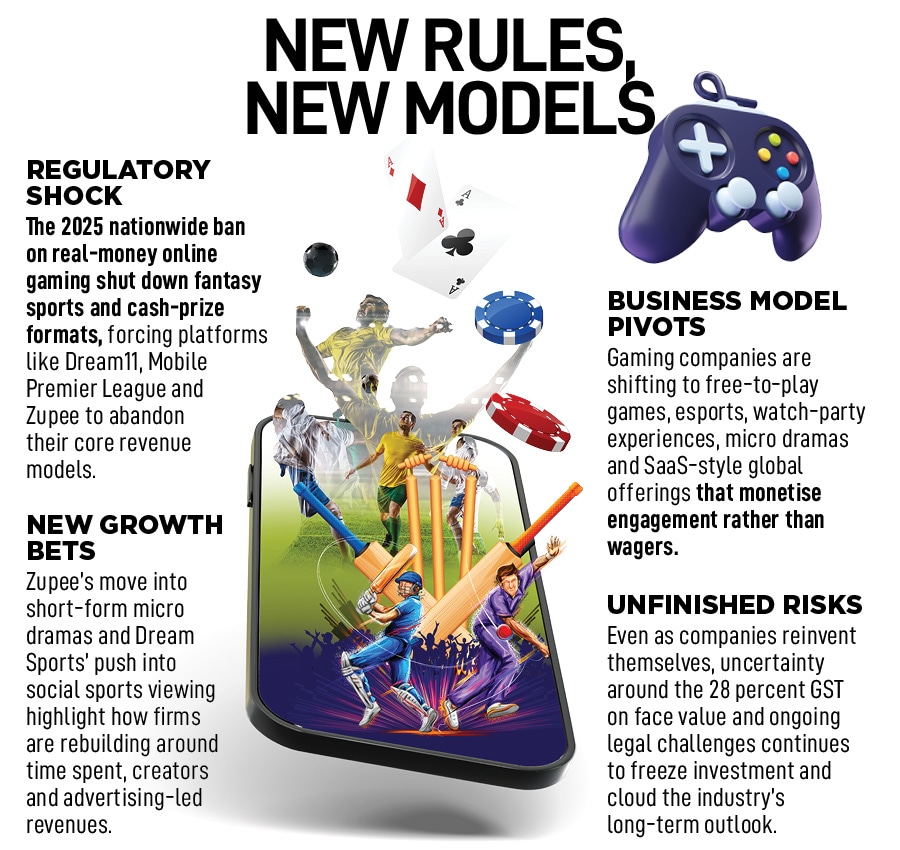

How online gaming companies are pivoting after the ban

They are reinventing themselves—through free-to-play formats, e-sports, micro dramas and global SaaS plays—as regulatory uncertainty and a looming GST verdict reshape the industry’s future

When Parliament passed the Promotion and Regulation of Online Gaming Act in 2025, effectively banning real-money online gaming nationwide, it didn’t just redraw regulatory boundaries—it reset the trajectory of a sector that had been among the fastest-growing segments of the digital economy. What had been a rare consumer internet success story—homegrown platforms with tens of millions of users, billions in venture capital and a new class of tech employment—suddenly saw its core business model rendered illegal.

Fantasy sports, poker, rummy and cash-prize casual games found their engines abruptly shut. Dream Sports’ Dream11, India’s largest and most recognisable fantasy platform, announced the closure of its real-money operations, asking users to withdraw balances as entry fees and cash prizes disappeared overnight.

Platforms such as Mobile Premier League suspended paid contests. Zupee and several casual gaming apps halted cash formats. Poker operators, including Nazara Technologies-backed PokerBaazi and Rummy Circle, wound down real-money offerings. For an industry that had supported hundreds of thousands of jobs and generated significant tax revenues, the impact was immediate—layoffs, restructuring and a sharp reassessment of India’s regulatory risk by investors.

Yet the law did not ban gaming outright. Non-monetary games, esports and skill-based formats without cash stakes were explicitly permitted, reflecting the government’s attempt to separate entertainment from wagering. That distinction became the industry’s lifeline.

Faced with extinction or reinvention, gaming companies began pivoting—sometimes reluctantly, sometimes ambitiously—towards models that prioritised engagement over entry fees, and communities over cash pools. But even here, ambiguity persists. There remains little regulatory clarity on whether platforms can legally run contests where they collect money and offer prizes, even if positioned as skill-based or promotional, prompting many companies to tread cautiously.

Free-to-play formats, long dominant globally but overshadowed in India by cash contests, moved to the centre of many strategies. Platforms like Zupee retained casual titles in free formats, focusing on advertising, brand partnerships and user retention rather than prize pools.

The metrics that mattered changed. Daily active users, time spent and repeat engagement replaced gross gaming revenue as the industry’s primary benchmarks.

One of the clearest signals of how far this reinvention has gone is Zupee’s move into micro dramas, a fast-emerging category of short, vertical, serialised storytelling optimised for mobile screens. According to a RedSeer Strategy Consultants report, the segment is entering a “J-curve” moment, projected to grow 40 to 50 percent annually and reach around ₹4,000 crore by 2026.

Zupee’s newly launched Zupee Studio features one- to three-minute episodes across genres such as romance, crime, comedy and fantasy, designed to drive habitual viewing rather than one-off engagement.

“Micro dramas extend the same philosophy we’ve followed in gaming into storytelling,” says Govind Mittal, chief spokesperson at Zupee. Built on the belief that India’s entertainment future will be interactive, mobile-first and creator-led, the format opens up monetisation pathways ranging from branded integrations and premium arcs to creator formats and, eventually, subscriptions. More importantly, he adds, it broadens the ecosystem Zupee is shaping—one where gaming, entertainment, creators and advertisers converge around time spent.

For some players, India’s regulatory clampdown accelerated ambitions that had existed quietly in the background. WinZO, for instance, began pushing harder into overseas markets where real-money gaming is regulated rather than prohibited, including parts of the US and Latin America. The company is believed to have put these investments on wait-and-watch mode. “A lot of real money gaming companies are in wait-and-watch mode post the enactment of the Promotion & Regulation of Online Gaming Act, 2025 before deciding what to do next. Companies are waiting to see the outcome of the Supreme Court in matters pertaining to past GST liability (where Supreme Court has reserved judgment in August 2025 after hearing all arguments) as well as clarity on possible overseas business structures, and permissible social games and esports formats,” says Jay Sayta, a technology and gaming lawyer.

Others have taken a quieter route. They are monetising engineering capabilities by offering SaaS-style gaming infrastructure—ranging from game engines and compliance tools to payments and engagement layers—to overseas operators. In effect, they are selling the picks and shovels of the global gaming industry, even as the domestic market remains in flux.

Dream Sports chose a different path. Rather than simply replacing cash contests with free games, it began reimagining itself as a broader sports entertainment platform aligned with India’s growing watch-party culture.

“We’ve always believed that sport is fundamentally a shared experience,” Harsh Jain, co-founder and CEO of Dream11, told Forbes India recently. “The regulation changed the format, not the fan behaviour. People don’t just watch matches anymore—they react, discuss and celebrate them together.”

Instead of drafting fantasy teams for cash, users now join creator-led watch rooms during live matches, participate in free-to-play predictions and polls, and interact via chat and reactions. Monetisation comes through advertising, brand integrations and premium fan features, turning attention and engagement into currency.

The regulatory reset has also reshaped the conversation around esports. By explicitly excluding non-monetary competitive gaming from the ban, the law placed esports in a regulatory sweet spot. Sponsor-backed tournaments and professionally organised leagues have since drawn renewed interest from brands and creators.

The long-term demand story remains intact. While India has only around 10 million gaming consoles, it has close to 750 million smartphones, ensuring that gaming—especially mobile-first formats—will always have a market.

Still, the ban is only one layer of uncertainty confronting the sector. Even as companies pivot operationally, a far larger financial issue continues to loom: The unresolved GST dispute. Since 2023, gaming firms have been contesting the government’s decision to levy 28 percent GST on the full face value of bets rather than on platform commissions.

Tax demands running into tens of thousands of crores have been issued, creating a parallel crisis that predates the ban but remains unresolved.

For founders and investors, the GST case has become as consequential as the gaming prohibition itself. Even companies that have exited real-money formats or shifted overseas remain exposed to legacy tax claims. The uncertainty has frozen capital allocation, delayed exits and cooled global investor enthusiasm for what was once seen as one of the world’s most promising gaming markets.

Not everyone has accepted the new order quietly. Some companies have challenged the ban, arguing that it fails to adequately distinguish between games of skill and gambling. A23, among the country’s largest skill-gaming platforms, has moved the Karnataka High Court, setting the stage for a prolonged legal debate. A small set of users has taken their businesses to overseas platforms like 1xbet where money is transferred through mule accounts.

Six months on, the ripple effects are still being felt. Investment into Indian gaming startups has slowed. Talent has dispersed into adjacent sectors. Enforcement actions against illegal betting websites have intensified.

Yet, the story of India’s gaming industry after the ban is not one of collapse but of recalibration under pressure.

Free-to-play models, esports, micro dramas, SaaS exports and social watch-party experiences are now forming the pillars of a reimagined gaming economy. The GST verdict remains the final—and perhaps most consequential—piece of the puzzle. But for founders and investors bruised by regulatory shock, one lesson is clear: In India’s digital economy, adaptability is not optional. The rules may change, but the game, in one form or another, goes on.

First Published: Jan 22, 2026, 11:43

Subscribe Now