Auto slowdown takes global turn

Worldwide trends show that declining car sales are not restricted to a particular country—and worryingly, they're here to stay

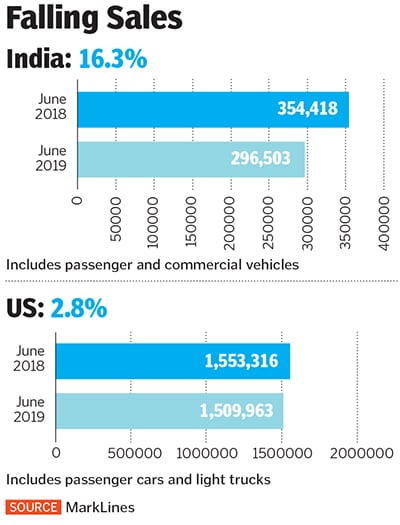

Image: Sam Panthaky / AFP / Getty Images [br]The automotive industry took a hit in the wake of the 2008 Lehman Brothers crisis. It took about two years to stabilise and saw good sales for 7-8 years after that. Since mid-2018, however, there has been a downturn which is likely to continue in 2019-2020.

Image: Sam Panthaky / AFP / Getty Images [br]The automotive industry took a hit in the wake of the 2008 Lehman Brothers crisis. It took about two years to stabilise and saw good sales for 7-8 years after that. Since mid-2018, however, there has been a downturn which is likely to continue in 2019-2020.

“Limited resources, expensive technology and a number of adverse parameters do not favour [electrification] to be adopted at a master level. As all the governments are trying to adapt to this technology, it might take up to five to ten years [to stabilise]. In such a situation, the overall investment in the industry is not encouraging,” says Mitul Shah, vice president-research, Reliance Securities.

The shift from people owning vehicles to relying on services such as Uber, Ola and Lyft is also a cause for slowing car sales. Global events like Brexit and US’s trade wars and sanctions haven’t helped either. “The common factor is that both [global and Indian downturn] have been triggered by a temporary saturation of the market due to high growth in the recent past,” says Deepesh Rathore, auto analyst for Emerging Markets Automotive Analysts.

Impact on India

India is bound to bleed as economies like China, the US and UK experience falling sales. Indian automotive manufacturers export a percent of their volume which affects them directly. A major portion of the Indian auto ancillary industry’s revenue comes from outside. Globally, profitable auto companies facing losses in India might need to shut them.

First Published: Jul 31, 2019, 09:40

Subscribe Now