The case for Indian secondary funds

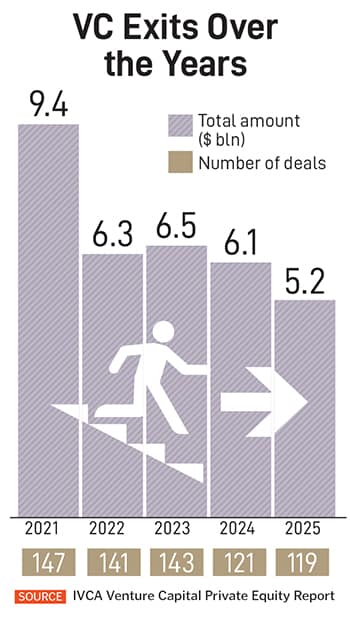

Unlike globally, homegrown secondary funds have only now started taking shape. In a market that still struggles with liquidity, they might be the answer to venture capital’s prayers for an exit

In June 2025, growth-stage venture capital (VC) firm Eight Roads sold three of its portfolio assets to global secondary fund TR Capital for $50 million, gaining a partial exit from the IPO-bound logistics company Shadowfax, customer engagement platform MoEngage and digital adoption platform Whatfix.

Eight Roads had first invested in Shadowfax in 2015, and a 10-year timeline to exit brought in 10.4x returns from the IPO, in addition to reducing its stake through the secondary deal.

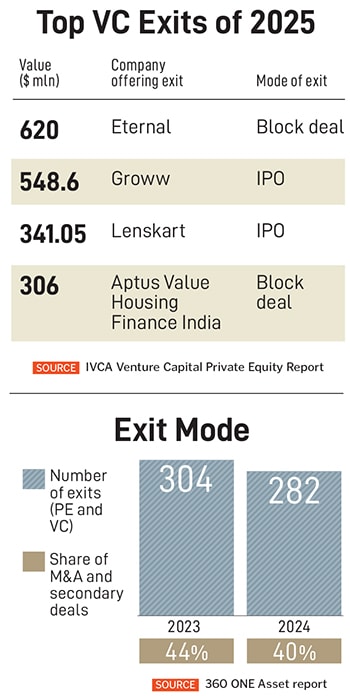

Despite an imminent listing, investors holding on to large shares in their portfolio companies are required to engineer a mix of secondary sales, sale through IPO, and block deals post-IPO to ensure the right return multiples. Scouting for generating liquidity has to be balanced with the best interests of the portfolio company for a successful IPO, not dominated by Offers For Sale (OFS) alone.

This is where direct secondary funds come in, offering liquidity to VC investors, in exchange for a position on the cap table of IPO-bound companies at a discount to pre-IPO rounds.

Apart from global players like TPG-backed NewQuest, TR Capital and others, there is a new crop of Indian direct secondary funds emerging, offering liquidity to VC and mid-market private equity (PE) investors. 360 ONE Asset launched its $590 million debut secondaries fund in 2024. Neo Asset Management has announced the first close of its $250 million secondaries fund in 2025, while former Peak XV MD Piyush Gupta, and former director of TR Capital Group, Norbert Fernandes, got together to launch growth stage secondaries fund Kenro Capital in 2024. Category II Alternate Investment Funds are Sebi-regulated private investment vehicles that invest in unlisted companies, PE, debt, or real estate. They do not engage in leverage (borrowing) except for day-to-day operational needs.

The buoyant IPO ecosystem in India has been rewarding largely for PE investors backing ‘traditional’ businesses. However, for VC investors in new-age technology companies, the number of ‘winners’ from the portfolio is conservative at best.

In order to generate good returns, most VC firms end up holding on to their investments in companies hoping for an IPO. “The stress will build on the VC ecosystem as not all portfolio companies will go in for an IPO. They will have to find other routes which could be M&A or secondary sales,” says Arjun Anand, managing director and head of Asia at evergreen PE firm Verlinvest.

Typically, a secondary sale happens when shares in a startup are sold to a new investor, transferring the ownership without raising new capital for the issuing company. This offers liquidity to the seller which could be an early investor, promoter, shares from the Employee Stock Ownership Plan (ESOP) or a mix of these.

Indian new-age tech companies typically have a high degree of private ownership at growth stages, with the founders holding as less as 15 percent stakes, and the rest being held by VC investors across stages.

“In the period leading up to the IPO, the VC investors have the option to offload some of their shares to wealth and family offices or PE funds, Even then, chances are that they are left with a large amount of continued ownership in a company as it hits the IPO timeline,” says Prateek Indwar, managing director and head, capital markets, at InCred Capital.

He adds that IPOs are size- and valuation-sensitive and often cannot absorb all of the share sale—with investors left with large chunks of shareholding even after IPO. In order to avoid this, VC investors need to weigh carefully how they can offload some of their shares well ahead of the IPO, often using a combination of tools, including secondary transactions.

While a secondary transaction can happen any time in a growth stage company, Indian direct secondaries funds are aimed at maximising the returns from the robust public market.

“The macro challenge is exits and liquidity. The micro challenge is do you hold on to your winners or do you defer? And it’s not easy. My personal view is that too many smart VCs have held on too long and have not taken chips off the table or partial exits when they could have,” says Sameer Nath, CIO and head, PE and VC at 360 ONE Asset.

He adds that the best returns can be made when an IPO is imminent within three years. “At a pre-IPO, before DRHP stage, there is more flexibility and after the DRHP is filed, it is governed by the listing norms. We started off as a classic pre-IPO investor, but have evolved into a late-stage opportunity. That is where the real alpha is,” says Nath.

The role of the secondary fund, he says, is similar to that of a late-stage PE investor, offering exits to early investors. This cleans up the cap table, absorbs the exodus of investors as soon as the lock-in period post-IPO is over and offers the founder and the management team a patient shareholder. “We get an attractive entry valuation and the funds exiting still make a healthy return,” he adds.

Also Read: Why IPOs present more than an exit opportunity for startup investors

Unlike mature markets like the US where it is possible to turn around an entire portfolio to a new set of Limited Partners (LPs—investors in funds), bundled deals are a rarity in India. The new crop of Indian direct secondary funds are usually focussed on underwriting a single asset or company.

“We will still see some asset-specific deals where a secondary fund might buy one to three assets,” says Neeraj Shrimali, managing director and co-head, digital & technology investment banking, Avendus Capital.

But such deals are few and far between. Asia-focussed secondary PE platform TPG NewQuest has seen the market evolve significantly since its inception in 2011, with a clear shift globally towards continuation vehicles (CVs) over the past decade as buyers focussed on quality assets versus a mixed bag of assets as end of fund life solutions.

Speaking about the trend, Mamtesh Sugla, partner at TPG NewQuest, says, “We may see a similar trend where PE funds in India are increasingly going to rely on CVs where the General Partners (GP) transfer their top-performing, ‘trophy’ assets from an existing fund to a new vehicle.”

He adds how CVs can provide existing LPs the option to “cash out” or roll their equity into the new vehicle, while also enabling GPs to hold the asset for longer to capture potential upside.

In 2025, TPG NewQuest along with HarbourVest Partners, Hamilton Lane and LGT Capital Partners closed a $430 million multi-asset continuation vehicle with PE firm Multiples Alternate Asset Management to extend its holding in Vastu Housing Finance, Quantiphi and APAC Financial Services.

Secondary funds are not meant to be passive in nature. In fact, the single-asset funds are looking to bring in the rigour necessary to prepare a company for the IPO process, similar to the kind of handholding done by seasoned PE backers. Kenro Capital, founded by industry veterans from Peak XV and TR Capital, is yet to announce its first close or the size of its corpus. However, the fund has already closed three investments, including $40 million in K12 Techno Services which owns Orchid International Schools, and is evaluating more.

The fund invests in companies typically two to four years away from an IPO, bringing in the necessary expertise and offering liquidity to early-stage investors. “It is important to understand what is valuable to the founder because he is not getting primary capital into the company. When we enter a company, we bring on board corporate finance, IPO preparation, company board creation, and ability to execute acquisitions—valuable capabilities for the founder at the stage they are in,” says Fernandes of Kenro Capital. He adds that the firm focuses on underwriting a single asset to be able to work closely with the founders.

As the Indian market matures, the number of secondary funds and their variations are only likely to increase. Secondaries are mere derivatives of the primary markets and will need time, observe industry experts.

While there is precedence for secondary transactions in other South Asian markets like Singapore and Mauritius, the ecosystem in India is still new. “You will see more continuation funds, more deals in this area. We are actively studying it. If we are sitting here one year from now, the secondaries volume would have grown,” says Nath of 360 ONE Asset, adding that it is a case of glass half full in terms of a growing market for direct secondary funds.

Apart from growth in domestic secondary funds, global secondary funds too are keen on India as an opportunity. As Indwar of InCred points out, much like the PE ecosystem in India where most global PEs now have an India office, global secondary funds too are setting up teams on the ground, moving from multi-asset secondary deals to underwriting single-asset deals.

First Published: Feb 11, 2026, 13:31

Subscribe Now(This story appears in the Feb 06, 2026 issue of Forbes India. To visit our Archives, Click here.)