Tech-heavy Nasdaq gets a boost

After 28 percent gain in 2017, index has risen by another 15 percent so far

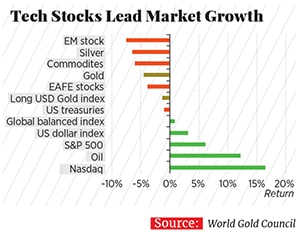

Image: Shutterstock If oil, the second best performing asset class so far this year, has stunned investors, there can be no surprise about the first one: The technology-heavy Nasdaq index. After a blow out 28 percent gain in 2017, the index has risen by another 15 percent as of July 26 as investors pile on to stocks that are upending traditional business models for a variety of industries. Bringing up the rear are emerging markets that have seen large outflows as a result of tightening US monetary policy. Fund managers would rather stick to investments in markets and currencies they understand best.

Image: Shutterstock If oil, the second best performing asset class so far this year, has stunned investors, there can be no surprise about the first one: The technology-heavy Nasdaq index. After a blow out 28 percent gain in 2017, the index has risen by another 15 percent as of July 26 as investors pile on to stocks that are upending traditional business models for a variety of industries. Bringing up the rear are emerging markets that have seen large outflows as a result of tightening US monetary policy. Fund managers would rather stick to investments in markets and currencies they understand best. Higher interest rates have also resulted in a strengthening US dollar. Bond markets, which had a disastrous 2017, have paused till now. As a result, the category hasn’t lost too much this year. Commodities have had a mixed year. After a secular rise in the second half of 2017, they’ve come to a halt as the market figures out what impact a trade war will have, if at all any.

Higher interest rates have also resulted in a strengthening US dollar. Bond markets, which had a disastrous 2017, have paused till now. As a result, the category hasn’t lost too much this year. Commodities have had a mixed year. After a secular rise in the second half of 2017, they’ve come to a halt as the market figures out what impact a trade war will have, if at all any.

First Published: Jul 30, 2018, 10:54

Subscribe Now