Britannia Industries: The taste of success

Britannia Industries's move of bringing on board Varun Berry has proved a winner. In just two years, the FMCG veteran has spearheaded a turnaround

The meeting, however, was not a cosy tête-à-tête. It was a headhunting foray. Wadia was scouting for someone to set things right at Britannia: The country’s largest listed bakery and dairy manufacturer was losing ground to Mumbai-headquartered Parle Products and the foods division of Indian FMCG behemoth, ITC. Biscuits are bread and butter to Britannia, which has a market cap of $5.1 billion. But despite a formidable portfolio of brands—Good Day, Tiger, Marie Gold, 50 50 and Milk Bikis, among others—it had ceded market dominance to Parle. In FY06, according to industry reports at the time, Britannia had an approximately six percentage point lead over Parle in market share (in value terms). But, Parle had beaten the company in the volumes game with its mass-market glucose biscuit Parle-G. By 2010, the tables had turned with Parle establishing a 6-7 percentage point lead over Britannia in market share in value terms.

Wadia needed someone to help set things right. With experience of over two decades in the FMCG sector, Berry was the perfect candidate to spearhead a revival. (The Wadia Group had gained majority control of Britannia in 2009, after having bought out French firm Danone’s 25 percent stake for an estimated $200 million.)

His interview with Wadia was slotted for 30 minutes at the Bombay Dyeing office in Wadia International Centre, Worli. “Guess for how long it lasted? Almost six hours!” says Berry. The marathon meeting with Wadia had a clear agenda. “He [Wadia] felt the company could do a lot better.”

The meeting was fruitful. Berry joined Britannia Industries in January 2013 to oversee the Bengaluru-based company’s India operations, which accounts for 95 percent of its total revenue. And by April 2014, he had moved from chief operating officer (COO) to managing director. This was inevitable too.

Berry is no lightweight in the FMCG space: He’s the go-to guy who can turn a brand around and is credited with having grown PepsiCo India’s market share in Gujarat by 38 percentage points over 12 months in the 1990s.

His success, however, rests on one caveat: The brand has to have equity. “If there is no brand, I don’t know how to make a turnaround,” he says. Britannia exceeded his requirements in that it had all the right ingredients for the 53-year-old Berry to stage a turnaround. The biscuit maker is known for its big marketing interventions and programmes. At one point, almost half the Indian cricket team’s players used bats that sported the Britannia logo. “I think the overall corporate brand has extremely powerful equity. It is one of the few brands that continues to have an Indian ethos and flavour,” says Raghu B Viswanath, managing director of Vertebrand, a Bengaluru-based brand value advisory and marketing consultancy.

“Britannia has always been a fabulous company,” Berry tells Forbes India. From the moment he came on board, he had one agenda: To turn the 123-year-old company into a lean, mean fighting machine. This was at a time when the overall food and, in particular, biscuit market was witnessing a slowdown. He had to force a legacy company to change gears practically overnight and adopt a startup-like mindset.

Under Berry’s watch, the company has doggedly pursued a strategy to improve its sales and distribution reach, better the overall cost management, increase its in-house production capabilities, infuse operational efficiencies across its supply-chain and scale up its innovation capabilities. It is rare for legacy companies to undertake such radical makeovers, say industry analysts. “It calls for a shake-up in the status quo. A lot of heartburn will, and does, happen,” says Harish Bijoor, brand expert and CEO of Bengaluru-based Harish Bijoor Consults Inc.

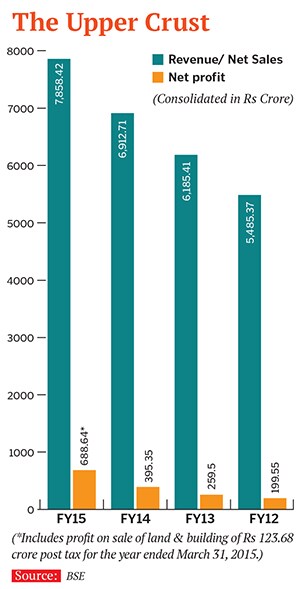

Berry’s shake-up yielded results: For nine straight quarters leading up to the quarter ended March 31, 2015, Britannia has grown its operating margins, an indicator of the company’s profitability. Its operating profit margin in Q4 of FY15 stood at 13.95 percent, against 7.6 percent in the same quarter of FY13. Its net profit margin grew over 400 basis points in the two-year period. Besides, in the same period, Britannia posted double-digit revenue growth, in the 11-15 percent range, every quarter. This was despite the fact that growth in the biscuit market had dropped from 8 percent (in August 2013) to 4 percent by December 2014.

The company’s changing fortune has reflected in its stock price as well. As of June 19, Britannia is the fifth most traded stock on the S&P BSE FMCG index. Since Berry joined, the company’s stock has risen over 400 percent.

In two years, the company has also expanded the reach of its direct distribution network from 7 lakh to over 10 lakh retailers. In rural India, it has extended the footprint of its sub-stockists by 40 percent. It has doubled its frontline sales force in cities and semi-urban areas, which has resulted in an incremental sales growth of six percent by the end of FY15. Through best practices, it has shaved off Rs 100 crore from its distribution costs and reduced its power costs by 10-12 percent.

In his 30-year career, Berry says he hasn’t seen a company in the FMCG sector grow its revenue, profit and market share simultaneously for two consecutive financial years.

He is, however, reluctant to talk about market share numbers, and instead draws attention to a May 2015 news report in The Times of India, which suggested that Britannia, with a 28 percent market share, had overtaken Parle with a 0.5 percentage point lead (in value terms) in April. But the same report mentioned that on a yearly basis, Parle continued to be the market leader, in terms of volume and value. The gap that Britannia is now trying to bridge between itself and Parle for market dominance is about three percentage points, a figure Wadia mentioned in the company’s annual general meeting last year.

Industry watchers and analysts have been taking note of Britannia’s revival. In a recent report, HSBC Securities and Capital Market noted that Britannia “was in the second phase of value creation, which should accompany volume growth acceleration, market share gains led by new product launches and increasing depth and breadth of distribution”. The report notes that the changes wrought have helped the biscuit maker double its margins and have resulted in a “substantial jump in return on capital”.

While some analysts argue that Britannia could have done all this and more years ago, others like Bijoor say that it has timed its revival well. “The context today demands aggression. I don’t believe it has come too late.It has come on time,” says Bijoor.It was also well planned. Within a year of gaining majority control, the Wadia Group had put in place a revival plan. The fact is, Berry’s turnaround strategy has been all the more successful because some of the company’s long-term plans, which the board had instituted before he joined, are now coming into fruition. For instance, initially, two-thirds of Britannia’s production was outsourced to contract manufacturers, but then, five years ago, the company—in a bid to have more control over manufacturing costs and leverage new technologies—began investing in its own manufacturing facilities. Now, the FMCG company is in the process of increasing its capacity by 20,000 tonnes of biscuits per month by the end of March 2017. Over the next 20 months, 58 percent of its manufacturing will be done in-house.

Some of the cost-pruning initiatives on the supply chain side were put in place after an internal programme called Britannia Next (BNext) was set up in 2010. Its objective was to look at how the company could become structurally fit. Vinay Singh Kushwaha, vice president-supply chain, who joined Britannia in 2010 and spearheaded BNext, explains, “We looked at new ways of buying materials. We asked ourselves: How do we distribute differently how do we set up our plants differently how do we manage our inventories and distribution? We also looked at how we buy media space.” It took Kushwaha three years to introduce a slew of “new capabilities”.

But these new business strategies needed more capable hands to trump Parle. Enter Berry. The FMCG veteran started putting together a crack team to infuse new life into Britannia. Given the biscuit maker’s low margins and the need to keep costs in check, Berry believed the company would not be able to bear the cost of hiring too many people from other FMCG players. “The best option was to size up people within the organisation and give them bigger responsibilities,” says Berry, who reviewed Britannia’s top 50 managers after diving into the company’s financials.

After nearly two years, he has a 10-member core team comprising functional and business heads who report directly to him. Of these, only three—the head of sales, head of R&D and the chief financial officer—are outside hires. Five of the 10 were promoted from within the ranks. (They were in relatively junior positions, two levels below their current designations). But when it came to getting things done and investing in people, Berry was willing to break from precedent. “There were two areas of difficulty. One was to convince the board that a person, who is two levels below, will be able to perform. The other difficulty was getting them to rise to the job’s demands,” he says.

One of the members of the team is Ali Harris Shere, who joined Britannia as a management trainee in 1998, and served the company for 16 years in various roles in sales and marketing. In April 2014, he quit (he was senior marketing manager at the time) to join Vodafone India. But three months later, he was back at Britannia as marketing head at Berry’s behest. “One does not expect somebody to trust you and give you a job with full responsibility, ownership, accountability and freedom,” says 39-year-old Shere, who is excited about re-energising Britannia’s brand, and wants to strengthen its association with cricket and Bollywood.

Britannia was the title sponsor for a leading film awards function in 2015 and, through its biscuit brands Good Day and 50 50, it has associated itself with the Indian Premier League. In February and March this year, the company ran a promotional offer on 50 50, giving away an iPhone 6 every day. “In the past, we did many activities, but on a smaller scale. Now, we are doing fewer activities, but we are doing them big. Because of this, the average ticket size of our campaigns has doubled,” says Shere.

Shere is an old hand familiar with the nuts and bolts of Britannia, unlike Hemant Rupani, vice president-sales, who joined last year. The sales department, according to Berry, needed “a very aggressive person” because it had become too “transactional” in the way it functioned. “When I started to meet distributors in the market, I felt that we were just pushing sales to them not worrying about their RoI [Return on Investment] not worrying about what they did with the product or how they sold it and whether their execution was good,” says Berry. That had to change. He took his time, and finally, in May 2014, handpicked Rupani, who was previously national distribution head at Vodafone India.

The first thing Rupani did was to take stock of the company’s policies towards incentive earnings and its rewards and recognition programmes, two critical elements in motivating a sales force. Rupani installed an incentive platform. “If any manager wanted to be evaluated as a good performer, a bare minimum 70 percent of his team should be earning 70 percent incentives, at the very least. Otherwise, they have no right to claim that they have performed,” he says. It is an aggressive policy, but he wears it as a badge of honour, and tells Forbes India that team morale has risen.

Even as the sales force was getting its mojo back, Berry started strengthening the R&D arm. Britannia didn’t have much to show for in the last decade, in terms of ‘big-bang’ innovation. According to Shere, in the last 10 years, it has had only two successful new product launches: Tiger Krunch Choco Chip (cookies) and NutriChoice Essentials (oat and ragi cookies).

About six months ago, the Britannia board approved a Rs 55-crore investment into a new R&D centre in Bengaluru, which is expected to be up and running by March 2016.

Berry wants to see new product innovations account for 6-7 percent of the company’s revenue, every year. In August 2014, Berry hired Sudhir Nema, who at the time was heading operational excellence and capability building in R&D for PepsiCo in Bangkok, to take up this task. “If you don’t have delightful products, then you don’t have any right to go to consumers and say please spend Rs 5 and pick me up. That ‘pick me up’ comes from R&D,” says 44-year-old Nema, vice president - R&D & Quality.

He’s not waiting for the new centre to open. Britannia has launched three innovative products at the premium end of the market over the last nine months: Good Day Choco Chunkies, NutriChoice Heavens and Pure Magic Chocolush. The R&D team is already thinking about innovations in adjacent food categories. The ready-to-eat segment is another avenue for Britannia.

But Berry is not ready to reveal his hand so early in the game. “We are working on a strategy for the next billion,” is all he’s willing to say. What’s clear is his determination to stay on top. Britannia cannot lose its lead. Not under Berry’s watch.

First Published: Jul 21, 2015, 06:25

Subscribe Now