Exploring AIFs in India: A guide to alternative investment funds for modern inve

This article provides an insight into Alternative Investment Funds (AIFs), their benefits, risks, tax implications, and how they differ by category

India’s investment landscape has undergone significant shifts in the past decade. From traditional options like fixed deposits and gold to mutual funds and direct equities, investors today have more choices than ever, each with different levels of risk and potential reward. However, as markets mature and wealth grows, many high-net-worth individuals and experienced investors are now looking beyond the standard choices.

One such investment option that has gained popularity over the years is Alternative Investment Funds (AIFs). AIFs in India offer exposure to niche opportunities that don’t typically sync with public markets. Interest in alternative investment funds has surged, with investors seeking diverse strategies and potentially higher AIF returns.

If you"re exploring new ways to build your wealth, it might be the perfect time to understand what it means to invest in AIF. In this post, we’ll discuss the basics, types, pros, cons, and tax implications of alternative investment funds.

Alternative Investment Funds (AIFs) are privately pooled investment vehicles that collect money from a select group of investors to invest in non-traditional assets. These may include private equity, real estate, venture capital, or other non-public opportunities. The Securities and Exchange Board of India (SEBI) regulates AIFs under a separate set of guidelines introduced in 2012, which are typically set up as limited liability partnerships (LLPs), trusts, or companies in India.

AIFs—with a minimum lock-in period of three years—are intended for individuals with a higher risk profile and long-term investment objectives. To invest in AIF, you need to put in a minimum of ₹1 crore. Fund managers, employees, or directors can start with ₹25 lakh. The number of investors is capped at 1,000 per scheme, except for angel funds, which allow up to 49.

According to SEBI"s data, by March 2025, alternative investment funds had a total commitment of almost ₹13.5 lakh crore. With longer lock-in periods and specialised strategies, AIFs in India are seen as a way to target differentiated AIF returns beyond public markets.

SEBI classifies AIFs in India into three categories based on their investment strategy and asset types.

These alternative investment funds focus on socially or economically beneficial options. They include venture capital funds, angel funds, SME funds, infrastructure funds, and social venture funds. They typically invest in early-stage start ups, small and medium enterprises, or infrastructure projects.

For example, Angel funds support early-stage businesses, while venture capital funds usually support start ups with proven growth potential.

The private equity funds, debt funds, real estate funds, and funds of funds fall under this category. These are structured for investors aiming to access assets that are not available through regular investment channels. With a long-term view and lock-in periods ranging from 4 to 7 years, many AIFs in India fall under this group. Leverage is not allowed beyond operational requirements.

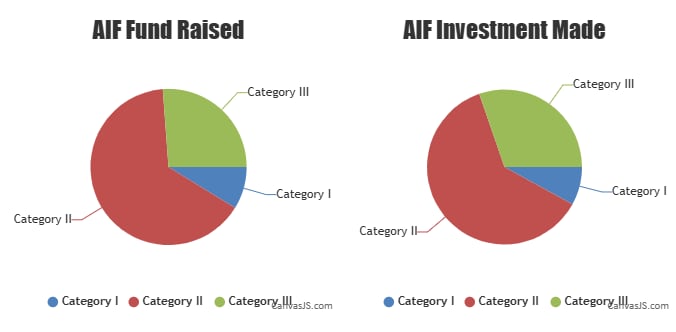

Source: SEBI | AIFs in India: Funds raised and total investment (March 2025)

As of March 31, 2025, the funds raised by Category II AIFs were ₹3.6 lakh crore, more than the combined total of Category I and III. Similarly, the total investment made in Category II AIFs exceeded ₹3 lakh crore, significantly more than in the other two categories.

Alternative investment funds use complex trading strategies and can invest in listed or unlisted derivatives. This category includes hedge funds and PIPE (Private Investment in Public Equity) funds. They aim to generate higher AIF returns by taking more aggressive positions. These funds may use leverage and carry higher risk, making them suitable for experienced investors.

The benefits of AIFs include:

Diversification: Alternative investment funds allow you to spread your capital across various asset classes. It’s a smart way to avoid putting all your eggs in one basket, helping to reduce potential risks.High AIF returns: AIFs can tap into niche markets and early-stage ventures, giving you access to opportunities that traditional investments often miss. This can boost long-term AIF returns.

Multiple investment opportunities: Since AIFs back private companies that are not listed on public markets, they provide exposure to high-potential growth and multiple investment opportunities.

There are certain risks associated with alternative investment funds:

The tax rules for AIFs in India depend on their category and legal structure—whether it’s a company, a trust, or an LLP.

Until now, income from Category I and II alternative investment funds has lacked a clear structure and has sometimes been taxed as business income. From April 1, 2026, the government has clarified that AIF returns will be treated purely as capital gains and taxed at a flat 12.5 percent, instead of a tax rate of 25 to 35 percent. This represents a major shift, as it provides greater clarity and potentially lower tax liability, and may encourage many people to invest in AIFs in India.

First Published: Jun 17, 2025, 18:55

Subscribe Now