Elevation Capital's long game

Why the early-stage venture capital firm has launched a holding fund to score multi-bagger IPO exits

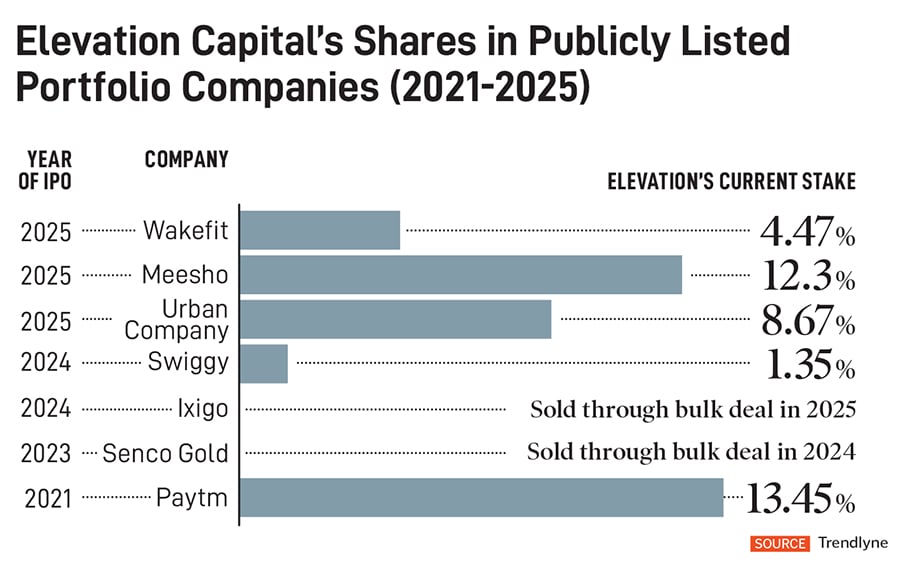

It came as a surprise to Meesho co-founder and CEO Vidit Aatrey when early-stage backer Elevation Capital wanted to increase its stake in the company ahead of its public market debut. In a round in June 2025, co-founders Aatrey and Sanjeev Kumar offloaded their shares, with Elevation Capital increasing its shareholding in the company to 14 percent ahead of the IPO in December.

The move reflected Elevation Capital’s confidence in Meesho’s upcoming public market performance, and the long-term relationship shared by the early-stage investor and the value-commerce platform.

“Ecommerce in India was built for the top 40 million to 50 million customers living in urban areas before Meesho came in and built a true value-ecommerce play for the broader India,” says Mukul Arora, co-managing partner at Elevation Capital.

He adds, “Even if online commerce in India grows to 15 percent of the total retail opportunity of nearly $1 trillion in a few years, from the current share of 6 percent, the headroom is massive. Meesho is well-positioned to command a disproportionate share of this market with its differentiated platform, stellar team and being the only one generating cash. We think of ourselves as long-term partners of Meesho.”

The association worked out well for Elevation even as it sold shares worth ₹271 crore in the Offer for Sale (OFS) during Meesho’s listing process, booking a 37x return on its initial investment. It continues to hold 12 percent in the company, apart from being a part of its board.

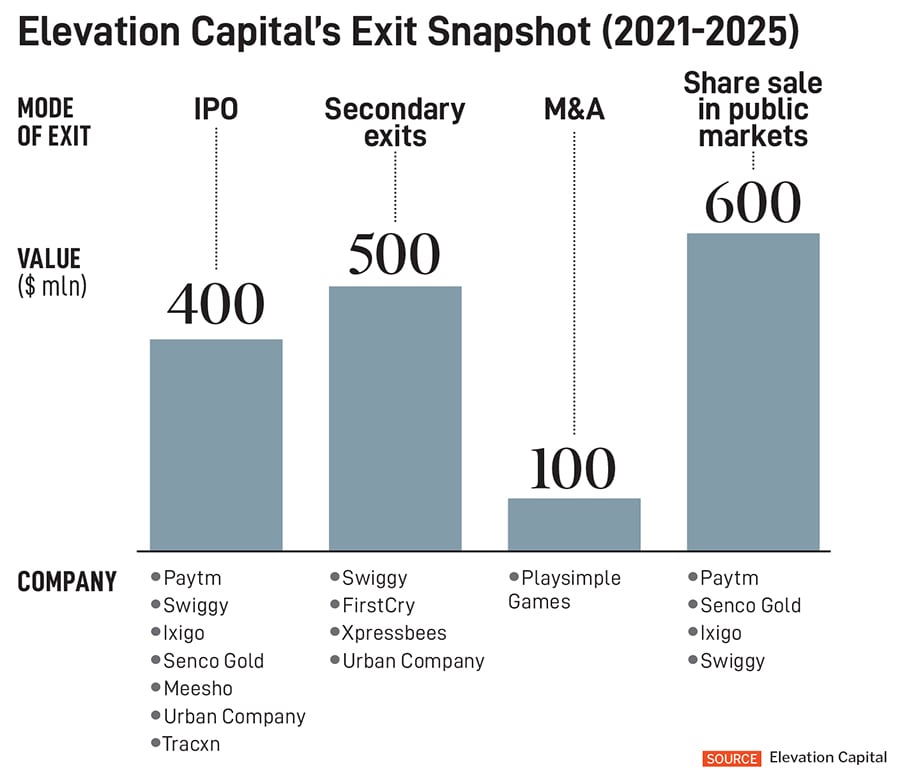

Not just Meesho, Elevation Capital has also seen Urban Company generate 19x returns in 2025 on partial sale of its stake during the OFS, while it holds around 9 percent. The venture capital firm continues to hold its shares in Wakefit and did not participate in the OFS in December 2025. Its past portfolio of winners include Swiggy and Paytm, as well as FirstCry from which it exited ahead of the IPO.

Elevation Capital also announced its $400 million late-stage fund, Elevation Holdings, in August to bet on companies one to three years away from a public listing. The new fund ties in with the firm’s principal of offering long-term partnership to its portfolio companies, in addition to investing in opportunities it might have missed along the way.

A closer look at the fund’s investments show they are bullish on the post-IPO value realisation by its strongest bets.

Timing is everything for a successful exit for an early-stage investor with the option of selling in secondary transactions to incoming investors, exiting during an acquisition event or in the best case, selling during or ahead of an IPO.

“One of my former bosses told me that sometimes you are a long-term investor; sometimes you are forced to be a long-term investor,” jokes Mridul Arora, partner at Elevation Capital.

On a serious note, he adds that, by nature, startups are meant to be a long-term play and that is what the Limited Partners in a fund back it for. “Capital markets and public markets can always be volatile in the short term. The more important thing to consider is business fundamentals. We have seen companies like Paytm and Eternal go through big drawdowns on their share price. But the question is whether the business is doing well or not, and seeing strong business fundamentals continues to give us the confidence to hold on to the shares,” adds Mridul.

Also Read: Why IPOs present more than an exit opportunity for startup investors

The decision to continue to hold shares in an IPO-bound company for Elevation Capital depends on multiple factors—whether the company is still a strong player in the market, whether the founders are motivated to run it for another 15 to 20 years, and whether the business has significant moat so that it continues to compound.

As companies in India continue to list much earlier than their peers in the US markets, the runway for these companies to compound is longer—driving value for its investors. “This is why listing is a preferred route to exit in India as it also benefits the public shareholder,” says Mridul.

Industry experts also believe that some consumer-focussed new-age businesses are not an attractive proposition for private equity investors to come in, and offer an exit to the venture capital funds. This leaves the venture capital investors holding on to large stakes in these businesses, and an IPO offers the best route for an exit.

The M&A (mergers and acquisitions) market continues to be shallow, with challenges in price discovery for the company being sold. “We are hopeful as some of the tech companies reach the size and scale where they can be more aggressive in acquiring some of these companies. There are examples like BigBasket and Caratlane for us to see. Hopefully, it gives confidence to scaled-up tech companies and traditional large companies to do more of these acquisitions,” says Mukul.

Early-stage investors help co-build Abhiraj Singh Bhal, co-founder and CEO of Urban Company, says early-stage investors have a clear role to play beyond providing capital. “Their role is that of a strategic thought partner, helping the founder think through the company’s building, especially through some of the early pivots and business operating models,” says Bhal.

He adds that Elevation Capital, which came on board as an investor in 2015 along with venture capital firm Accel in its first institutional round of funding, has helped Urban Company navigate these challenges well. “Ravi Adusumalli (co-managing partner at Elevation Capital), who was on our board for a long time until we went public, played a shaping role in the strategic thinking around the readiness to go public. He was, for me, the right sounding board on whether we were ready to go public or not, and a nod from him was a big tick against my own checklist for doing an IPO,” adds Bhal.

With each partner underwriting between one and three investments a year at Elevation Capital, the investments are high conviction bets and require significant time and capital commitment from the partner on board. To make it easier for early-stage startups to get over shared problems of structuring, hiring, Go-to-Market (GTM) challenges and others, Elevation Capital also invests heavily in ‘founder success teams’. “These are mostly subject matter experts within the fund and some consultants to the fund who work with founders in different areas such as GTM, PR, branding, hiring, design, finances and others,” say Vaas Bhaskar and Chirag Chadha, partners at Elevation Capital.

The firm has also seen some of its winning portfolio companies through key pivots. When Meesho moved from a re-seller-based ecommerce entity to selling directly to value conscious consumers through its platform, the decision was strongly backed by Elevation Capital.

“In 2021, the paper gains of Elevation Capital were significant. When we told the board about our decision to focus on consumer commerce company, Elevation Capital was supportive and put everything at risk. What I like about them is that they think like entrepreneurs,” says Aatrey of Meesho. He adds that Mukul, who is on Meesho’s board, said that the pivot would require a lot of capital and steered Meesho to raise its largest round of $600 million in 2021.

Similarly for Urban Company, Elevation Capital stood firm as it pivoted from a lead generation platform across broad services to building out a full-stack solution for key challenges. “In the early days, they (Urban Company) started with many categories and were mainly a lead-gen platform. They realised soon that they could not solve the problem of quality services and consumer trust. And so, they picked a few categories to go full stack. This is a result of being customer-focussed and long-term thinking and, as a fund, we try to do a lot of it along with the founders,” says Mukul.

After delivering multiple public-market success stories from its portfolio to the tune of $400 million in overall exits over the past five years, Elevation Capital seems to have formalised its strategy of long-term investments till IPO and beyond.

With its new $400 million Elevation Holdings, the firm plans to do more of the same for promising growth-stage companies. Through the fund, Elevation will back nearly 10 to 12 companies with an average cheque size of $25 million to $40 million. While the early-stage fund is exploring new areas with investments in clean tech, AI and health care, the holdings fund will largely focus on consumer tech and fintech investments.

The idea is to be a “sparring partner” for these growth companies, typically one to three years away from IPO. “A fund which comes in a year or three ahead of IPO is looking at the IPO as an exit event. What we are doing differently is that we are looking at an eight-to-10-year investment horizon even at that stage. Our view is that there is a lot of compounding ahead of them,” says Mukul.

The holdings fund will invest in portfolio companies as well as non-portfolio companies within the framework of founder-run category defining companies with proven unit economics.

As more new-age tech IPOs stack up in 2026, Elevation Capital’s strategy to drive multi-bagger exits from the public markets sems to be on an upward curve.

First Published: Feb 10, 2026, 11:50

Subscribe Now(This story appears in the Feb 06, 2026 issue of Forbes India. To visit our Archives, Click here.)