Smarter F&O trading starts with Sahi’s exclusive indicators

Sahi’s exclusive indicators make F&O trading easier with clarity. See price and option positioning on a single screen and make better decisions

Futures and options (F&O) trading can feel chaotic on screen, especially for new traders. You start with a plan, but end up juggling option chains, calculations, and indicators that don’t always agree.

By the time things line up, price swings. The real issue is too much information spread across multiple windows, slowing down decisions.

Sahi addresses this from a trader’s perspective. Its exclusive indicators appear on a single screen and deliver real-time market insights.

Let’s understand more about the Sahi trading app and its exclusive indicators.

Sahi’s indicators are built with one clear idea - price alone doesn’t tell the full story in F&O trading. Positioning matters just as much, and both need to be visible at the same time.

On Sahi trading app, price action and option positioning sit on the same chart, so decisions aren’t based on candles in isolation. Here are exclusive Sahi indicators that you won’t find anywhere else:

All indicators run on in-house trading charts, built to stay clear and readable during live F&O trades.

You can open Scalper, tap the indicators icon, select the indicators you need, and apply them to see them active on your charts.

In F&O trading, price moves fast, emotions move faster, and risk often gets handled late, making your profits slip away.

Sahi approaches risk as part of the chart itself, not something added after the trade is live:

Apart from charts now rendering up to 60% faster with recent performance upgrades, Sahi also offers:

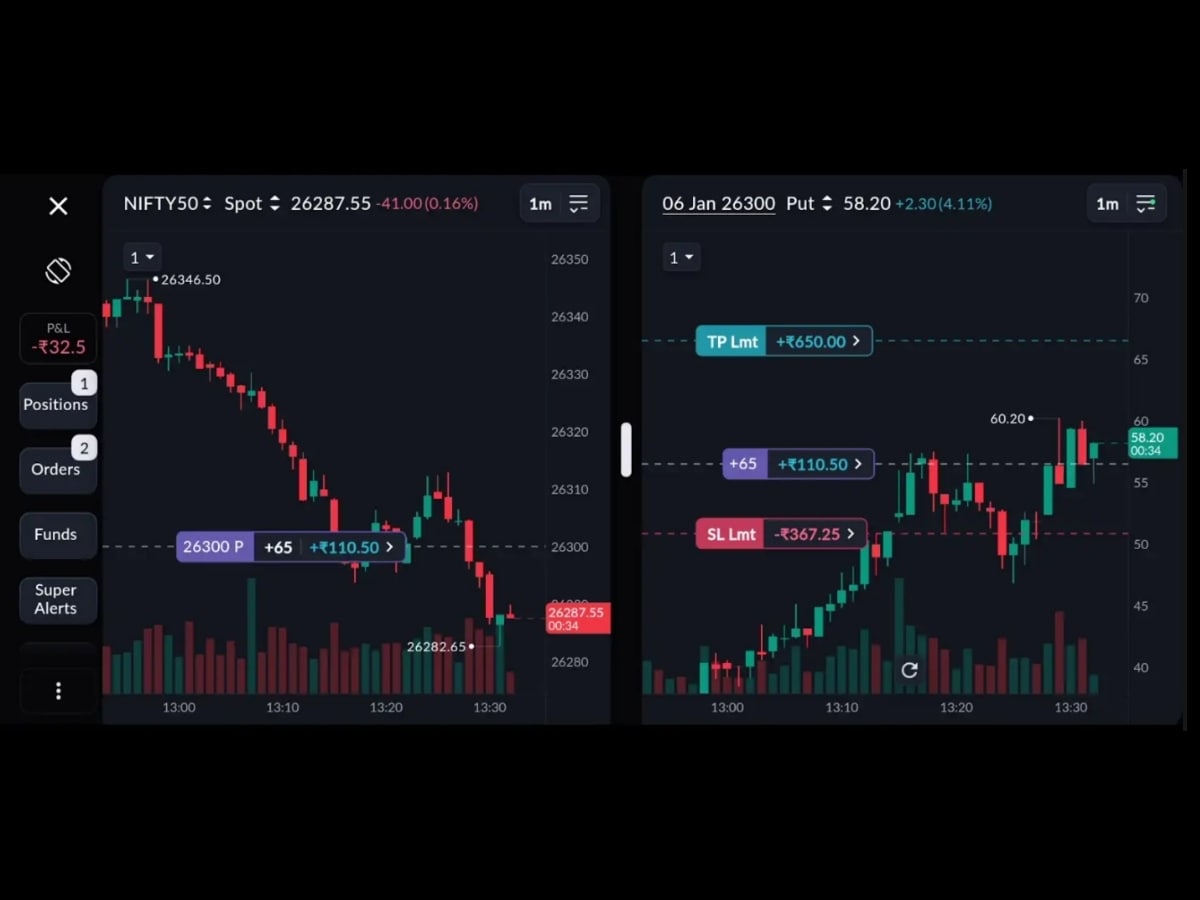

With Sahi, you can now exit trades directly from the chart using limit orders, not just market. Spot resistance, mark your price, and place a precise exit in one tap - reduces slippage during fast or volatile moves.

View Index with Call/Put or Call + Put charts together on the same screen. This makes premium behaviour across both legs visible at once, making decisions quicker and entries cleaner.

With picture-in-picture mode, live P&L and candle movement stay visible even while switching apps or taking calls. Your position remains in sight, helping you stay mentally connected to the trade without staying glued to the app.

You can choose how stops and targets execute based on market conditions. Use Market SL/TP for quick exits or Limit SL/TP for controlled fills.

You can also access the live option chain without leaving your execution screen. Select expiry and check strike-wise OI, OI change, and Greeks right where trades are placed. Entries stay informed, with positioning and risk context always visible.

Sahi’s smart indicators add context directly on the F&O trading chart, helping you see where participation is building rather than analysing candle shapes alone. Key levels, OI-based zones, and OI Profile stay visible alongside price.

This keeps entries smooth, improves zone selection, and reduces random trades by showing where market interest is actually concentrated.

To learn more about the Sahi trading app and their products, visit www.sahi.com. You can also Follow Sahi on YouTube for all the latest updates.

SEBI Stock Broker Registration No: INZ000317632

Disclaimer

Investment in securities market are subject to market risks, read all the related documents carefully before investing.

The pages slugged ‘Brand Connect’ are equivalent to advertisements and are not written and produced by Forbes India journalists.

First Published: Feb 16, 2026, 16:44

Subscribe Now