Advertisement

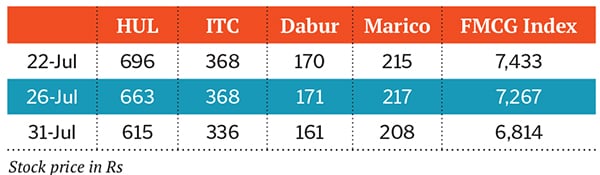

The downturn in the India growth story spares no one, not even the Sensex’s top performers. Consumer companies have been stock market darlings for close to five years. During this time, the BSE FMCG Index has risen by 227 percent to 6,948. When nothing else was performing, consumer (and pharma) stocks along with private banks seemed to be the best bets. As a result, valuations have sky-rocketed the index trades at an earnings multiple of 41. Compare this to 14 for the Sensex and the disparity is stark. So now, as FMCG stocks get hit too, it is a grim affirmation of the slowdown. ![mg_71219_fmcg_280x210.jpg mg_71219_fmcg_280x210.jpg]()

Private banks received a setback last month when the RBI tightened liquidity to protect the rupee. There are also initial signs that well-known consumer names are slipping. In the recent round of earnings, market leader Hindustan Unilever disappointed the street with a 7 percent top line growth. HUL said it has seen growth rates slipping since the first half of 2012. ITC also let the street down with its top line as cigarette volumes declined by 1-2 percent, according to brokerage estimates.

First Published: Aug 12, 2013, 06:35

Subscribe NowLatest News

Advertisement

Advertisement

Advertisement