How a young India is redrawing the luxury road map

Rapid economic growth has reshaped the attitudes towards spending, resulting in a surge in demand for high-end cars

When Varun Jain returned to India in 2006 after graduating from the University of Wales, Cardiff, his first request to his father was not a job or seed capital. It was a BMW M5, a car that today carries a price tag of more than ₹2 crore.

The ask marked a generational break, says Jain, the founder of vodka brand Smoke Lab.

For his father’s generation, luxury was deferred—something earned after decades of work and milestone achievements. But for many of India’s younger, wealthier consumers, it has become an early and unapologetic reward.

Rapid economic growth has reshaped attitudes toward spending among India’s affluent, loosening a long-held emphasis on thrift. Stories like Jain’s, once rare, are now increasingly common as heirs to family businesses spend with less restraint.

The result has been a surge in demand for high-end cars priced above ₹50 lakh.

In showrooms across India, the typical luxury buyer is getting younger. Many are self-made, digitally savvy and often first-generation millionaires, their wealth rooted in equity markets, startups or professional careers.

Sharad Kachalia, director at Navnit Group, which operates several luxury car dealerships, says the profile of the average buyer has shifted markedly over the past decade. “Ten years ago, the typical luxury buyer was in his late 40s or 50s,” Kachalia says. “Today, most new buyers are in the 30-40 age bracket, sometimes even in their late 20s.”

The change is not just generational but behavioural. “The traditional buyers would always ask ‘last price kya hai’ (what’s the maximum discount you can give me),” he says. “That mindset has changed.”

Younger buyers now arrive armed with research. They compare prices across cities, understand product positioning and rarely push for cash discounts upfront. Instead, they focus on value around the car—service packages, extended warranties and bundled options. “The negotiation is more structured,” Kachalia says. “It’s about what they get over the life of the vehicle.”

At India’s largest luxury carmaker Mercedes-Benz India, managing director and chief executive Santosh Iyer says the market is now clearly split. There is the traditional luxury buyer and then there is a fast-growing pool of first-time luxury customers. “These new entrants are highly informed, digitally savvy and aspirational. While they remain value-conscious, they are uncompromising when it comes to safety, comfort, brand prestige and the overall ownership experience,” says Iyer.

This shift in expectations has reshaped how luxury carmakers operate in India. The value proposition at these price points is no longer just a car with the latest tech or the best engine or immaculately finished interiors. It’s the experience—which starts after the sale has been made.

Brands have created a whole ecosystem around car selling. They offer concierge services, curated drives, access to art and culture events, and other money-can’t-buy experiences.

Mercedes rival BMW says its core buyer today is 30-49 years old, a strategic generational shift that reflects the brand’s enduring emphasis on driving pleasure and performance. “This segment comprises high-growth-sector professionals, entrepreneurs, and first-generation millionaires who view luxury as purposeful,” says Hardeep Singh Brar, president and CEO, BMW Group India.

This cohort demands performance with everyday ease, a digital-first ecosystem, continuous upgrades via software, and curated, concierge-like brand engagement, not just transactions, according to Brar.

Audi’s buyer profile follows a similar arc, where over 70 percent of customers are under 50. Audi India Brand Director Balbir Singh Dhillon says this cohort wants “responsible indulgence”. They seek performance and design, but also technology. Extended warranties, assured buybacks and long-term roadside assistance now sit alongside lifestyle events, digital-first dealership engagements and curated drives.

Nowhere is the shift towards mindset-led luxury clearer than at JLR India, which sees different buyers for its four different brands: Range Rover, Defender, Discovery and Jaguar.

Range Rover customers are often time-poor leaders looking for a sanctuary—something equally comfortable to drive or be driven in, says JLR India managing director Rajan Amba.

“Defender clients have a spirit of adventure, while Discovery owners prioritise versatility and practicality. Over 50 percent of Discovery owners also own a dog and enjoy spending time in nature.”

Jaguar customers, meanwhile, are independently minded, emotionally driven and increasingly open to electric mobility.

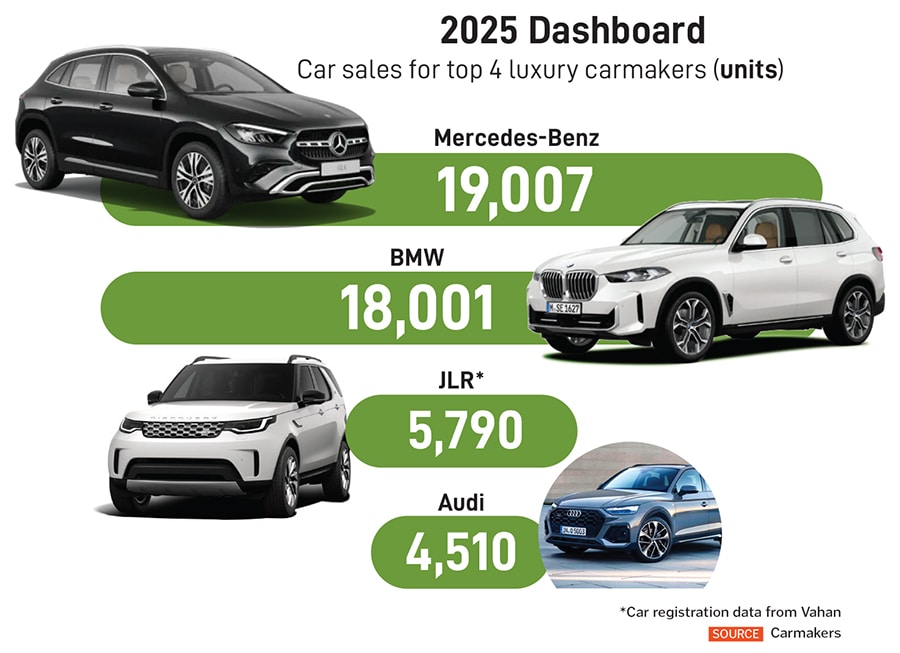

JLR offers several India-specific limited editions, bespoke colour and material choices, travel experiences, and concierge services—all of which helped the Tata-owned automotive manufacturer emerge as the third-largest luxury carmaker in India in FY25, replacing Audi.

Also Read: India-EU FTA could reshape luxury carmakers’ India strategy

One of the most important drivers of the market’s expansion has been localisation. Over the past decade, luxury brands have quietly moved away from being pure importers to becoming selective local assemblers. The effect has been multi-fold: Lower landed costs, better supply control, and faster variant planning and time to market.

Mercedes-Benz assembles cars at its Chakan plant in Pune, operational since 2009. It produces various models there but India is the only market outside the US that locally produces the EQS sedan and the EQS SUV, two of its EVs.

BMW’s Chennai facility has been producing cars since 2007 and now assembles ten models that have up to 50 percent localisation. Audi started manufacturing several of its core models—including the Q range and key sedans—at the Skoda Auto Volkswagen facility in Aurangabad in 2007. JLR has used localisation more selectively, assembling models such as the Evoque, Velar and Discovery Sport and Jaguar F-Pace while keeping flagships imported to maintain exclusivity. The localisation push has helped the original equipment manufacturers (OEMs) churn out models faster.

Model lifecycles that once stretched close to seven years are now compressed, with full redesigns arriving sooner and interim upgrades introduced mid-cycle, says Kachalia of Navnit Group. “The customer appetite for the new is much stronger now. And the industry has recalibrated around that.”

He says luxury cars were once kept for seven to ten years—often replaced only for milestone occasions such as weddings. They are now being upgraded far more frequently. “Today, replacement cycles are closer to three to four years,” Kachalia says.

The average price of a luxury car has gone up substantially since Covid as some carmakers focus on high-margin models. At Mercedes-Benz, the average selling price is close to ₹1 crore now compared to ₹57 lakh pre-pandemic.

Over the last few years, luxury OEMs in India have moved away from volume-maximisation towards margin and brand control, says Harshvardhan Sharma, head of auto retail practice at Nomura Research Institute. “OEMs are tightly aligning imports/CKD (completely knocked down units, where parts are imported and assembled locally) volumes with confirmed demand rather than pushing inventory into the dealer network. This limits distress discounting and protects residual values.”

Sharma points to a clear skew towards higher-margin trims, long-wheelbase versions, fully loaded SUVs, and limited editions. “Entry variants still exist but are no longer the volume driver. This lifts average selling prices without relying on headline price hikes.”

In effect, luxury OEMs are prioritising pricing power and brand equity over short-term unit growth, he says.

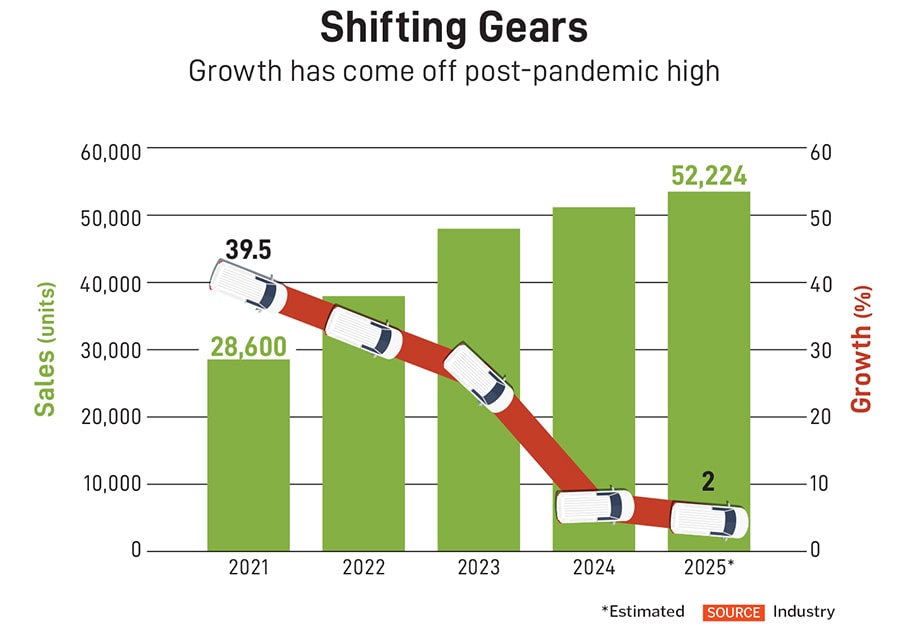

That trade-off is now showing up in sales data. After the post-Covid surge, growth has slowed to low single digits. Industry estimates suggest 2025 likely closed with growth of about 2 percent, down from 6 percent in 2024 and well below the double-digit growth rates recorded in the years immediately following Covid.

Sales at Mercedes-Benz India fell 3 percent, while Audi saw a 22 percent decline. BMW was the only German brand bucking the trend, ending 2025 with 14 percent growth, helped by aggressive pricing and a broader push into EVs. JLR volumes are expected to be flat after a cyberattack hit production for almost three months globally.

Luxury car buying in India has always been tightly linked to sentiment, which came under pressure amid geopolitical uncertainty and a volatile stock market last year. Even so, despite the pre-2024 surge, luxury penetration remains low at around 1 percent.

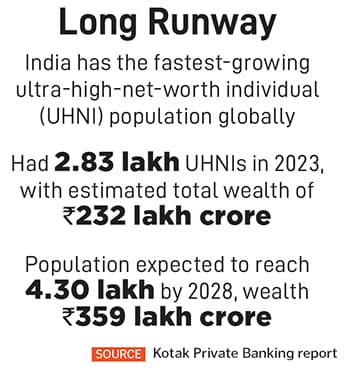

The numbers point to a disconnect. India was home to an estimated 2.83 lakh ultra-high-net-worth individuals (Ultra HNIs) in 2023 with combined wealth of ₹232 lakh crore, according to a Kotak Private Banking report. That figure is projected to surge to 4.3 lakh individuals with wealth of ₹359 lakh crore. Yet annual luxury car sales hover around just 50,000 units.

Aditya Khandelia, managing director and partner at Boston Consulting Group (BCG), says that for new HNIs, luxury cars usually come after they’ve solved for security and convenience. “You need time to become mentally comfortable spending ₹50 lakh to a crore on a car. Indian HNIs still prioritise security and functional value over discretionary, symbolic spends like ₹1 crore-plus cars.”

The long-term story, though, remains intact. Carmakers are now looking beyond metros as demand grows in Tier 2, 3 towns.

Navnit Group’s Kachalia recalls an episode that, he says, shows how aspirations are growing even in smaller towns. About seven or eight years ago, he noticed a security guard reprimanding a young boy for peering into his Rolls-Royce showroom in Mumbai. The boy of around 10 was with his grandfather who was around 70, dressed simply in a lungi and slippers.

Kachalia intervened, invited them inside and asked his sales manager to show the car in detail. “I told him, ‘He is my future customer,’” Kachalia recalled.

After spending nearly half an hour examining the car, the grandfather asked the price. “I told him it was about ₹3.5 crore. The man reached into a small pocket inside his lungi, pulled out a cheque for ₹3 crore and said: ‘This is it. I would like to have this car, but the colour and trim my family will decide. Can you send somebody to Kerala where I will make the balance payment?’” says Kachalia.

Carmakers have noticed the aspirations of small-town consumers and are strengthening their sales and customer service network in smaller cities, which is where they see their next leg of growth coming from.

Which brings the market to its next inflection point: What does the luxury car of tomorrow look like. Ask the carmakers and the answer is strikingly consistent. It will not be defined by body style or even by powertrain. Mercedes calls it a “supercomputer on wheels”. “Mercedes-Benz will remain technology-agnostic, offering the cars that are demanded by the customers. Ultimately, the defining elements of future luxury will be personalisation, exclusivity and advanced technology—not just the form factor,” says MD & CEO Iyer.

BMW describes the car of tomorrow as “software on wheels”. According to president and CEO Brar, “Buyers will expect advanced driver assistance systems, seamless connectivity, and cars that update and improve during its use phase. Ultimately, the luxury car of the future will blend performance, sustainability, and a continuously evolving technology ecosystem and BMW is already shaping that future.”

JLR talks about redefining the experience altogether. “Tomorrow’s luxury car will be a space that anticipates your needs, connects you to your world effortlessly, and reflects your individuality. Whether it’s electric, autonomous, or something entirely new, the real question isn’t the body type—it’s how we make it feel truly exceptional,” feels managing director Amba.

Audi sees a connected ecosystem that links home, office and mobility. “The future is indulgent yet intuitive, where the car becomes part of a connected ecosystem across your home, office and mobile life, offering seamless comfort and effortless control,” says brand director Dhillon.

“At Audi, we see the future as multi-powertrain and multi-body-style, united by one philosophy: Progress. For us at Audi India, true luxury is about making ownership more personal, effortless and responsible, offering a touch of exclusivity and smart, intuitive technology that keeps you seamlessly connected.”

In practice, SUVs will continue to dominate Indian roads because they suit both aspiration and infrastructure. EVs will grow, but alongside internal-combustion and hybrid models rather than replacing them outright. The real transformation will be invisible: More software, deeper personalisation and a widening halo of experiences around the machine.

The next phase will be less about what Indians drive and more about the world that comes with it.

First Published: Jan 28, 2026, 17:18

Subscribe Now(This story appears in the Jan 23, 2026 issue of Forbes India. To visit our Archives, Click here.)