XIRR in mutual funds explained: The key to understanding SIP returns

Understand the importance of XIRR in mutual funds, how to calculate it, and how it helps you track your investments accurately in the market

India’s mutual fund industry has seen steady growth in recent years. As of February 2025, the Indian mutual fund industry’s assets under management (AUM) crossed a cool ₹64 lakh crore. This growth is largely due to the popularity of systematic investment plans (SIPs) amongst retail investors and a growing awareness of long-term investing. More people are now turning to mutual funds for better, relatively safer gains, but figuring out how much you earn isn"t always as simple as it seems.

Knowing the real picture of our investments and returns is important, particularly in an SIP, where your investments happen at different times. That’s where the Extended Internal Rate of Return (XIRR) comes in.

In this post, we’ll explain what XIRR means for you as a mutual fund investor, how it helps make sense of your returns, and why knowing this metric can bring more clarity to your financial decisions.

Extended Internal Rate of Return, or XIRR, is a way to measure how your mutual fund investment has performed over time, especially when you’ve invested money at different intervals. For example, SIPs have multiple purchase rates and different instalment periods. If you"re investing in SIPs, your cash flows aren’t evenly distributed and calculating the final profit can be tricky. XIRR in mutual funds makes simple metrics like CAGR (compound annual growth rate) and ROI (return on investment) less effective, as they consider only a single investment and a fixed holding period.

XIRR in mutual funds adjusts for the timing and amount of each investment and withdrawal. It calculates a single annual return that reflects how your money has worked for you, considering each cash flow.

XIRR is one of the most accurate ways to evaluate investment returns for anyone who invests in mutual funds.

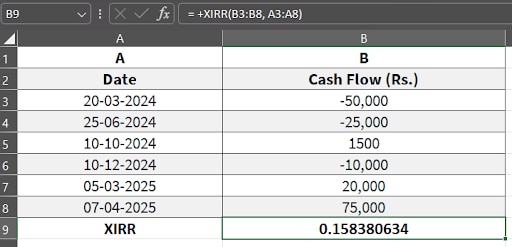

You can easily calculate XIRR in Excel using the built-in XIRR function. All you need are accurate dates and the cash flow details (outflows or inflows). The syntax for the XIRR function in Excel will be: = +XIRR (B2:B5, A2:A5), where the B cell will contain the cash flow values and the A cell will have the dates specified.

Hypothetically, let’s say these are your transactions:

In this example, the calculated XIRR is 0.1583—or 15.8 percent—which reflects the annual return value from March 20, 2024, to April 7, 2025.

Here’s how XIRR compares with CAGR and absolute returns:

XIRR accounts for each cash flow—monthly or lump-sum investments—and the exact date of investments, making it useful for those investing in mutual funds through SIPs. XIRR gives you a rate of return that reflects the actual timing and size of your transactions.

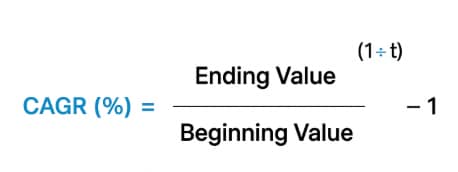

Conversely, CAGR works best when a single investment is made and held for a specific period. It calculates the annual growth and returns, assuming your investment grows steadily. The formula is:

CAGR = (Final value/Initial value) ^ (1/Number of years) - 1

While CAGR is simpler to calculate, it doesn’t reflect irregular cash flows like XIRR.

Absolute return gives you the percentage loss or gain on an investment over a specific period without considering any deposits or withdrawals made during that interval.

It is calculated using the formula:

Absolute return = [(End value - initial value)/Initial value] X 100

While absolute return can offer a quick overview of your investments, XIRR in mutual funds digs deeper and gives you all the compounding effects and transaction details over time.

XIRR matters because it reflects how your investments have actually performed based on your specific investment pattern. If you invest or withdraw money at different times based on market conditions, simple return metrics won’t be able to calculate these changes effectively.

XIRR can help you make mindful decisions by offering accurate insights on the rate of return while aligning with your specific financial goals. It also helps you better understand the risk-reward balance for your investment plans, such as short-term savings or retirement planning in a volatile market.

Some benefits of XIRR in mutual funds include:

Accurate investment analysis: XIRR considers both the timing and amount of each investment. This is useful when money is added regularly, instead of all at once. You get a more accurate sense of your mutual funds" performance.

Comparing different investment styles: Whether you"re considering SIPs, lump-sum investments, or varying contribution amounts, XIRR considers all of them while evaluating returns. It adjusts for cash flow patterns so you can compare performance fairly and make better decisions.

Tracks overall portfolio performance: If you invest in multiple mutual funds with different cash flows, XIRR helps you to calculate the total return across your entire investment portfolio. This makes it easier to see if your diversification strategy is on track or needs adjustments.

Though XIRR in mutual funds are beneficial, it also has certain limitations:

Sensitive to errors: Even if one transaction date or amount is wrong, XIRR can show misleading results. It relies heavily on accurate data, and small slip-ups can make a big difference in calculating returns.

Complex metric: Compared to simple ROI and CAGR, XIRR is more technical. For someone new to mutual funds or SIPs, it might take a while to wrap their head around how XIRR works.

Analyses past data: XIRR calculates how your investments have performed so far but doesn’t predict what might happen next, especially during market fluctuations.

SIPs, or systematic investment plans, let you invest a fixed capital in mutual funds at regular intervals—usually monthly. Since these investments happen at different times, XIRR can greatly help. It accounts for every SIP instalment and the exact date the money was invested.

For example, if you increase your SIP amount when the market dips or pause it during a high, XIRR adjusts for that. It calculates returns based on every cash inflow and outflow, giving you an accurate value.

First Published: Jun 03, 2025, 16:43

Subscribe Now