For Indian carmakers, EU FTA means higher benchmarks, not fewer buyers

Lower import duties will sharpen competition on features, safety and tech, say analysts; components makers seen gaining

The India-European Union (EU) free trade agreement (FTA) is set to open one of the world’s most tightly protected auto markets. But for India’s mass market carmakers, the immediate effect is likely to be muted, with the sharpest impact concentrated well above the price bands where most cars are sold.

India currently imposes import duties of up to 110 percent on completely built units (CBUs)—cars that are imported as finished products—a policy that has kept European brands largely confined to premium models. Under the contours being discussed, those tariffs would fall in stages—first to about 30 to 35 percent and eventually to 10 percent—but only for a capped number of higher-priced vehicles (250,000 annually).

The deal lowers barriers at the top end without throwing open the doors to small and mid-size segments that dominate Indian roads. Nearly 95 percent of vehicles sold in fiscal 2025 were priced below Rs20 lakh, according to Crisil Ratings.

That structure is deliberate, says Saket Mehra, partner and auto & EV industry leader, Grant Thornton Bharat. “The agreement significantly alters market access in a segment that has historically been tightly protected,” he explains, adding that the low starting base means the impact on volumes will be “evolutionary rather than disruptive”, with “limited spillover into mass-market volumes in the near term”.

The mass passenger vehicle market remains dominated by affordability. “The mass-market passenger vehicle segment remains largely insulated and highly price sensitive,” says Poonam Upadhyay, director at Crisil Ratings.

Even with reduced duties, she adds, imported European cars are likely to remain priced above the core mass segment, limiting their relevance at the lower end.

What will change sooner is competitive intensity at the top edge of the mass market. European automakers would gain flexibility to recalibrate pricing, expand model ranges and offer higher specifications. “Greater pricing flexibility may support upper-end variants, faster refresh cycles and stronger feature offerings,” Upadhyay says, lifting benchmarks on safety, technology and brand experience.

Harshvardhan Sharma, group head for automotive technology and innovation at Nomura Research Institute, says the FTA would not trigger “a sudden influx of inexpensive European cars”, but would alter competitive dynamics over time. “Sensitive segments such as small cars are likely to remain protected,” he says, limiting the immediate impact on Indian manufacturers that dominate compact and entry-level models. The bigger implication, he adds, is “benchmark pressure”, as customer expectations rise in premium SUVs and aspirational segments.

The FTA is significant because it covers 25 percent of the world population and 25 percent of world GDP. “In practical terms, Europe gains a new market comparable to the Netherlands (which has lower volumes than 250,000 proposed in the FTA), while India effectively adds an automotive ‘state’ the size of Maharashtra in demand potential (625,000),” says Ravi Bhatia, president of automotive consultancy Jato Dynamics.

Price cuts, however, may be less dramatic than headline tariff reductions suggest. That’s because automakers already absorb part of the duty when they price their models for India and so, any reduction is unlikely to translate into a commensurate drop in sticker prices.

Grant Thornton’s Mehra notes that European OEMs (original equipment manufacturers) have already taken cumulative price hikes of 15 percent to 25 percent over the past few years due to higher commodity, logistics and compliance costs. A weaker rupee against the euro has also inflated landed costs. “While the FTA will reduce headline duties, the pass-through to on-road prices is expected to be measured rather than dramatic,” he says.

Where the FTA becomes strategically interesting is exports. “For vehicles and components manufactured in India—whether by Indian OEMs or non-European automakers—the agreement could improve competitiveness in Europe if products qualify under the FTA’s rules of origin and meet EU regulatory requirements,” says Nomura’s Sharma.

There is a critical caveat: Preferential access will depend on how much value addition happens in India and how strictly origin norms are defined.

“If India-made models can meet EU homologation standards and rules-of-origin thresholds, the FTA could strengthen India’s position as a global small-car and compact-vehicle export hub,” Sharma says.

For Indian exporters, the upside may not immediately show up in volumes, feels S&P Global Mobility’s Gupta. “The upside may come more from better profitability than from higher volumes.”

The domestic industry is looking at the agreement as carefully calibrated. Mahindra Group CEO and MD Anish Shah says the pact “lowers in-quota duties only at higher priced segments”, which he argues would “enhance scale in the core segments relevant to Make in India for the world” without changing competitive dynamics in the mass market.

Shailesh Chandra, president of the Society of Indian Automobile Manufacturers, and managing director of Tata Motors Passenger Vehicles, says the approach should create a “win-win between increased global participation on one hand and growth of the domestic auto industry with investments and employment on the other”.

Dealers echo that view. Federation of Automobile Dealers Associations President CS Vigneshwar says more than 95 percent of European OEM sales in India are already locally manufactured. “This FTA strengthens Make-in-India, expands consumer choice and opens reciprocal export opportunities for Indian OEMs,” he says, pointing to safeguards such as tariff-rate quotas and protections for India’s electric vehicle (EV) road map.

EVs are outside the agreement for the first few years. This gives domestic manufacturers time to scale platforms and local supply chains without direct import pressure.

While the impact on mass-market car sales may be limited, industry executives see deeper implications for auto components. The FTA talks about complete tariff elimination for car parts after five to 10 years.

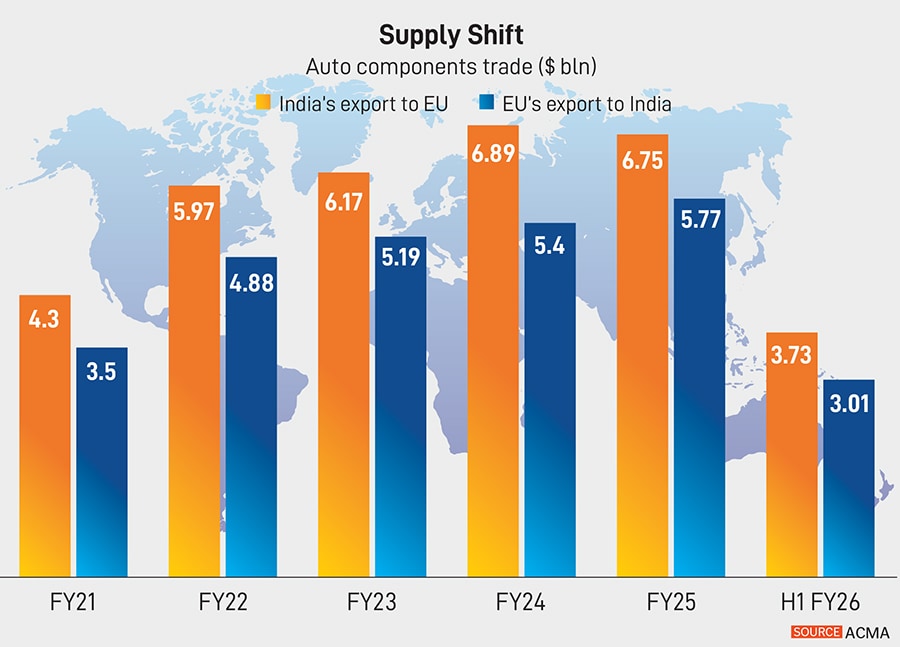

Indian suppliers already export billions of dollars’ worth of parts to Europe, with exports of about $3.7 billion in the first half of FY26 alone, according to Grant Thornton. The EU accounts for nearly 30 percent of India’s component exports, according to the Automotive Component Manufacturers Association of India (ACMA).

“The phased elimination of duties on components over the next five to 10 years is expected to deepen India’s integration into European value chains,” Mehra says, accelerating opportunities in areas such as electrification, power electronics and advanced materials.

ACMA President Vikrampati Singhania calls the agreement “a timely and strategic step” that could unlock exports, technology partnerships and long-term investments. “As global OEMs and suppliers look to build resilient supply chains, a well-balanced and pragmatic FTA can position India as a reliable manufacturing and sourcing partner for Europe,” he says.

Crisil’s Upadhyay says European OEMs expanding local assembly in India are likely to increase sourcing from Indian suppliers to manage costs and improve supply reliability, translating into higher domestic orders and tighter quality standards.

Auto component maker Spark Minda says the FTA acts as a catalyst by enhancing export competitiveness and deepening technology collaboration, reinforcing India’s role in global supply chains. “While our engagement with European customers has already been strong, the agreement provides additional confidence and momentum to expand partnerships and pursue new opportunities in key markets and creates a clearer runway for export growth,” says Pankaj Uniyal, group head-exports, Spark Minda.

First Published: Jan 29, 2026, 12:14

Subscribe Now