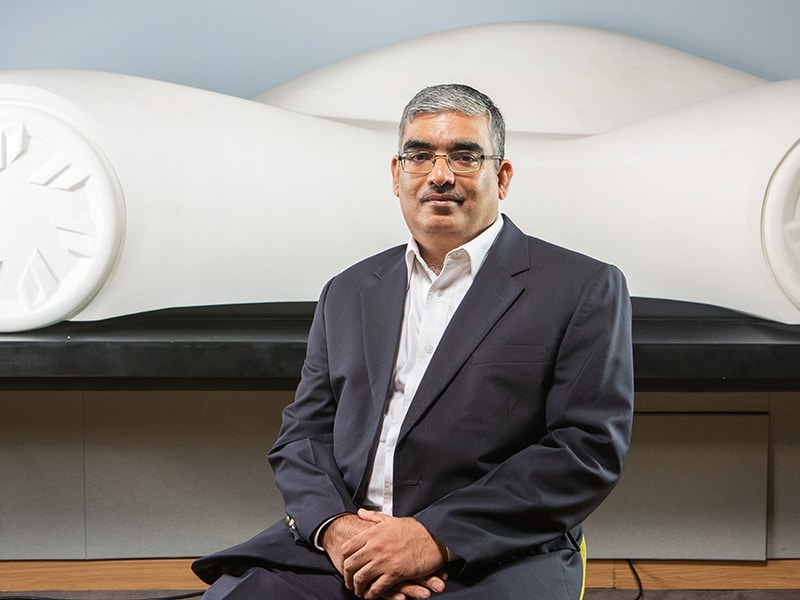

Digital helps democratise price points across urban and rural India: Vivek Gambhir

Godrej Consumer Products (GCPL), the Rs 10,423 crore FMCG company headquartered in Mumbai, has built brands like Cinthol and Goodknight in the television era. Vivek Gambhir, CEO and managing director of GCPL, tells Forbes India how it is now harnessing the power of such brands and parent company Godrej in the digital era to build a spate of consumer goods brands for new markets.

Brands like Cinthol evolved in the soaps category, but have been repurposed for niche segments like male-grooming. What was the rationale of doing this?

Cinthol has been an iconic brand that has been loved and trusted by millions of our consumers over generations. The brand has always stood for freshness and confidence. As we were looking at the next wave of growth opportunities beyond soaps, we realised Cinthol always had a strong male equity. In fact, it’s interesting that every Cinthol research we did, ended with consumers saying that Cinthol has a shaving cream, hair gel, etc., even when we were not present in any of those product ranges at the time.

We realised that we were actually sitting on a gold mine. Consumer research told us that the biggest pain-point for men was that they wanted the best results while grooming, but with minimum time and effort. That’s how the male grooming range started.

In the last five years, more than one-fifth of Godrej Consumer Products’ India’s revenues have come from new product launches. What role has technology played to enable faster rollout of products?

We have relied significantly on harnessing and leveraging technology in a better way to sense and pick up market signals, identify new opportunities, and reduce product-launch lead times. We are still in the early phases of our journey, but effective use of technology has played an important part in being more agile with new and differentiated products to meet our consumers’ needs.

Both in our core business and adjacencies, technology has been an enabler to drive growth. There’s a huge amount of data available. The trick is to convert the data into meaningful insights. We have used technology to generate insights, and advanced analytics to release differentiated products in shorter cycle times. We see huge potential to fast track launches by listening, monitoring, tracking and engaging with our customers through our market intelligence and social listening platform – the Black Box. It not only helps us listen to what customers are talking about, but also helps us track future trends across hair, baby and skin categories.

Would you say technology now gives Godrej a tangible advantage in consumer research beyond traditional methods like television advertising and fieldwork?

In some ways, digital is revolutionising how consumers listen and engage with brands, and how brands engage with their consumers. This happens across a range of media platforms, and a lot of it happens on the go, thanks to mobile phones. So companies have far more opportunity to personalise, experiment and prototype. While television still remains an important medium, digital is providing tremendous opportunities to better understand consumer behaviour, to connect and respond to consumers on a one-to-one basis, and tailor communications and offerings.

Unlike most FMCG companies that outsource R&D, Godrej has retained R&D in-house with its own platform, RIDE [Research & Development + Innovation + Design + Expertise]. Tell us about this platform.

Our belief is that the areas which give us a competitive advantage should be handled internally. We certainly look towards building partnerships in the ecosystem but it’s very important to build certain critical capabilities internally. Innovation is our lifeblood. So for us, RIDE is really the anchor of our innovation system. We compete with the world’s largest FMCG companies so the only way we can thrive is to be more innovative and nimble. For most companies, 80 percent innovations actually fail in the market. RIDE came about when we wanted to build a winning innovation system. It is an integrative approach, which brings together the various functions critical for innovation. It encourages experimentation and prototyping, and enables us to learn and fail fast.

How old is the RIDE platform?

The idea is actually almost a decade old, from when we decided that we wanted to make delightful and distinctive design a key differentiator. Initially, we began by creating a world-class design function, which is now run by our Chief Design Officer, Darshan Gandhi. She built the design function, and we hired some top-notch designers. Design-driven thinking has now become the pillar of our innovation approach. We also created a separate innovation function, which orchestrated and brought together marketing, manufacturing, R&D, design, and all other functions required to create disruptive products.

How lean is the RIDE team?

The core team comprises 10 people in design and a six-to-eight person innovation team. There is a larger R&D team. RIDE also has experts from the consumer insights, marketing and manufacturing teams. The central idea is to bring people from various functions together to break the silos.

More than 20% of GCPL’s global revenues come from the fast-growing category, like haircare for women of African descent. How did the company grow this opportunity?

Our journey in Africa began over a decade ago, when we acquired a hair-colouring company in South Africa. Since we were the market leaders in hair colour, we felt it was a good opportunity to leverage our skillset in a very fast-growing market. Once we became familiar and learnt about the hair colour category there, we recognised African women spend a lot of money on haircare—ethnic hair care was a massive $5-billion market across the world. Hair colour is actually a small part of it. But artificial hair—hair extensions— is a huge part, along with a unique range of products for African women to nourish and style their hair.

We recognised that there were a lot of need gaps in this underserved market. As we dove deeper, we found so much potential. And through a series of acquisitions, like Strength of Nature in the US, we are now one of the largest players in the world to serve women of African origin.

How did digital tools and analytics allow GCPL to build this new segment globally?

This category has turned out to be a crossover between consumer goods and fashion. So, technology has helped us stay current with the latest styles, understand fashion, and drive new trends. We have a website called ‘Black Hair Hub’—it is now one of the leading destinations for hair trends and hair fashion. On it, we drive thought leadership, work with influencers to shape demand and also get a sense of what the latest trends will be.

Has deeper internet-reach in India helped Godrej tap the rural consumer base?

We look at penetration rates and consumption rates. There is so much headroom for growth in rural markets across every single metric. The key is to launch affordable high-quality products, and make them accessible for the rural consumers. Distribution along with great value is very important for rural. What’s very interesting is the principle we call “democratisation”. Our idea is to bring price-points down without compromising on quality, and to offer great features. At low unit prices—for example, Rs 10 or Rs 20 price points—we actually find significant demand in both rural and urban India.

But certainly, some techniques like digital panels [to get online data] are used in urban India, while a lot of the insights generation in rural India still requires fieldwork like home visits, having home panels—a fixed set of consumer households that are visited at regular frequency (typically a month) to understand purchase patterns like volume, penetration, frequency of purchase, switching behaviour, and so on, over a period of time. Currently, we have access to a home panel of 15,000 households in rural India across socio-economic strata.

It’s important to note though that rural consumers now consume the same kind of media as urban consumers. So the level of aspirations and needs is actually quite similar across rural and urban. We’re seeing far greater level of convergence between urban and rural India. But the price points still need to be a bit different. One of our big successes in rural and urban India was a paper-based mosquito repellent called Fast Card. We found its usage was high in urban India as well rural India. As we built awareness about malaria, dengue and chikungunya, we saw an increasing convergence across both these segments.

In logistics and distribution, how have computing trends like IoT (internet of things) made a difference in management thinking?

It is still early days but we’ve found tremendous benefits of particularly IoT and more advanced analytics tools. One of the big themes we have been pushing is Industry 4.0, and we are looking at connected machines and smart manufacturing. In manufacturing, we use IoT to remove bottlenecks, reduce downtime, and improve productivity and quality in our factories. For example, we have robotic “eyes” or visual sensors to improve quality in some of our liquid-vapouriser lines.

In planning and logistics, it is still in its early days, and there is a fair amount of work going on in fleet management and tracking too, to improve lead times. The same is true in warehouse capacity and management. We’re also trying to ensure better adherence to planograms—a diagram which shows how and where specific retail products should be placed on shelves or displays to increase visibility – in stores, and are exploring an image analytics solution.

However, it needs improvements, but as technologies advance, the accuracy is expected to improve significantly too.

Has the thinking based on rapid prototyping and agile execution changed the kind of talent you look for?

In select areas, yes, we have brought in specialised experts. We’ve also learned not to reinvent the wheel. Instead, our model is to be a fast follower. There are lots of companies out there who have achieved more success than we have. The idea is to quickly learn from them, and adapt things in the Godrej and GCPL context. There is a hunger and desire to learn in our team members. So paired with a select few experts and outside partners, they have been very agile to learn and adapt quickly.

Does the internet allow each of your products to have a unique identity? Or do you find they have to rely on the Godrej brand name like in the television era?

It depends. In some cases, the ‘Godrej’ brand name adds a lot to the brand. In others, it’s not necessary at all. The decision actually depends on the individual product at a category level. But the ‘Godrej’ brand name does stand for trust and integrity. So it has important values that brands can build on. But certainly for categories which are millennial-friendly, we tend to make the product-brand stand out. There is no ‘one size fits all’ answer.

.jpg)

.jpg)