Pharma tariff shock: Indian pharma companies were already reducing US reliance p

Major Indian firms are seeing an expansion across other international geographies, notably in Europe, apart from India

Major Indian pharma companies were already witnessing a significant reduction in their revenue shares from the US, predating the Trump administration’s proposal of a massive 100 percent tariff on patented and branded products.

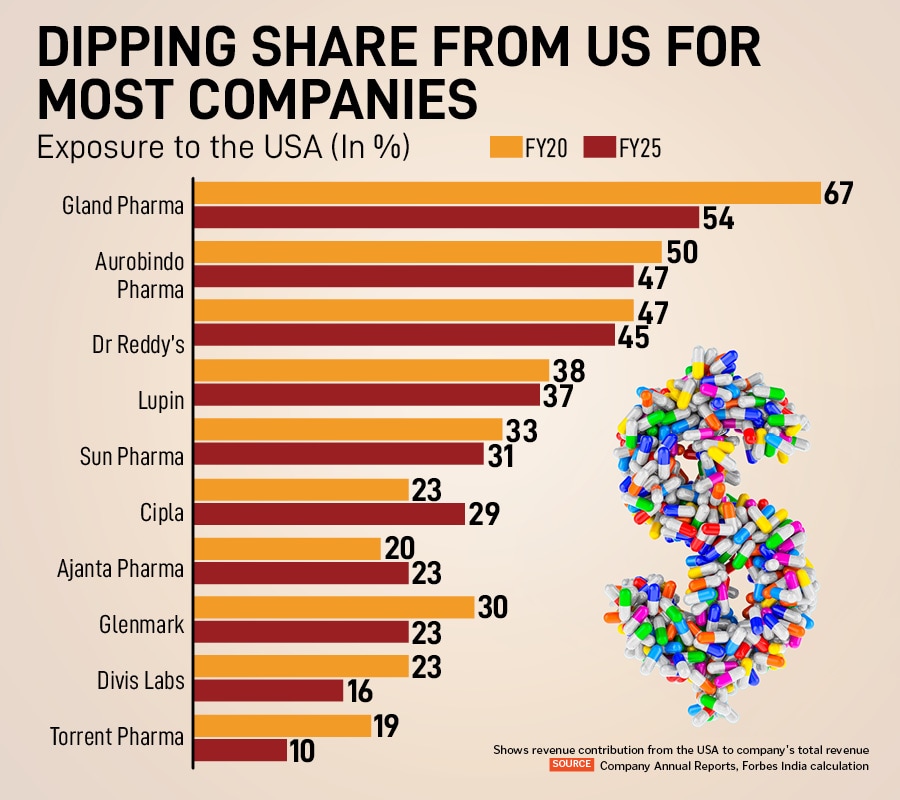

While the US has long been a primary revenue engine for Indian pharma, a Forbes India analysis of company financial data shows a declining dependence on America for revenue.

Firms with historically high US exposure have seen the steepest declines in reliance. For instance, Gland Pharma’s US revenue share plummeted from 67 percent in FY20 to 54 percent in FY25. Similarly, Torrent Pharma nearly halved its exposure, dropping from 19 percent to a mere 10 percent over the same period. Other major players, including Aurobindo Pharma (from 50 percent to 47 percent) and Dr Reddy’s (47 percent to 45 percent) have also shown significant reductions.

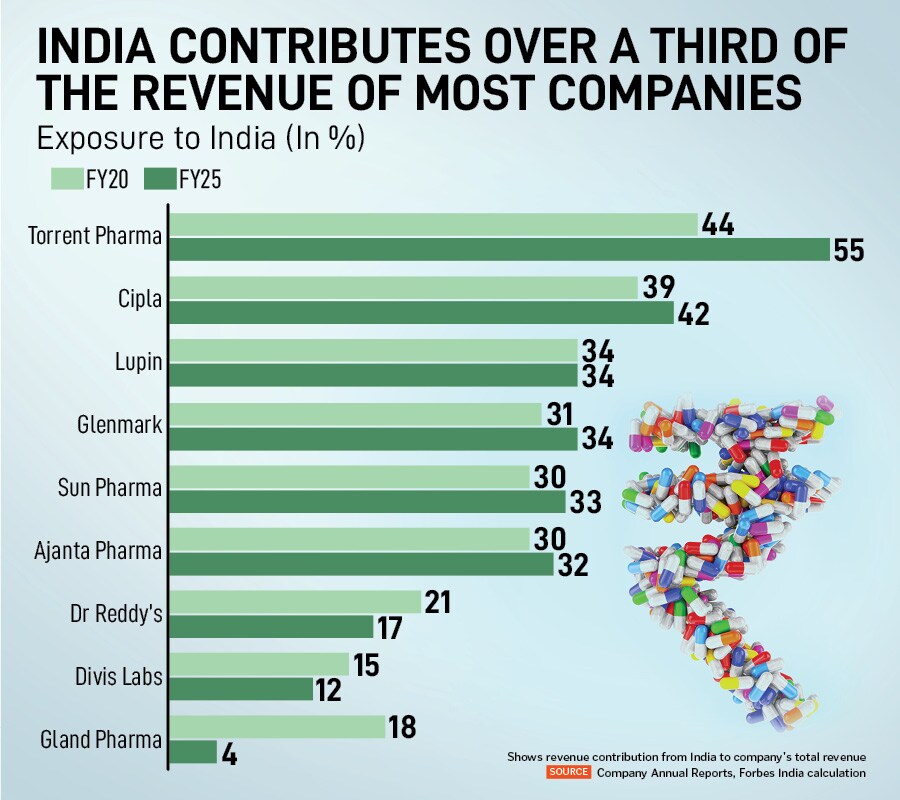

Of the largest Indian pharma companies, Torrent Pharma’s revenue share from India spiked substantially from 44 percent in FY20 to 55 percent in FY25, positioning the Indian market as its primary revenue driver. Cipla, another key player, increased its Indian exposure from 39 percent to 42 percent in the same period, while Glenmark and Sun Pharma also saw modest but steady gains. There are also a few outliers, such as Dr Reddy’s and Gland Pharma where revenue share from India has declined.

Further analysis shows that major Indian firms are consequently seeing an expansion across other international geographies, notably in Europe, and the broader emerging markets apart from India. For instance, while Cipla’s exposure to the European markets increased from 5 percent in FY20 to 12 percent in FY25, Gland Pharma’s did so from 4 percent to 19 percent, and Dr Reddy’s from 8 percent to 11 percent in the same period.

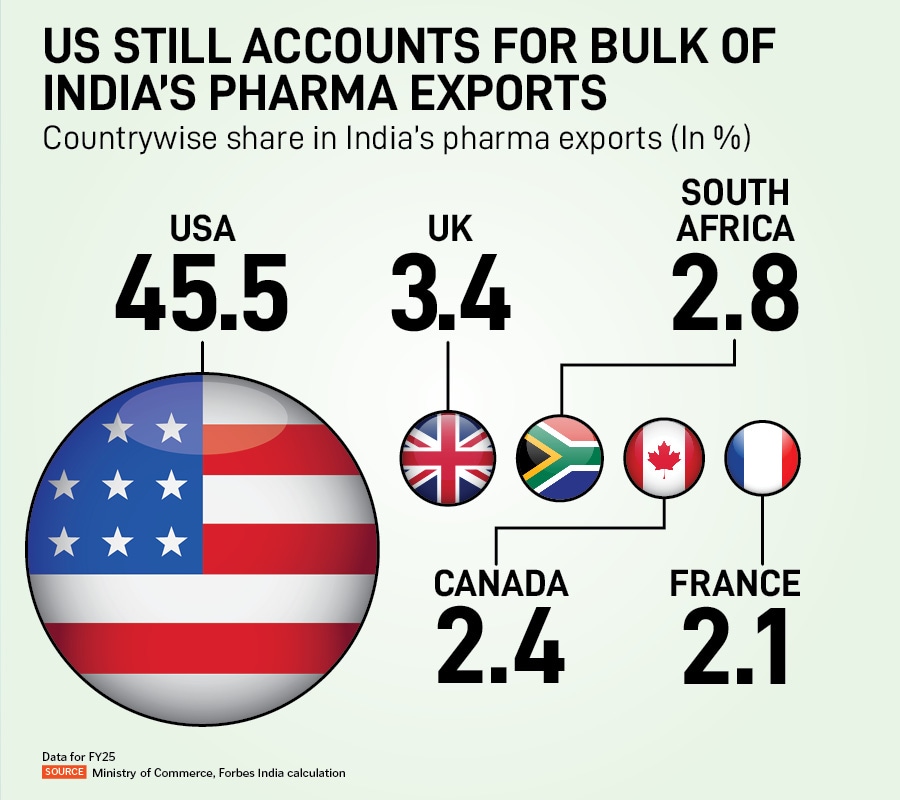

Despite these efforts at diversification, the dependence on the US remains significant. Government data for FY25 shows that the US still accounts for an overwhelming 45.5 percent of India’s total pharmaceutical exports, a share that dwarfs the combined contribution of the next four largest export destinations: The UK (3.4 percent), South Africa (2.8 percent), Canada (2.4 percent) and France (2.1 percent).

Although this 100 percent tariff is scheduled for October 1, its immediate application is limited to branded and patented drugs. Yet significant uncertainty persists over whether the policy’s scope could be expanded to target generics which is a critical segment of India’s pharma exports.

Meanwhile, India’s pharma exports increased by 14 percent to $19 billion in FY25 compared to the previous fiscal year.

First Published: Sep 26, 2025, 18:54

Subscribe Now