Advertisement

Image: Shutterstock

Image: Shutterstock

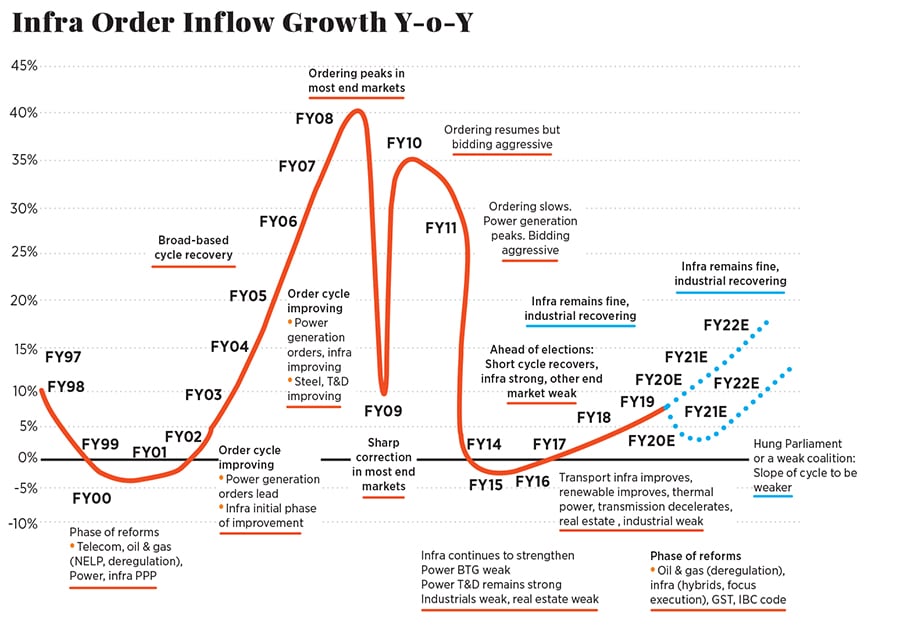

A recent report by Bernstein points to a slow uptick in investments, a process that is likely to accelerate with the election of a stable government. In the last two quarters, there has been an increase in gross fixed capital formation as companies gradually exhaust capacity and get ready to invest for the next leg of growth. The numbers are nowhere close to the capex-led boom in the 2000s and there is likelihood of it slowing down in case of an unfavourable poll outcome.

First Published: Mar 14, 2019, 14:59

Subscribe Now- Home /

- Leaderboard /

- Will-we-see-a-capex-revival

Latest News

Advertisement

Advertisement

Advertisement