IT’s labour code shake up

IT giants face a jolt as one time labour code charges hit quarterly earnings and reshape cost structures

The introduction of India’s four new Labour Codes on November 21, 2025 has triggered one of the most disruptive shifts the IT industry has seen in decades. The immediate impact was visible in the financial results of the country’s top IT firms in Q3 FY26, many of which reported significant one time charges due to the revaluation of employee benefits such as gratuity and leave encashment.

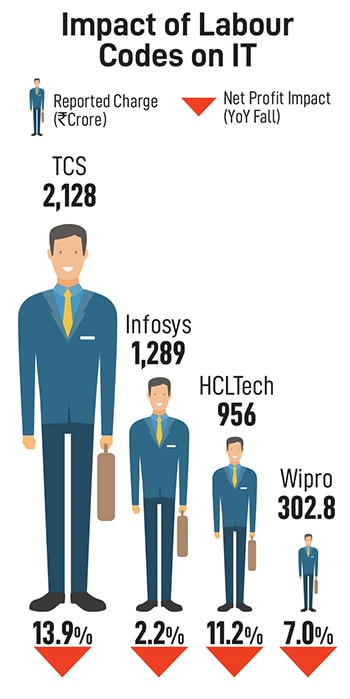

Collectively, giants like TCS, Infosys, HCLTech, Wipro, Tech Mahindra, and LTIMindtree absorbed hits totalling reportedly between Rs5,000 and Rs5,400 crore, forcing a noticeable dent in their quarterly earnings.

Among these, TCS bore the largest burden with a statutory charge of Rs2,128 crore, resulting in a 13.9 percent year on year fall in profit. Infosys followed with a Rs1,289 crore exceptional charge, which contributed to a 2.2 percent decline in its net profit.

During the earnings call, Samir Seksaria, chief financial officer, Tata Consultancy Services, said, “We expect the ongoing impact to be minimal, around 10 to 15 basis points.” He further added: “We don't expect any incremental one-offs. Unless the rules give more clarity and there is something else which needs to be addressed…”

Analysts have warned that while the provisioning is a one time event, the new labour regime may increase recurring employee costs.

“Whatever is known at this point in time on the back of the regulation that has changed is being taken this quarter. We do not expect—unless, of course, there are changes in the regulation—any further impact going forward as one-off. The recurring impact of this would be 15 basis points on an ongoing basis approximately,” said Jayesh Sanghrajka, executive vice president & group CFO, Infosys. The company had to recognise an additional Rs 1,289 crore in gratuity and leave liabilities.

One of the most consequential changes is the new, uniform definition of “wages,” which mandates the basic wage must constitute at least 50 percent of total compensation. This change expands the base for statutory contributions such as provident fund and gratuity, likely increasing employer costs while marginally reducing take home salaries for certain employee cohorts. “Companies may need to partially offset these through higher increments in the next appraisal cycle. However, given the intense pricing pressure in the industry, it is unlikely that IT firms will be able to pass on the higher wage costs to clients,” says Kamal Karanth, co-founder, Xpheno, a specialist staffing firm.

At the same time, the Codes tighten regulations around working hours, overtime, and shift design—paramount considerations for an industry dependent on 24x7 global delivery models. With permissible workdays extending from 8 to 12 hours within a weekly cap of 48 hours, and overtime mandated at twice the normal rate, companies now face rising operational expenses and a pressing need to redesign shift governance, especially in BPO and night shift heavy environments.

Beyond compensation, the new labour codes fundamentally reshape how IT companies staff. One of the most significant shifts is the expanded definition of “worker”, which, depending on how states notify their rules, could bring developers, analysts, engineers, and other white collar roles under statutory protections such as overtime pay, mandated rest periods, and enhanced leave benefits.

This marks a sharp departure from the earlier regime, where IT/ITeS companies enjoyed wide exemptions under state Shops and Establishments Acts. The move towards a unified compliance framework introduces greater uniformity and predictability, but also increases the administrative load for companies operating across multiple states, requiring standardised policies across delivery centres.

This structural change comes at a time when the IT sector is deeply dependent on flexible staffing. Contractual, fixed-term, project based and contingent workers form a sizeable layer of India’s tech workforce. Under the new labour codes, all workers—including fixed-term staff—must receive formal appointment letters and, in many cases, benefits on par with permanent employees.

“While the gross recurring impact may push employee costs up by as much as 5 percent, IT firms may limit this impact by lowering wage hikes at senior levels. A 2 percent increase in Indian employee costs may hit FY27 earnings estimates,” Jefferies highlighted.

First Published: Jan 28, 2026, 14:22

Subscribe Now