Why investors are pulling out of equity mutual funds

Indian investors are getting nervous about their equity investments; mid and small-cap funds seem to have been the worst-hit

Image: ShutterstockWith two years of weak returns in mid and small cap funds, a slowing economy and global trade tensions, Indian investors too are getting nervous about their equity investments.

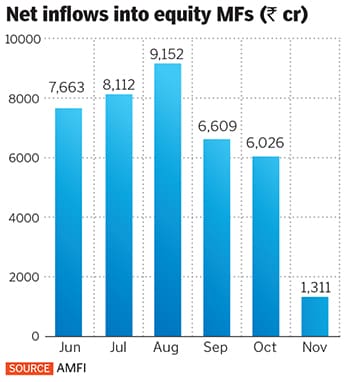

Image: ShutterstockWith two years of weak returns in mid and small cap funds, a slowing economy and global trade tensions, Indian investors too are getting nervous about their equity investments. November’s net mutual fund numbers indicate that keeping some money aside is the preferred strategy. Net inflows, which had averaged between ₹6,000 crore and ₹9,000 crore between June and October fell to ₹1,311 crore in November (see graph), according to data from Association of Mutual Funds in India. “The headlines are not very positive on the economy front. Even on the global front there are a lot of headwinds,” says Akhil Chaturvedi, associate director–head of sales & distribution, Motilal Oswal AMC. “That seems to have prompted the investors who have made some money to move out.”Mid and small-cap funds seem to have been the worst-hit. Inflows into mid cap and small cap fell from ₹1,091 crore in October to ₹801 crore in November and ₹678 crore to ₹261 crore respectively.

November’s net mutual fund numbers indicate that keeping some money aside is the preferred strategy. Net inflows, which had averaged between ₹6,000 crore and ₹9,000 crore between June and October fell to ₹1,311 crore in November (see graph), according to data from Association of Mutual Funds in India. “The headlines are not very positive on the economy front. Even on the global front there are a lot of headwinds,” says Akhil Chaturvedi, associate director–head of sales & distribution, Motilal Oswal AMC. “That seems to have prompted the investors who have made some money to move out.”Mid and small-cap funds seem to have been the worst-hit. Inflows into mid cap and small cap fell from ₹1,091 crore in October to ₹801 crore in November and ₹678 crore to ₹261 crore respectively.

First Published: Dec 18, 2019, 08:51

Subscribe Now