Why IDFC FIRST Bank’s travel rewards are a game-changer for Indian travellers

IDFC FIRST Bank travel-oriented credit cards maximise rewards on hotels, flights, and lifestyle spends

New Delhi [India], August 22: When making travel plans, whether domestic or international, most people look for affordable flights, great hotel deals, and meaningful savings along the way. Yet, very often, the value of reward points and travel privileges offered by credit cards gets overlooked. With IDFC FIRST Bank’s credit cards, Indian travellers now have an edge—thanks to elevated bonus reward structures, unmatched redemption value, and exclusive privileges that go beyond just discounts. Credit cards from IDFC FIRST Bank are thoughtfully designed to enhance every stage of your travel journey, from booking to checkout.

For frequent fliers and holiday-goers alike, IDFC FIRST Bank offers a comprehensive range of credit cards that provide significant value on travel-related spends. Whether you are booking flights or reserving hotels, these cards reward you handsomely with bonus reward points on every eligible transaction made via the IDFC FIRST Bank mobile app.

With the Mayura Credit Card, for instance, you enjoy up to 30X bonus reward points on flight bookings and a massive 50X bonus reward points on hotel reservations—one of the highest in the segment. These reward points are on top of the base monthly reward of 10X points on spending above ₹20,000 and 5X reward on spending below ₹20,000 in a billing cycle.

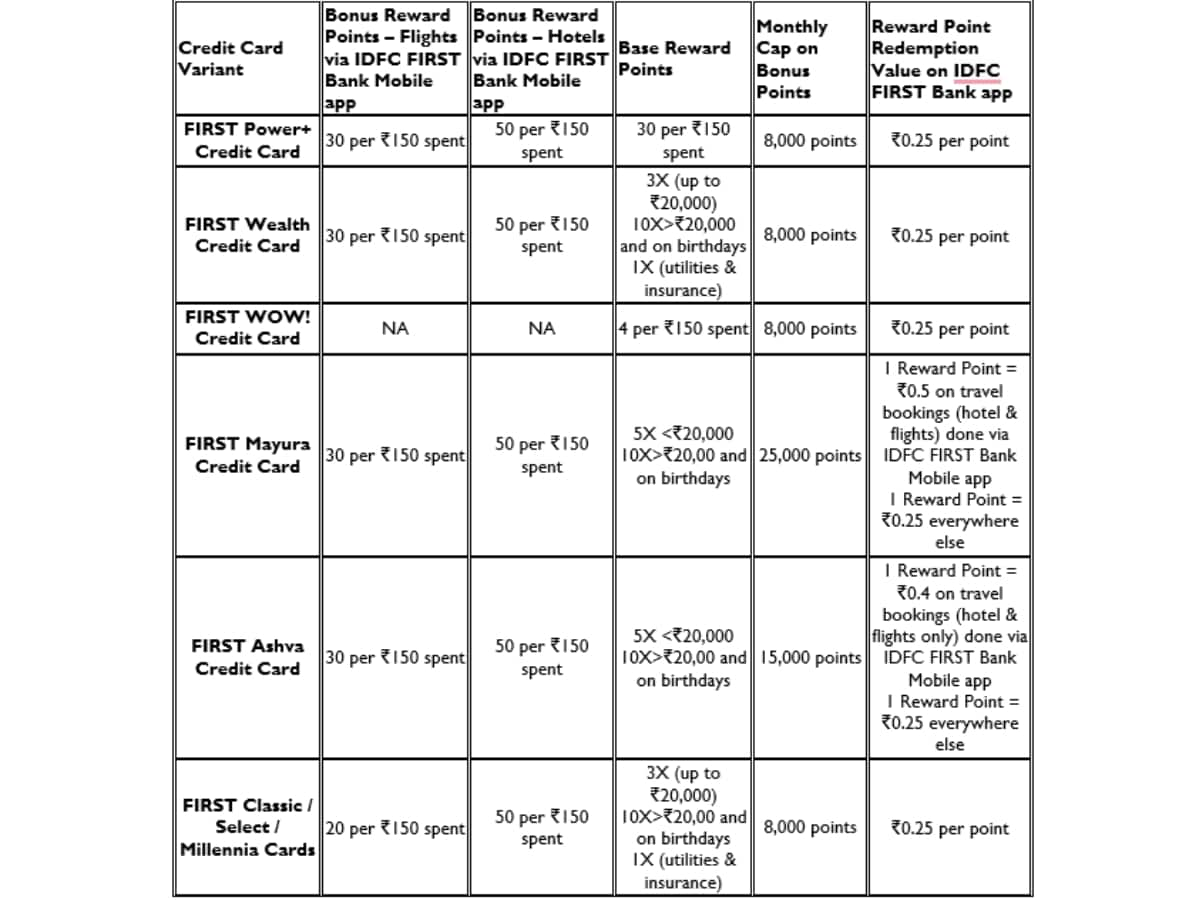

Here’s a closer look at the bonus reward structures across key IDFC FIRST Bank credit cards when you book flights and hotels via the IDFC FIRST Bank mobile app:

How to redeem the reward points?

IDFC FIRST Bank makes reward redemption seamless and rewarding. You can redeem your accumulated points directly on the IDFC FIRST Bank mobile app for flights and hotel bookings. Each credit card has a fixed redemption value per point (ranging from ₹0.25 to ₹1.00), and you can use reward points to cover up to 70% of the booking value, including taxes. The remaining balance must be paid using the same credit card.

Do note that only full-swipe transactions are eligible for bonus reward points, and cash + points transactions will not qualify for this benefit. Additionally, points will be credited by the 5th of the next calendar month post-travel or hotel check-in, provided your card is active.

With thoughtfully structured rewards, generous bonus point multipliers, and easy redemption options, IDFC FIRST Bank credit cards with integrated flight and hotel booking features are fast becoming the go-to financial companions for Indian travellers. Whether you're a budget explorer or a luxury traveller, there’s a card that matches your lifestyle and spending preferences. Maximise every travel spend and let your next booking earn you more—only with IDFC FIRST Bank credit cards!

The pages slugged ‘Brand Connect’ are equivalent to advertisements and are not written and produced by Forbes India journalists.

First Published: Sep 08, 2025, 17:47

Subscribe Now