Is 2026 the year of the EV?

A crowded launch calendar and a heavyweight’s debut raise the stakes this year

India is set for a surge in electric vehicle (EV) launches this year, with about 30 new models expected. This is nearly double the number of EVs introduced last year, according to data from automotive consultancy firm Jato Dynamics. The increase could bring fresh momentum to a segment that has grown rapidly but remains highly concentrated.

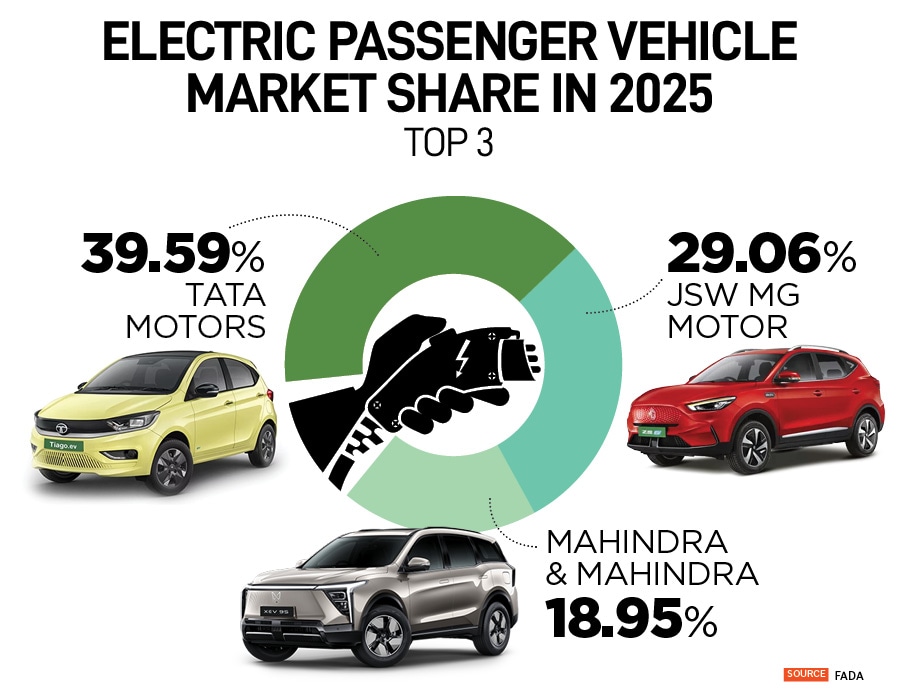

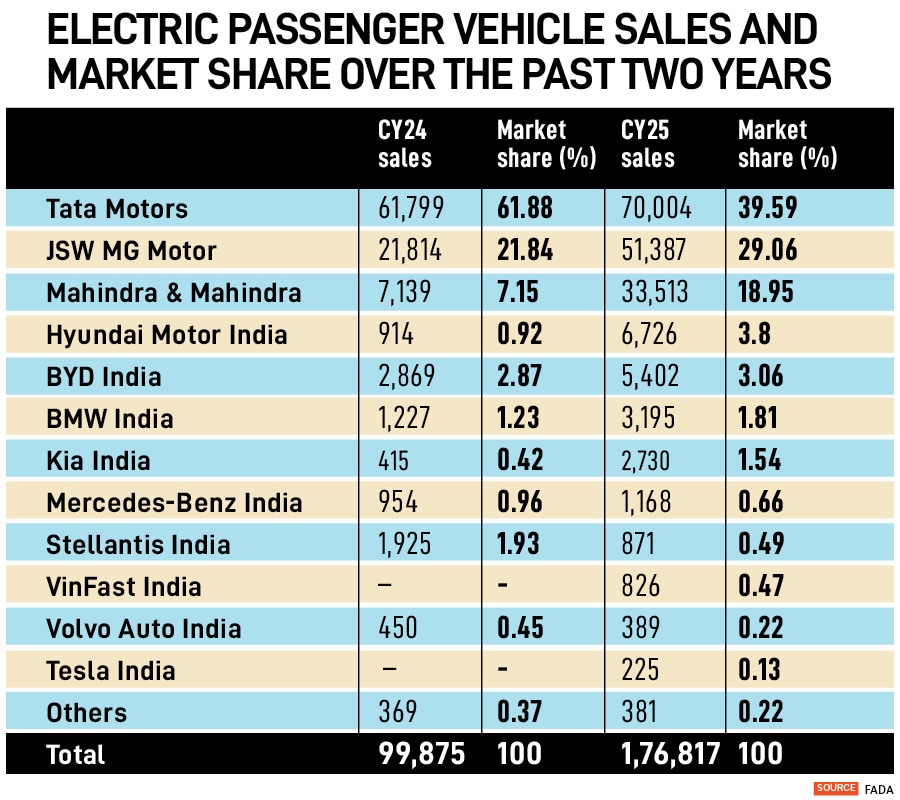

In 2025, the top three manufacturers accounted for 87 percent of electric passenger vehicle (PV) sales. Tata Motors led the market with a 39.6 percent share, followed by JSW MG Motor at 29.1 percent and Mahindra & Mahindra at 19 percent.

That dominance is likely to be tested this year. A crowded launch calendar is swelling supply in a market where manufacturers have already begun offering steep discounts to move inventory.

Roughly two-thirds of upcoming EV launches are sport utility vehicles (SUVs), mirroring trends in the internal combustion engine market. Indian buyers have steadily shifted toward SUVs, drawn by higher seating positions, perceived road-worthiness and aspirational appeal.

Currently there are two EV hatchbacks in the market: MG Comet and Tata Tiago.

An executive at a major automaker says battery packs, which account for about 40 percent of a vehicle’s cost, continue to make small EVs commercially unviable. That constraint is not unique to India. Globally, entry-level EVs remain loss-making for most manufacturers. Still, projects such as a proposed electric version of the Renault Kwid suggest renewed interest in the lower end of the market.

“High battery costs make sub-₹10 lakh EVs with limited range and charging speeds impractical,” says Ravi Bhatia, president of Jato Dynamics. Carmakers, he adds, are instead focusing on higher-priced electric SUVs with better technology, interiors and convenience features to protect margins.

BYD India increased sales to 88.3 percent in 2025, becoming the fifth-largest EV player. VinFast entered the Indian market last year and has three launches planned for 2026. In December, it briefly emerged as the fourth-largest EV brand by monthly sales, a sign of early traction.

“Chinese‑origin brands now command about one‑third of India’s EV market, intensifying competition on both pricing and technology,” says Jato’s Bhatia.

That dynamic is forcing incumbents to respond more quickly. “This pressures Tata, Mahindra, Hyundai and Maruti to accelerate product refreshes, localisation and value features to defend share,” Bhatia adds.

Tata Motors has acknowledged the challenge and is targeting price parity with Chinese EV makers soon.

Mahindra has downplayed concerns, saying it welcomes competition as long as the market operates on a level-playing field.

Tata Motors’ grip on the EV market loosened sharply in 2025. Its share fell to 39.6 percent in 2025 from 61.9 percent a year earlier, as MG Motor and Mahindra expanded at a much faster pace. MG’s share rose from 21.8 percent to 29.1 percent, while Mahindra’s nearly tripled—from 7.2 percent to 19 percent.

The most closely watched development in 2026 will be the long-awaited entry of India’s largest carmaker, Maruti Suzuki, with the electric eVitara. Pricing is yet to be announced, but Maruti’s move carries weight given its scale, dealer network and reach into smaller cities.

Explaining its delayed entry, a Maruti executive says the company adopted a deliberate wait-and-watch approach. “Early adopters of EVs had a bad experience,” says Partho Banerjee, senior executive officer for marketing and sales at Maruti Suzuki, citing after-sales issues, unreliable charging infrastructure and range anxiety. Moving slower, he explains, was intentional. “It’s the right way to launch a product.”

| Launch Year | Make | Model | Body type |

| 2024 | BMW | I5 | sedan |

| 2024 | BYD | EMAX 7 | mini MPV |

| 2024 | BYD | SEAL | sedan |

| 2024 | KIA | EV9 | SUV |

| 2024 | MAHINDRA | BE 6 | SUV |

| 2024 | MAHINDRA | XEV 9E | SUV |

| 2024 | MERCEDES | EQA | SUV |

| 2024 | MERCEDES | EQB | SUV |

| 2024 | MERCEDES | EQS | SUV |

| 2024 | MG | WINDSOR | Hatchback |

| 2024 | MINI | COUNTRYMAN | SUV |

| 2024 | PORSCHE | MACAN | SUV |

| 2024 | PORSCHE | TAYCAN | sedan |

| 2024 | ROLLS-ROYCE | SPECTRE | coupe |

| 2024 | TATA | CURVV EV | SUV |

| 2024 | TATA | PUNCH EV | SUV |

| 2025 | BYD | SEALION 7 | SUV |

| 2025 | HYUNDAI | CRETA EV | SUV |

| 2025 | KIA | CARENS EV | mini MPV |

| 2025 | KIA | EV6 | SUV |

| 2025 | LOTUS | EMEYA | Hatchback |

| 2025 | MAHINDRA | XEV 9S | SUV |

| 2025 | MASERATI | GRANCABRIO | conv |

| 2025 | MASERATI | GRANTURISMO | coupe |

| 2025 | MASERATI | GRECALE | SUV |

| 2025 | MERCEDES | G-CLASS | SUV |

| 2025 | MG | CYBERSTER | conv |

| 2025 | MG | M9 | MV |

| 2025 | PORSCHE | CAYENNE | SUV |

| 2025 | TATA | HARRIER EV | SUV |

| 2025 | TESLA | MODEL Y | SUV |

| 2025 | VINFAST | VF 6 | SUV |

| 2025 | VINFAST | VF 7 | SUV |

| 2025 | VOLVO | EX30 | SUV |

| 2026 | Audi | E-tron GT | SUV |

| 2026 | Audi | A6 E-tron | Sedan |

| 2026 | Audi | Q6 E-tron | SUV |

| 2026 | BMW | iX | SUV |

| 2026 | BYD | ATTO 2 | SUV |

| 2026 | HYUNDAI | IONIQ 5 | SUV |

| 2026 | KIA | SYROS EV | SUV |

| 2026 | JAGUAR | GT | coupe |

| 2026 | LAND ROVER | RANGE ROVER ELECTRIC | SUV |

| 2026 | LEAP MOTORS | C10 | Hatchback |

| 2026 | LEAP MOTORS | T03 | Hatchback |

| 2026 | MARUTI SUZUKI | E-VITARA | SUV |

| 2026 | MARUTI SUZUKI | B-MPV EV | MPV |

| 2026 | Merc | CLA Elec | coupe |

| 2026 | MG | STARLIGHT S | SUV |

| 2026 | Mini | Aceman | Hatchback |

| 2026 | RENAULT | KWID EV | Hatchback |

| 2026 | SKODA | ENYAQ | SUV |

| 2026 | SKODA | ELROQ | SUV |

| 2026 | TATA | SIERRA EV | SUV |

| 2026 | TATA | AVINYA EV | SUV |

| 2026 | Tesla | Model 3 | Hatchback |

| 2026 | TOYOTA | URBAN CRUISER EV | SUV |

| 2026 | VINFAST | LIMO GREEN | MPV |

| 2026 | VINFAST | VF 3 | SUV |

| 2026 | VINFAST | VF 8 | SUV |

| 2026 | VOLKSWAGEN | ID.4 | SUV |

| 2026 | Volvo | ES90 | Sedan |

| 2026 | Volvo | EX90 | SUV |

| 2026 | MAHINDRA | XUV 3XO EV | SUV |

| 2026 | BMW/Mini | Unknown | Unknown |

Source: Jato Dynamics

First Published: Jan 23, 2026, 18:00

Subscribe Now