Election effects: Expecting the unexpected

The Sensex was up 4.6 percent in the three sessions since the results were declared, and the market had shrugged off the poll results

Image: Kunal Patil / Hindustan Times via Getty Images

Image: Kunal Patil / Hindustan Times via Getty Images

How do markets react to unforeseen events? The state election results on December 11, which saw the BJP lose its majority in three states, were expected to result in declining stock markets. Instead, the opposite happened. The Sensex was up 4.6 percent in the three sessions since the results were declared, and the market had shrugged off the poll results.

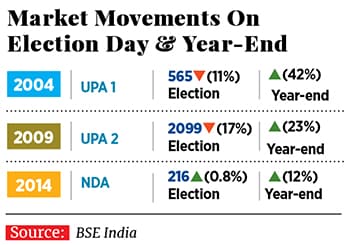

In doing so the Indian markets follow a global script: When Donald Trump won the US presidential race in 2016, the Dow recovered within days when the UK voted to leave the EU, the FTSE began pricing in higher profits for British exporters due to a weaker pound. Similarly, in 2004, the NDA’s shock defeat had prompted a quick brutal correction before rising corporate earnings resulted in a four-year bull run. The 2009 UPA’s re-election euphoria was short-lived, despite the markets hitting two upper circuits on election day.

Those waiting for a correction before the 2019 elections in India would do well to remember that “more money has been lost waiting for corrections than in the actual correction”. As blogger Rohit Chauhan tweeted after the December 11 results: “Media: Expect markets to drop. Actual: Markets are up. Lesson: For the nth time ignore the chatter and focus on companies and their business. Over the long term, the noise cancels itself out.”

First Published: Dec 16, 2018, 17:38

Subscribe Now