

The National Institutes of Health counts 6,000 diseases that afflict less than 1 percent of the population. That’s 30 million people treating every one with a $30,000 drug would cost $1 trillion, the size of the global pharmaceutical market. But if the medicines are effective, it’s possible they could save almost as much as they cost. Worth noting: While Alexion is highly profitable, rival Biomarin is not, despite having launched two drugs for ultra-rare disorders.

The biggest problem with Alexion from an investor’s perspective is that it trades at a shocking 105 times 2011 earnings. To justify that multiple, it needs to sustain its astounding pace of growth. Lacking its own pipeline of new drugs, Alexion has been on a buying spree. In December, it paid $610 million in cash, plus the promise of up to $470 million more tied to performance goals, to buy Enobia, a small Montreal-based company seeing initial success developing ENB-0040, which treats a rare genetic disease. Children with this mutation may have weak bones and, in a few severe cases, are born with such weak rib cages that they cannot breathe. In one recent case, a child was born with almost no bone structure and was still saved.

But Bell’s rarest bet may be Orphatek, a drug bought from a German company a year-and-a-half ago for an undisclosed amount. It treats a disorder in which babies are born missing an enzyme and, as a result, their brains dissolve over the first weeks or months of life. “So it’s not life-threatening,” says Bell. “It’s lethal.” As best as Bell can tell, there are only 10 cases of this disease a year in the US, but children given the drug seem to recover remarkably. “So I said, ‘Look, if we’re doing what we say we’re doing and there are babies, we could develop a therapy for where we could change their lives not for five, 10, 30, 50 but for 70 years,’” Bell says. “I think that’s innovation.” What will it cost? At this point, nobody knows.

First Published: Oct 24, 2012, 00:17

Subscribe Now