India's Richest 2019: Asian Paints is a bright picture

Asian Paints' promoters saw their wealth soar to over $1 billion each on the back of buoyant sales

[br]Despite the slump in consumer demand and slowdown in construction activity, shares in Asian Paints jumped almost 30 percent in FY19, giving India’s leading paint maker a market capitalisation of around ₹1.3 lakh crore ($18 billion).

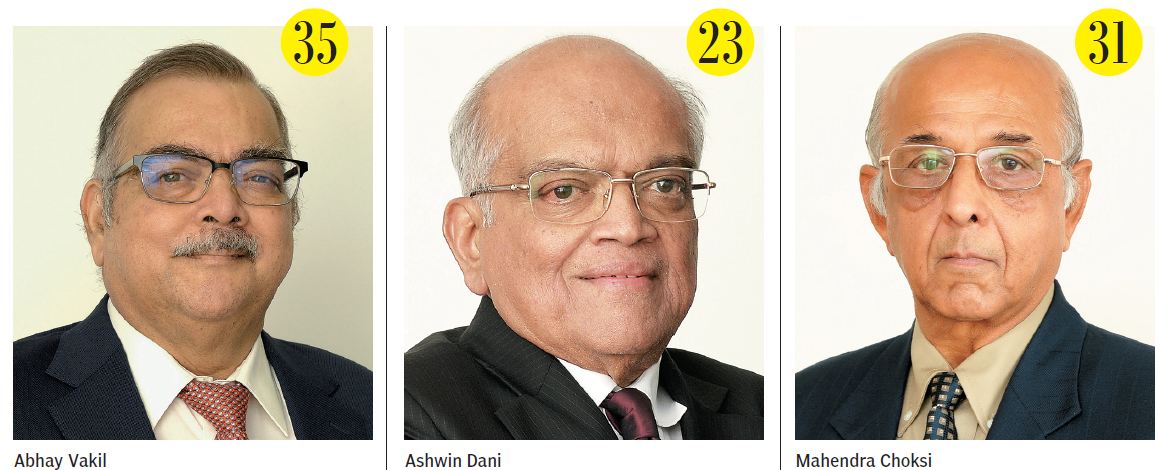

Ashwin Dani (No 23), Mahendra Choksi (No 31) and Abhay Vakil (No 35), whose fathers co-founded the business in 1942, saw their wealth soar to $4.8 billion, $3.86 billion and $3.5 billion respectively. The tycoons—who along with their families hold 53 percent of Asian Paints’ shares—saw gains of over $1 billion each over the last year. Choksi’s wealth was previously listed under his brother Ashwin, who died in September 2018.

Double digit volume growth saw Asian Paints, now Asia’s largest paint company behind Japan’s Kansai and Nippon, post profits of ₹2,211 crore on revenues of ₹19,341 crore in FY19, up by 10 percent and 15 percent respectively over the previous fiscal.

The reasons for the volume growth are many. First, the government reduced the GST rate on paints from 28 percent to 18 percent last year. “As a result, the pricing of paints has come down and the gap between the unorganised players, who make up 30 percent of the market, is smaller,” says Abneesh Roy, executive vice president, research, Edelweiss.

Second, the penetration of paints in India is only 45 percent, implying plenty of headroom for growth, especially in tier II, III and IV towns. Over the last three to four years, Asian Paints has been continuously launching new products in these markets. As a result, rural and small towns are today growing at a faster clip than metros for the paint maker, which also sells putty and distempers, according to outgoing CEO KBS Anand, who announced his resignation at the time of writing this story.

Third, 85 percent of the paint demand in India is for repainting purposes, hence the malaise in real estate has not affected Asian Paints’ decorative paint segment, which accounts for almost 85 percent of revenues.

Besides, Asian Paints’ strong brand appeal and formidable distribution network—the company has around 50,000 dealers, well ahead of competitor Berger Paints, which has 25,000—keep it ahead of the pack. Unsurprisingly, the company’s market share at 53 percent of the organised market is three times that of the No 2-ranked Berger’s 18 percent and Kansai’s 15 percent, according to Roy. Internationally too, Asian Paints has been growing its presence, with operations in 16 countries, 27 manufacturing facilities and servicing customers in over 65 countries. Says Roy, “We expect Asian Paints to maintain its market leadership going forward.”

First Published: Nov 22, 2019, 11:24

Subscribe Now