Amid the fracas over buying more oil from Russia, Russia’s President Vladimir Putin is set to visit India soon, National Security Adviser Ajit Doval told the media. Doval, who was in Moscow, did not specify the timeline, but Interfax news agency reported that it is likely to take place later this year.

The tariff levels, if they sustain, will disrupt capital flows, squeeze key export sectors and bring volatility to domestic markets as investors navigate uncertainties.

India’s Ministry of External Affairs (MEA), in an official statement, called the additional tariffs and targeting of New Delhi “unfair, unjustified and unreasonable". Prime Minister Narendra Modi on August 7 said, India “will not compromise on farmers interests and is ready to pay a heavy price" hours after US President Donald Trump announced an additional hike.

The possibility of a proposed trade deal between India and the US appears slim at this stage. Trump on August 8 ruled out talks for a trade negotiation until the tariff issue was resolved.

![]()

Anger and negotiations

“For us, the interest of our farmers is our top priority. India will never compromise on the interests of farmers, fishermen and dairy farmers. I know we will have to pay a heavy price for it, and I am ready for it. India is ready for it," Modi told a gathering at the MS Swaminathan Centenary International Conference in New Delhi in early August.

Dammu Ravi, India’s secretary, economic relations, MEA, told reporters on the sidelines of the LIDE Brazil India Forum in Mumbai, “Perhaps, this is a phase we have to overcome. The negotiations are still going on. So, we are confident that solutions will be found in the course of time in looking at mutually beneficial partnerships."

The US is India’s largest export destination, accounting for 18 percent of total exports and 2.2 percent of GDP.

On July 30, Trump said the US had levied 25 percent tariff on India starting August 1. Five days later, irked by India’s continued imports of oil from Russia, he penalised the country with an additional 25 percent levy. The initial tariffs came into effect since August 7.

![]()

Re-building Indo-Chinese relations

While tensions with the US escalate, Modi is set to visit China, where leaders of the Shanghai Cooperation Organisation (SCO) will gather for a regional summit in Tianjin city from August 31 to September 1. This is seen as another step to help normalise Indo-Chinese relations that had frayed after the Galwan clash of 2020.

Modi last visited China in 2019, but he had met Chinese President Xi Jinping on the sidelines of the BRICS Summit in Kazan in October 2024.

Economists are not yet convinced of a ‘sweet deal’ between India and the US with a concern that the steep tariff may knock off India’s economy, driving out capital from domestic shores.

Sakshi Gupta, principal economist at HDFC Bank, tells Forbes India: “Trump’s order of an additional 25 percent tariff gives another 21 days for a deal to break through. This broadly seems like a negotiating tactic, and it remains uncertain whether it would be negotiated down ultimately." She adds: “In case it does not, we will have to significantly lower our FY26 GDP growth forecast to below 6 percent, baking in at least a 40 to 50 basis points hit." Gupta had pegged India’s GDP growth rate at 6.3 percent prior to the fresh tariff hike.

India has said the bilateral partnership between India and the US remains resilient and forward-looking. “India and the US share a comprehensive global strategic partnership anchored in shared interests, democratic values and robust people-to-people ties," said MEA spokesperson Randhir Jaiswal at a weekly press briefing. “This partnership has weathered several transitions and challenges. We remain focussed on the substantive agenda that our two countries have committed to and are confident that the relationship will continue to move forward."

According to Pranjul Bhandari, chief economist, India and Indonesia, HSBC, the elevated tariff rate, if levied, could shave off over 0.3 percentage points from India’s growth, and the penalty rate could erase more. “From another lens, the announcement could reinvigorate negotiations on the India-US trade deal. We find that India has lowered oil imports from Russia in July," she adds.

India and Brazil will now be paying the highest adjusted tariff of 50 percent, followed by Syria (41 percent), Laos (40 percent) and Myanmar (40 percent).

![]()

Nomura’s economists Sonal Varma and Aurodeep Nandi expect the reciprocal tariff rate may be temporary, and might settle for lower, as negotiations will continue. “However, the best-case outcome would still be tariffs in the 15 to 20 percent range, which is disappointing, considering India’s more advanced stage of negotiations," they say. “The 50 percent tariff they said, “will be similar to a trade embargo, and will lead to a sudden stop in affected export products".

Over the medium-term, they expect India to remain a beneficiary of the China-plus-one strategy.

Among emerging market peers, Vietnam, Indonesia and Philippines have lower tariffs than India (20 percent) Korea has 15 percent, while for China it is 35 percent.

The Federal Open Market Committee (FOMC) decision to not tinker key interest rates has not surprised the markets. Federal Reserve Chair Jerome Powell said interest rates are in the right place to manage continued uncertainty around tariffs and inflation, tempering expectations for a rate cut in September, Bloomberg reported.

In their post-meeting statement, officials downgraded their view of the US economy, saying “recent indicators suggest that growth of economic activity moderated in the first half of the year". The Federal Reserve had previously characterised growth as expanding “at a solid pace".

The committee’s decision to hold steady once again defies the intense pressure from Trump to cut rates. Powell added that the Fed looked through the tariffs by not hiking and keeping them where they are. Trump has been vocal in demanding aggressive cuts.

Growth pangs

India’s gems and jewellery segment is expected to be one of the hardest hit. Overall, the estimation predicts that India’s total gems and jewellery exports to the US could fall to $2.76 billion from $11.18 billion, indicating an overall loss of $8.42 billion.

Of this, approximately $5.95 billion is attributed to direct export loss (negative trade creation), while $2.47 billion represents trade diverted to competing nations.

Colin Shah, managing director of Kama Jewelry, says: “This situation is expected to result in severe economic repercussions, especially for employment. An estimated 125,000 jobs may be lost over the next four to five months, largely impacting workers in Surat and Mumbai who are engaged in diamond cutting and polishing, and jewellery manufacturing."

![]()

According to Kapil Gupta, chief economist, Nuvama Institutional Equities, the key takeaway from Trump’s tariffs is that the US trade deficit may begin to narrow. “This is more so because the dollar has also dipped 8 to 10 percent, further eroding US consumers’ purchasing power vis-à -vis imports. Finally, US interest rates also stay elevated, and the Fed is delaying rate cuts," he says. “All this would work to narrow the US trade deficit, which could be a deflationary impulse for the global economy (hurting global growth/trade/earnings), unless surplus countries (China, Germany) boost domestic consumption timely and sizeably."

India’s goods trade surplus with the US has doubled over the last 10 years, growing to $40 billion in FY25 from $20 billion in FY15. Key items India sells to the US are electronics, precious stones, pharmaceutical products, textiles and machinery. Major items India buys from the US are mineral fuel, precious stones, machinery and electronics.

Some experts are optimistic that India’s economy will not be hurt too much. Aastha Gudwani, India chief economist, Barclays, feels the Indian economy is relatively closed, with domestic demand as the mainstay of growth. “As things stand, we estimate that the effective average US import tariff on Indian goods is at 20.6 percent in trade-weighted terms," Gudwani explains.

![]()

Oil: The deal breaker?

The US pressure on India to diversify from Russian oil and military purchases is an additional challenge, say Varma and Nandi.

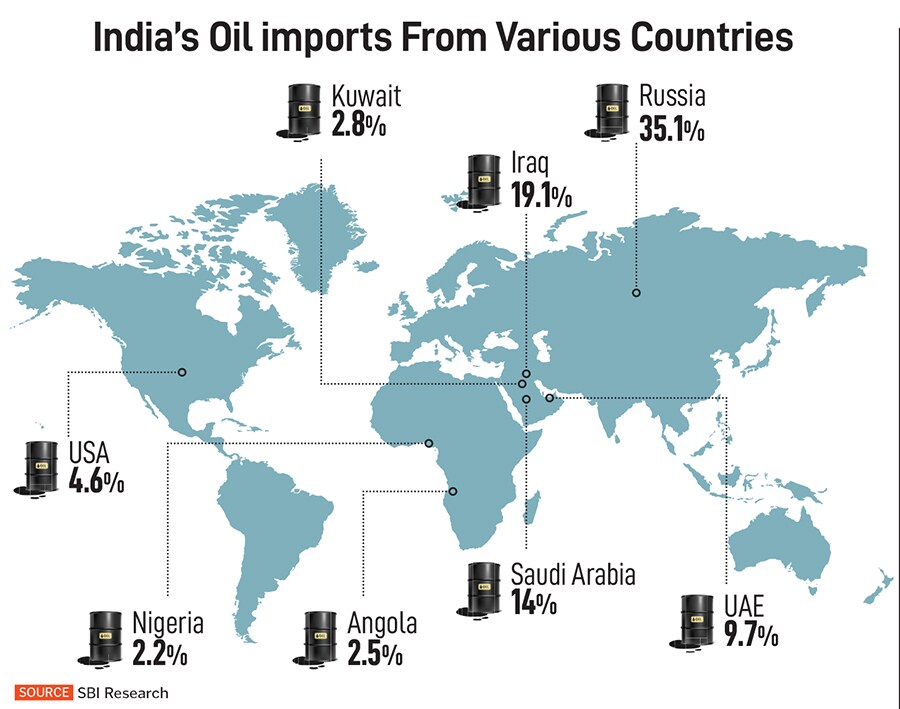

India’s oil imports from Russia currently account for 35 percent of its total oil imports. Separately, the US accounted for 4 percent of India’s crude oil imports (in volume terms) in FY25, falling from 9 percent in FY21. India could reduce its reliance on Russia by sourcing more from the Middle East and ramping up LNG imports.

“However, costs could be higher at the margin, weighing on the current account. In an ideal scenario, India could have switched from Russian oil to US oil to ensure a better trade balance. But unilateral imposition of tariffs and penalties could make this substitution more difficult. India may still use oil as a bargaining lever in further trade negotiations with the US," say Nomura’s Varma and Nandi.

In 2021, India was buying 3 percent of its annual oil imports from Russia. Over the last five years, it lowered its purchases from the Middle East and the US.

Bank of Baroda’s chief economist Madan Sabnavis also agrees that when global crude oil prices were stable in the lower trajectory, the discounts from Russia were not really significant. Hence, even today if imports are reckoned from countries like Iraq, there would not really be pressure on the current account deficit of India.

Russian oil is $3 to $8 per barrel cheaper than Middle Eastern or US grade on a landed-cost basis, but a likely 100 percent secondary tariff will mostly offset any such gains from discounted prices.

![]()

Ebb & flow: Markets & money

At the time of going to press, Indian markets were largely flat between August 1 and August 7. Analysts expect the tariff hike to impact overall earnings, and valuations of equities and Indian currency. With uncertainties around tariff and a possibility of further negotiations between the US and India, markets are expected to stay volatile and turbulent.

“The higher tariffs on India (versus expectations) could potentially weigh on capital flows," say analysts at Nuvama Institutional Equities. According to their estimates, the indirect impact of capital flight from Indian equities is likely to be more dominant and could weigh on small and midcaps and high-beta domestic cyclicals like real estate, NBFCs and industrials.

![]()

On the other hand, an Indian rupee depreciation could help IT and it could potentially outperform, given the now-low relative valuations. The Indian rupee has been weakening over the last few weeks, hovering around a five-month low.

Others concur. Analysts at Goldman Sachs estimate a 2 percent incremental hit to EPS if the new tariffs are enforced. Only 2 percent of MSCI India total revenues are derived from goods exporting sectors.

While Indian equities have significantly lagged broader emerging equities in 2025 so far, analysts at Goldman Sachs are concerned that the underperformance is likely to extend in the near term.