AI turns the tide for Indian IT

Q3 results point to a surge in AI-led deals and renewed client spending, thus shaking off a two-year demand slump

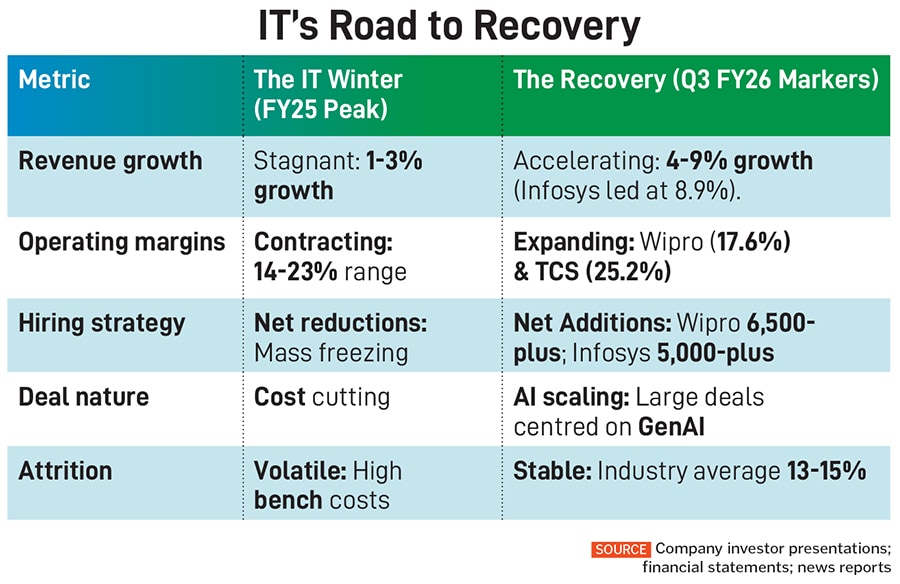

For the first time in nearly three years, India’s IT sector is beginning to sound confident again. The December-quarter (Q3 FY26) results from the top IT and ITeS firms point to a sector that has finally found its growth engine after a prolonged slowdown in demand—and that engine is artificial intelligence (AI).

In 2025, Gartner had observed an “uncertainty pause”, where many organisations postponed new IT projects, although budgets remained largely intact. As companies adapt to ongoing uncertainty and prioritise strategic initiatives—particularly in AI—these projects are resuming, which is reflected as a recovery in 2026.

AI continues to be the most significant positive force in IT spending. “AI-related expenditures are expected to grow by 44 percent in 2026, fuelled by organisations building out AI infrastructure and vendors racing to capture market share,” says Biswajit Maity, senior principal analyst at Gartner.

The improved sentiment is reflected in the performance of the major IT companies this quarter. Despite one-time charges from the implementation of new labour codes weighing on profitability, most firms reported steady revenue growth and a visible uptick in demand linked to AI-led transformation.

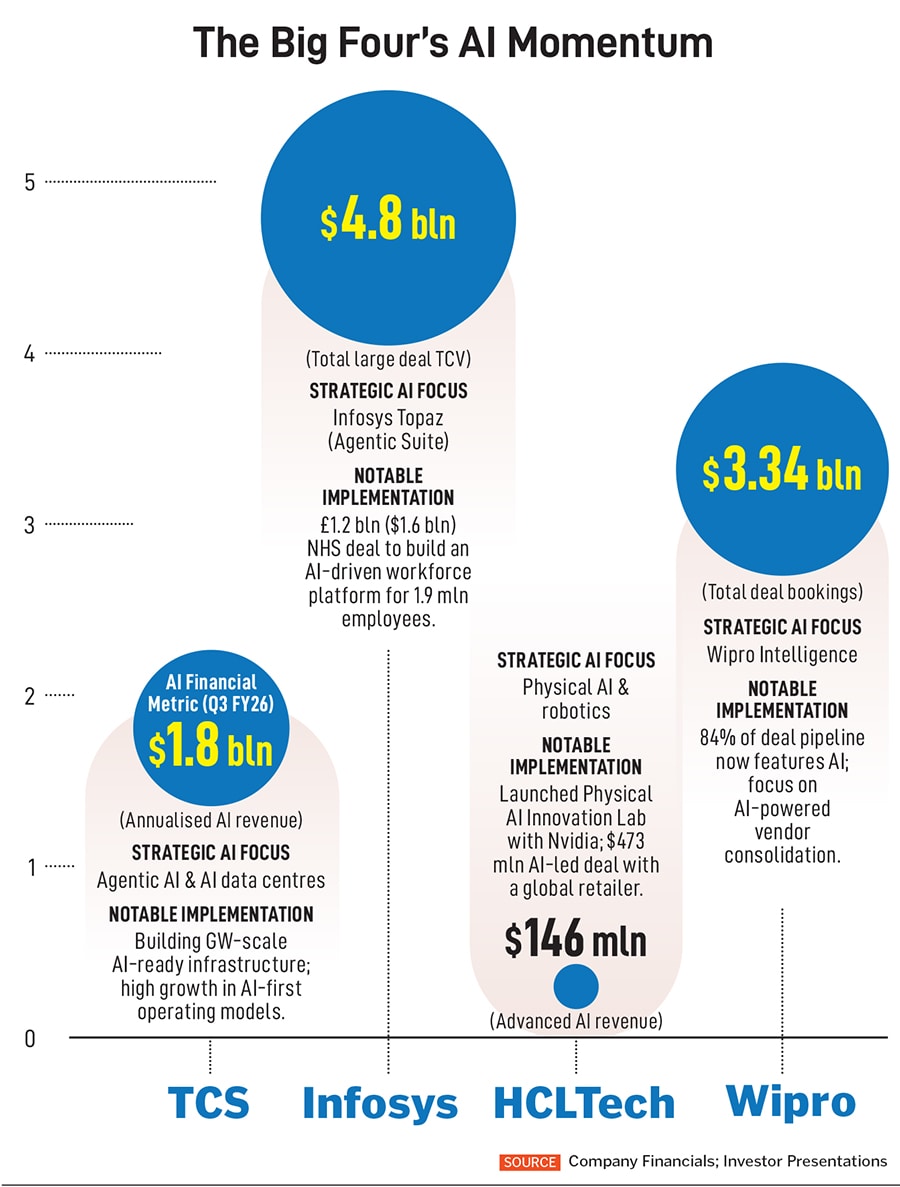

TCS posted a nearly 14 percent year-on-year (y-o-y) drop in profit to Rs10,657 crore, but revenue rose nearly 5 percent to Rs67,087 crore. The company also disclosed an annualised AI revenue of $1.8 billion, up 17.3 percent sequentially—a clear sign that AI work is moving beyond pilots.

Infosys, impacted by a Rs1,289-crore labour code charge, reported a 2.2 percent y-o-y decline in profit to Rs6,654 crore while revenue grew 8.9 percent to Rs45,479 crore. CEO Salil Parekh said, “AI adoption continues to gain strong momentum across our client base. Today, we work with 90 percent of our largest 200 clients to unlock value with AI.” The company is engaged in 4,600 AI projects and has built more than 500 AI agents. Infosys also raised its FY26 revenue guidance to 3–3.5 percent in constant currency.

HCLTech’s profit declined 11.21 percent y-o-y to Rs4,076 crore following a one-time cost of Rs956 crore, but revenue rose 13.3 percent to Rs33,872 crore.

Tech Mahindra delivered a 14 percent y-o-y rise in profit to Rs1,122 crore, with revenue up 8 percent to Rs14,393 crore, and reported its strongest deal quarter in years. As Chief Operating Officer Atul Soneja told Forbes India, “We experienced strong deal momentum in the recent quarter, achieving the highest quarterly deal bookings in the past five years and the strongest 12-month deal wins in the same period.” This translated into a sharp rise in new business signings: “Our total contract value for new deals in Q3 reached $1,096 million, a 47 percent y-o-y increase and a 34 percent quarter-on-quarter rise.”

Wipro, too, reported stable top line performance despite a 7.11 percent y-o-y decline in profit to Rs3,119 crore; revenue rose 5.5 percent to Rs23,555 crore. CEO Srini Pallia highlighted how sharply client priorities are shifting: “Organisations are reshaping priorities as AI influences how they plan, invest and operate. In fact, AI is now a standing board level mandate, led by CEOs who recognise its ability to transform business models, unlock productivity and, of course, create lasting competitive advantage.” He added that Wipro’s strategy is anchored on a unified framework for delivering AI-driven transformation at scale: “It is our unified approach to delivering AI-powered transformation across industries that we serve.”

Indian IT firms reported a noticeably stronger deal pipeline this quarter, with several announcing their biggest wins in years. Infosys signed large deals worth $4.8 billion, Tech Mahindra’s new deal TCV touched $1.09 billion, and the top tier firms collectively reported single quarter signings ranging from $3 billion to over $9 billion.

Much of the demand has come from BFSI, retail, health care, manufacturing and telecom clients looking for domain-specific automation, copilots for internal teams, and faster decision systems built on enterprise data. These projects are far more modular than traditional transformation programmes, often signed and executed within a single quarter.

Companies are observing that the deal structures are changing. “These deals are typically longer in tenure and higher in value than in previous cycles. Increasingly, AI capabilities are embedded throughout these engagements,” explains Soneja. The shift in deal composition this quarter also reflects how clients are rethinking technology spending, aimed at delivering measurable business outcomes.

The pricing of AI deals is also evolving. “Clients are increasingly moving away from traditional time-and-material or fixed-price models and instead seeking outcome-oriented approaches that link fees to tangible business impact,” explains Ashank Desai, principal founder and chairman, Mastek. While this creates pressure on legacy pricing structures, he adds that it also enables deeper, long-term partnerships in which service providers participate more directly in client success.

The pivot is happening from traditional tech services to AI-led tech services. As Raja Lahiri, partner and tech Industry leader at Grant Thornton, puts it, “The key challenge and the opportunity is how to accelerate the AI projects and bring in measurable business outcomes… and 2026 would be the year where AI projects would need to bring in tangible business outcomes. This shift is evident in deal metrics from the latest quarter, where single-quarter deal signings ranged from around $3 billion to over $9 billion, with a meaningful share classified as net-new business.”

Industry experts point out that this quarter’s momentum matters not just because it lifts near-term numbers, but because it signals where Indian IT’s next wave of revenue could come from. With discretionary tech spending still uneven, a steady rise in AI-led deal flow gives the sector something it has lacked since early FY23: A clear, expanding demand vector.

First Published: Feb 06, 2026, 17:17

Subscribe Now(This story appears in the Feb 06, 2026 issue of Forbes India. To visit our Archives, Click here.)