Why Peyush Bansal finds himself in the eye of a storm

The Lenskart co-founder is in the spotlight as India debates whether the company’s valuation is a bold gamble or just clear vision

A dinner with the founder, especially when it’s Bill Gates, usually converts 20-something employees into lifelong loyalists. For Peyush Bansal, it did the opposite. An evening at Gates’s home in 2007 was a pivotal point in the then-Microsoft techie’s life because he realised he wanted to solve big problems. Bansal decided to quit the next day and leave the US for good.

Back home, Bansal was stunned by a brutal truth: India was the blind capital of the world—where something as basic as clear sight was a luxury. Thus began Lenskart in 2008 as Bansal got down to solving an engineering problem hiding in plain sight. Delhi-based Lenskart is a technology-focussed company that designs, manufactures and sells eyewear both online and offline. It now operates in 14 countries.

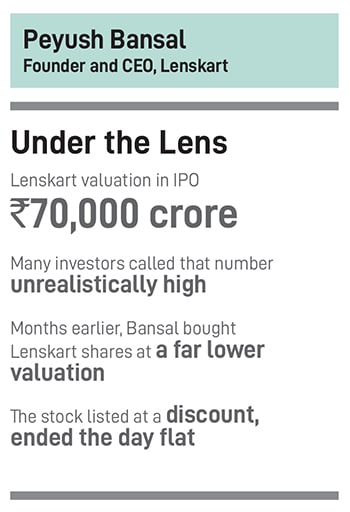

But for someone who works in vision for a living, Bansal did not see controversy coming. As Lenskart prepared to go public this October, its valuation of up to Rs70,000 crore (around $8 billion) invoked disbelief from a section of investors.

Debate quickly turned into accusations as the price tag—a price to earnings (P/E) ratio of over 250—looked stratospheric to many. It didn’t help that Bansal washed his hands of it, saying as entrepreneur, it was not his job to decide the valuation.

The critics returned to the fact that only months ago, Bansal—also a judge on Shark Tank India—bought Lenskart shares at a much lower valuation. Yet the IPO sailed through.

Ace investor Raamdeo Agrawal looked at the valuation from a different lens—of scale and opportunity. He said Indian firms usually target domestic GDP “of about $5 trillion”. But companies like Lenskart are going to be the first set of young multinational consumer companies to come out of India that will “aspire to target $125 trillion of GDP, the way American corporations do”, the founder of brokerage firm Motilal Oswal said on a news channel.

Lenskart indeed has a sharp global focus with about 40 percent of its revenue coming from international markets currently.

A day before the listing, Bansal again addressed the controversy, saying: “We didn’t build Lenskart to reach a valuation. We built it to reach people—from the heart of Delhi to the smallest towns in the Northeast.”

On listing day, the stock fell 11 percent before ending the day flat.

Whether the market eventually judges Bansal as a clear-eyed builder of a global consumer brand or just another beneficiary of the IPO frenzy will become apparent only in the years ahead. For now, Lenskart has capital and attention. What it needs is proof that this scale can produce durable returns, not just valuation theatre.

First Published: Nov 21, 2025, 12:46

Subscribe Now(This story appears in the Nov 28, 2025 issue of Forbes India. To visit our Archives, Click here.)