Jangid, 38, has taken a loan of ₹6.4 lakh from Finova Capital—a Jaipur-headquartered non-banking financial company (NBFC) founded by banker-turned-entrepreneur Mohit Sahney and his wife Sunita—which focuses on lending to micro, small and medium enterprises (MSMEs). People like Jangid are new to credit and do not have a formal credit score for large banks to be comfortable for them to lend to. Finova offers MSME (micro-business) and mortgage loans.

Jangid is Finova’s typical customer, having multiple incomes in the form of a dairy business where he bought a few cows last year agricultural income where his family grows vegetables, besides manufacturing furniture. He earns close to ₹65,000 ($890) a month through these businesses, which has helped him pay off a third of the outstanding loan to Finova.

Jangid says he may consider taking a fresh loan in the future. “Abhi business thoda sudhar raha hai… par interest zyaada hai. Main sochunga jab business zyada sudhrega. (Business is starting to improve, but the interest amount is steep. I will wait till business activity picks up substantially)."

Small entrepreneurs, small-ticket loans

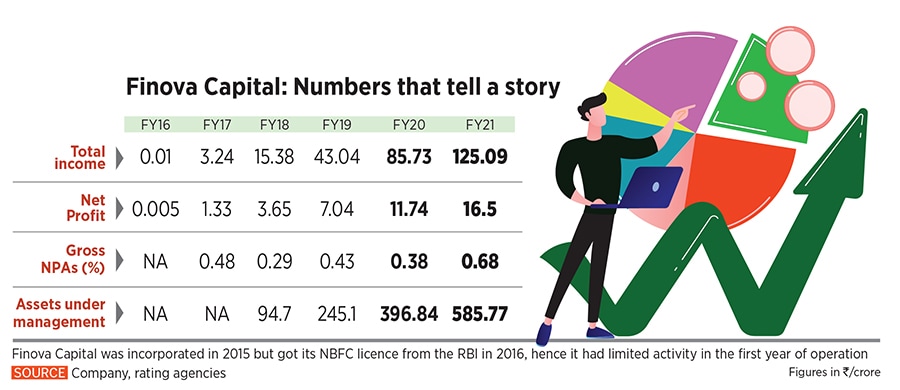

Finova is one of the rare NBFCs operating entirely out of rural India, which has managed to stay profitable since inception in 2016. Small ticket-sized loans of under ₹4 lakh ($5,500) and catering to small entrepreneurs (tea, milk vendors, carpenters, tailors, electricians, hair dressers and mom-and-pop store owners)—after analysing their cash flows to determine creditworthiness—have helped Finova keep its gross NPAs at manageable levels (see chart).

![]()

Margins remain healthy as it borrowed from banking channels at around 11 to 12 percent and lent at 22 percent. Finova now borrows at 200 basis points lower (9 percent), but lends at the same rate.

Finova reduced its ticket loan size from ₹10 lakh ($13,700) after realising during demonetisation in 2016 that the recovery of business was quicker in the smaller segments of business. Tea vendors, whose business was disrupted at that time, took only about a week to bounce back to regular levels of income, a hair dresser took about 10 to 15 days while a car mechanic took about three weeks, and a mobile shop dealer took nearly six to eight months. “The turnaround time is much quicker and we noticed the same post the pandemic waves," says Mohit Sahney, managing director and CEO, Finova Capital.

The NBFC also adopted a business model where credit scoring was not based on a “cluster model" where a threat could affect the entire universe of customers. Credit appraisal is done based on a cash flow analysis. For a tea vendor, for example, the assessment of income would be done on the basis of tea supplied to corporate offices and individual footfalls at the stall. Expenses would be calculated on the basis of tea cups and milk used, and gas cylinder usage. This would then help judge disposable income/profit and the ability to repay loans on a monthly basis.

![]() Finova has disbursed loans of ₹844 crore to nearly 20,000 customers through 130 branches, of which 90 are in Rajasthan and the rest in Delhi (NCR), Jharkhand, Haryana and Chhattisgarh. “We got into the MSME services segments and stayed in the rural areas," says Sahney. Finova adds 1,500 customers each month.

Finova has disbursed loans of ₹844 crore to nearly 20,000 customers through 130 branches, of which 90 are in Rajasthan and the rest in Delhi (NCR), Jharkhand, Haryana and Chhattisgarh. “We got into the MSME services segments and stayed in the rural areas," says Sahney. Finova adds 1,500 customers each month.

The expansion to other states and strengthening of its existing technology platform was largely funded from $70 million (₹511 crore) which it raised through Series C (in 2020) and Series B (in 2019) from investors Sequoia Capital and Faering Capital. An additional $20 million (₹145 crore) came through other lenders. The company had raised $6 million (₹45 crore) from Sequoia in 2018.

Ladhuram Chaudhary is another customer seeking to build scale of business in Sitapur (on the outskirts of Jaipur) after borrowing ₹8.5 lakh from Finova. Like Jangid, Chaudhary earns through multiple means—through a tailoring business he set up more than 20 years ago and a dairy business. Chaudhary, 52, took a loan just after the first pandemic wave had subsided.

He earns about ₹60,000-70,000 per month through both the businesses, though income from tailoring has slowed post Covid-19. “Dhandha abhi toh thapp hai. Jo bhi paisa aa raha hai, who doodh mein se hi hai," Chaudhary says. (Business is slow income is mainly from the milk/dairy business). Chaudhary has so far paid about a fifth of the total amount outstanding to Finova. He is unlikely to take any fresh loans until he is sure the business cycle is on an upswing.

The ICICI Bank schooling

Sahney comes from a family of bankers, his father and grandfather having worked with the erstwhile State Bank of Bikaner and Jaipur, which in 2017 was merged with the parent State Bank of India. Growing up and travelling across western and central India with the family expanded his understanding of macro conditions across various states.

But the genesis of recognising the opportunities of lending to the unbanked and the shift towards entrepreneurship emerged during his 17-year stint across various roles at ICICI Bank. In 1999, Sahney was the zonal business head (North) in charge of mortgages at ICICI Bank he later became the national head of retail property services. “During our focussed lending through RIBG (rural and inclusive banking group) at ICICI Bank, I saw the potential which existed for such MSME lending," says Sahney. The lending through this vertical was in the form of credit cards, commodity-based funding, MSME loans, cattle loans, self-help groups and tractor funding.

This opportunity to service the unbanked became clearer for him when he spearheaded the successful integration and merger of Bank of Rajasthan with ICICI Bank in 2010. ICICI Bank grew in size from the then 65 branches to over 350 branches. “The credit gap was huge and untapped," says Sahney. Sequoia estimates the credit gap to be at $380 billion (₹27,74,000 crore) for NBFCs and fintechs to tap.

In 2016, Sahney quit ICICI Bank and set up Finova, completely bootstrapped, along with wife Sunita, who was an entrepreneur running a salon in Jaipur and having previously helped her father build the family marble business. Sunita completed her production and industrial engineering from MBM Engineering College, Jodhpur, and MBA from FMS, MDS University, Ajmer. She oversees auditing, compliance, HR and operations at Finova.

The differentiator

Though commercial banks have been reluctant to expand operations in smaller towns and villages, the space is being served by microfinance institutions (MFI), small finance banks (SFB) and a wide range of fintechs. There are at least 96 NBFC-MFIs registered with the RBI and another 11 SFBs. India’s fintech industry is among the fastest growing with 67 percent of the around 2,100 fintechs set up in the past five years. The Indian fintech market is currently valued at $31 billion (₹2,26,300 crore) and is expected to grow to $84 billion (₹6,13,200 crore) by 2025, at a CAGR of 22 percent, according to India Briefing.

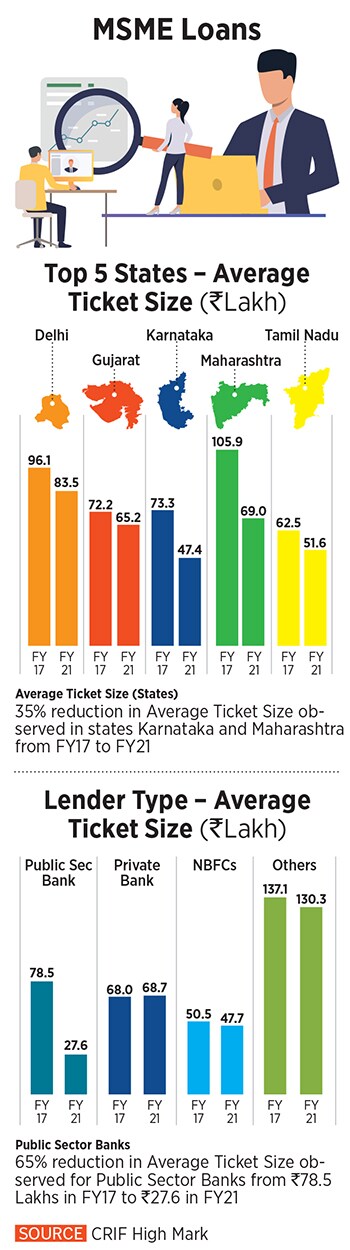

![]() The size of India’s total lending market is at ₹156 trillion, a growth of about 100 percent from FY17 to FY21. Retail and commercial lending each contribute 49 percent to total lending, while microfinance contributes 2 percent, according to an August report from CRIF High Mark. “The [four-year period] from FY17 to FY21 can be characterised by growth of small-ticket retail loans," the report says.

The size of India’s total lending market is at ₹156 trillion, a growth of about 100 percent from FY17 to FY21. Retail and commercial lending each contribute 49 percent to total lending, while microfinance contributes 2 percent, according to an August report from CRIF High Mark. “The [four-year period] from FY17 to FY21 can be characterised by growth of small-ticket retail loans," the report says.

Sahney is unfazed by the increased attention this segment is getting. “Building up [a loan book] is easy, but management of asset quality is tough," he says. This is a fair argument as microfinance firms and SFBs have struggled to manage asset quality (see table). Finova’s gross NPA ratio has remained below 1 percent in each of the financial years.

Finova clearly chose the formula of small ticket-size loan, small segment (servicing micro-entrepreneurs) and small locations, as its mantra towards lending. From his experience at ICICI Bank, Sahney was confident that the myth that financial services businesses can emerge only from large metros like Mumbai, Bengaluru or Delhi could be busted. It was this confidence and differentiated approach that Sequoia found refreshing when they were scouting for investments into fintechs in 2016-17.

The NBFC has also taken the route of being risk averse in recent years by not lending to food and beverages, travel and tourism, consumer durables and electronics businesses (which it did in earlier years). The focus continues to be to lend to retail investors, who earn income from multiple sources. Collection efficiency for the firm has bounced back to 99 percent in July (against 95 percent a year earlier).

Sunita has strengthened Finova’s audit process and carries out auditing prior to disbursement of the payment. “Query, if any, is sought from the operations department. Documents are kept completely updated with credit appraisals," she says. Finova continues to be aggressive in its recruitment, particularly relationship officers (RO) who source business for them. The NBFC—which has 994 staff—has recruited 400 in the current year, with a target of 700 by year-end.

A churn in ROs is high across all NBFCs and banks hence it is always a challenge to retain them. Finova has adopted a plan of giving ESOPs to all employees from the top management to ROs, besides bonuses, where necessary.

Investors confident

In 2017, a sub-team at Sequoia India was focussed on finding fertile investment areas in the financial services sector, attracted by the credit gap estimated. The team met many NBFCs on one such trip to Jaipur, and even met the Sahney couple. “We liked what they were building at Finova so much that we delayed our trip back to Delhi, and went to their office the very same day to spend more time with the team," says Ishaan Mittal, managing director of Sequoia India. Within a week, the teams shook hands.

Finova has adopted a phygital model instead of a pure digital model which other fintechs such as Capital Float, Clix Capital, Lendingkart have mastered well. Sahney wants to master the products they lend rather than spreading themselves thin across India.

It continues to go to those regions where lending to MSMEs is weak. But this is going to be the bigger challenge going ahead. While the universe Finova operates in is vast and offers opportunities, “it will have to continue to deepen its geographic presence to reach more customers and grow the team", says Mittal.

Finova, which is well-capitalised, has an execution-oriented culture which attracted investors and banks to it. If the Sahneys can continue to do the same as they expand their geographical presence, investments will continue to pour in.

Sunita (left) and Mohit Sahney

Sunita (left) and Mohit Sahney

Finova has disbursed loans of ₹844 crore to nearly 20,000 customers through 130 branches, of which 90 are in Rajasthan and the rest in Delhi (NCR), Jharkhand, Haryana and Chhattisgarh. “We got into the MSME services segments and stayed in the rural areas," says Sahney. Finova adds 1,500 customers each month.

Finova has disbursed loans of ₹844 crore to nearly 20,000 customers through 130 branches, of which 90 are in Rajasthan and the rest in Delhi (NCR), Jharkhand, Haryana and Chhattisgarh. “We got into the MSME services segments and stayed in the rural areas," says Sahney. Finova adds 1,500 customers each month. The size of India’s total lending market is at ₹156 trillion, a growth of about 100 percent from FY17 to FY21. Retail and commercial lending each contribute 49 percent to total lending, while microfinance contributes 2 percent, according to an August report from CRIF High Mark. “The [four-year period] from FY17 to FY21 can be characterised by growth of small-ticket retail loans," the report says.

The size of India’s total lending market is at ₹156 trillion, a growth of about 100 percent from FY17 to FY21. Retail and commercial lending each contribute 49 percent to total lending, while microfinance contributes 2 percent, according to an August report from CRIF High Mark. “The [four-year period] from FY17 to FY21 can be characterised by growth of small-ticket retail loans," the report says.