IPOs hit four-year low

Listed firms rely on qualified institutional placements to raise capital

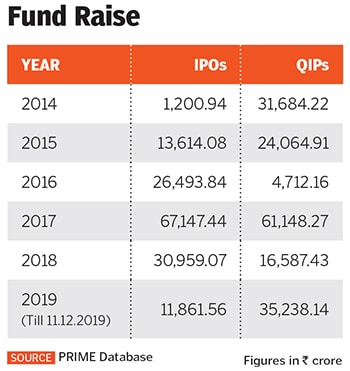

Image: ShutterstockGrowth may have slowed, but markets continued with their bull run during the year. However, the sentiments weren’t echoed by companies launching initial public offerings (IPOs). According to Prime Database, from January to December 11, companies raised ₹11,861.56 crore, the lowest in four years, and a drop of 62 percent compared to the same period last year (₹30,959.07 crore).

Image: ShutterstockGrowth may have slowed, but markets continued with their bull run during the year. However, the sentiments weren’t echoed by companies launching initial public offerings (IPOs). According to Prime Database, from January to December 11, companies raised ₹11,861.56 crore, the lowest in four years, and a drop of 62 percent compared to the same period last year (₹30,959.07 crore).

One issuance which caught investor attention was the listing of India’s first real estate investment trust—Embassy Office Parks—which raised ₹4,750 crore with domestic high net worth individuals and family offices lapping it up.

Listed firms depended heavily on qualified institutional placements (QIPs) to raise capital. Since January, companies raised ₹35,238.14 crore compared to ₹16,587.43 crore during the corresponding period last year, a two-fold increase. The activity picked up significantly since September. The fund raise has largely been led by Axis Bank Ltd which raised ₹12,500 crore followed by Bajaj Finance Ltd (₹8,500 crore). “Next year I again expect QIPs to be dominated by banks as they need to shore up capital," says Pranav Haldea of Prime Database.

First Published: Dec 16, 2019, 12:51

Subscribe Now