Sanctions on Russian crude suppliers to hike India’s import bill

Replacing Russian, discounted crude, with market-priced crude from other countries will adversely impact the gross refining margins of refining and marketing companies

India is the third largest consumer of crude oil after the United States and China. India’s crude oil consumption has increased from 183.9 million metric tonne (MMT) in FY2015 to 265.7 MMT in FY2025, growing at a CAGR of 3.7 percent, while the domestic production of crude oil has declined from 37.5 MMT to 28.7 MMT during the same period. Currently, only 12 percent of the country’s need is met domestically, while 89 percent is met through imports, entailing a huge import bill. The demand for crude oil is expected to increase by 2-3 percent in FY2026 and will continue to increase over the next several years. However, the growth in domestic crude oil production is expected to be limited, hence the high dependence on imports.

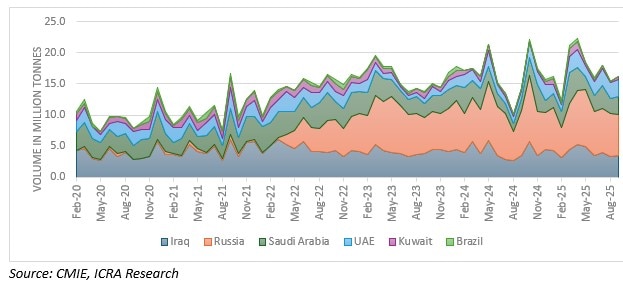

Traditionally, India has relied heavily on the West Asian region to source crude oil, with Russia accounting for only 2 percent of the total imports in FY2022. However, after the Russia-Ukraine conflict began in February 2022, global crude flows changed direction, with the G7 nations and the European Union (EU) imposing energy curbs on Russia. As the G7 and EU cut down on crude oil imports from Russia, the latter offered discounts to buyers. In a bid to cut its crude import bill and as Russian oil was available at a discount, there was a surge in India’s crude oil imports from Russia. During FY2023 about 22 percent of India’s oil imports were from Russia, which increased to 36 percent in FY2024 and FY2025. In H1 FY2026 34 percent of India’s crude oil imports were from Russia. While the discounts available on Russian crude were in double digits initially, these reduced substantially.

In FY2025, India’s crude import bill was a massive $137 billion. Uncertainty related to global tariffs and their impact on growth, coupled with the Organization of the Petroleum Exporting Countries’ (Opec’s) withdrawal of production cuts, has reduced oil prices from about $77 per barrel as of March 31, 2025, to $60-$70 per barrel since April 2025. Oil prices declined due to slowing growth in major economies like China. In addition, inflation and trade disruptions further dampened market sentiments. However, despite the lower crude oil prices, India’s import bill of crude oil has been $10 billion per month in YTD FY2026.

On October 22, 2025, the US Department of the Treasury’s Office of Foreign Assets Control (OFAC) imposed sanctions on the Rosneft Oil Company (Rosneft), Lukoil and several subsidiaries of these two companies. The sanctions come into effect from November 21, 2025, and are likely to impact purchases by India as these suppliers account for about 60 percent of the volumes India buys. Cutting out part of Russian oil from the global market can significantly increase prices, leading to inflationary pressures. Brent crude oil prices, which were around $60 per barrel on October 17, 2025, before the imposition of sanctions, are now around $65 per barrel, an increase of 8 percent. A $5 per barrel increase in the average crude price would increase India’s annual import bill by about $6-7 billion.

For the Indian refining sector, there are ample avenues to purchase crude oil. While India can substitute the purchases from Russia with suppliers from West Asia and other geographies such as Africa and South America, the import bill will increase. Opec members are estimated to hold more than 3 million barrels per day of spare capacity that could help fill the gap caused by the decline in Russian barrels.

On an annual basis, the replacement by market-priced crude would lead to an increase in the import bill by less than 2 percent, which would also adversely impact the gross refining margins (GRMs) of the refining and marketing industry. However, the profitability of oil marketing companies would be supported by the healthy marketing margins on auto fuels. Additionally, profits and cash accruals of the upstream companies would increase due to the increase in crude oil prices.

The writer is senior vice president and co-group head, Corporate Ratings, ICRA Ltd

First Published: Nov 04, 2025, 13:53

Subscribe Now