How Jaspal Bindra and the Centrum Group saw an opportunity in a broken bank

Relaunching the beleaguered PMC Bank not only throws a lifeline to its existing depositors, but also gives Centrum the scope to grow beyond an NBFC

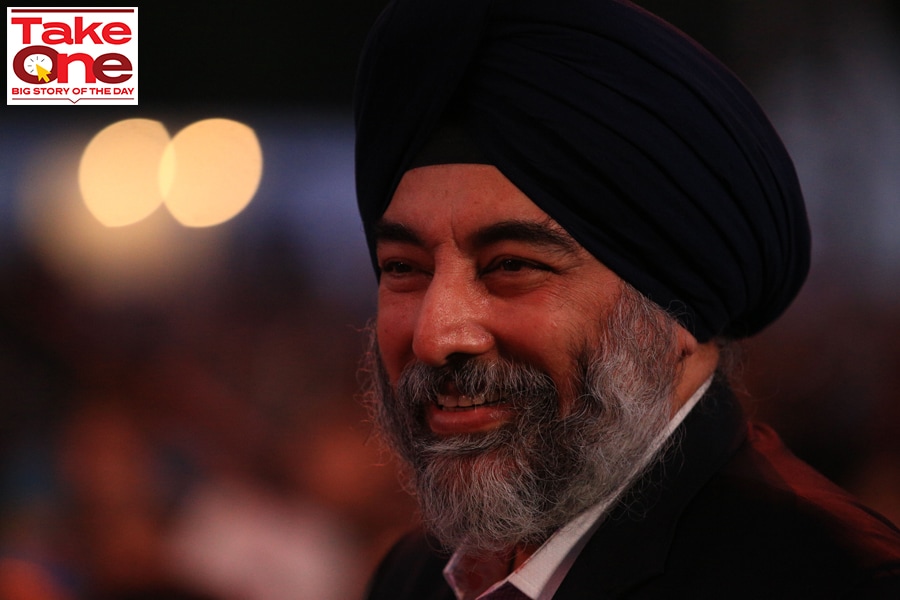

Jaspal Bindra, executive chairman of Centrum Group[br]

Jaspal Bindra, executive chairman of Centrum Group[br]

Jaspal Bindra knows the nitty-gritty of running a bank.

After all, the 60-year-old has spent a considerable portion of his life turning around the fortunes of banks in India and abroad during his nearly four-decade-long career as a banker. Once India’s global poster boy for banking—he formed a rather illustrious league with contemporaries such as Anshu Jain of Deutsche Bank and Vikram Pandit of Citibank—Bindra was responsible for the phenomenal success of Standard Chartered in India and Asia.

All that, of course, was much before he decided to step back, pack his bags and come back to India, to settle in Mumbai and be with his son Amritpal, whom he had begun missing dearly. Bindra hadn’t lived in the same city as his son for 14 years, and was longing for time with him. It helped that he knew Amritpal was, most certainly, making Mumbai his forever home, and a nudge from his wife only made things much easier.

Amritpal, Bindra’s only son, is a movie maker and producer, having written and produced shows, including Bang Baaja Baaraat and Bandish Bandits, and co-produced the Netflix original Love Per Square Foot, among others. “In hindsight, he was instrumental, and equally his mother, who wanted to have as much of him as she could," says Bindra, about his move to India in 2016.

Today, it’s that call, taken five years ago, that has come to possibly redefine his legacy and propel him into the annals of India’s banking history. Not that he desperately needs the recognition but a chance to build a bank within India is the stuff dreams are made of. And particularly so, when it involves turning around a shattered bank.

That’s because, on June 18, the Mumbai-based Centrum Group, of which Bindra is the executive chairman, said that it has received an in-principal approval from the Reserve Bank of India (RBI) to take over the troubled cooperative lender PMC Bank, and re-launch it as a small finance bank. Centrum Group will become the first small finance bank in nearly six years to be given permission by the RBI to do this.

Centrum had joined hands with New Delhi-based BharatPe to take over the crisis-ridden Punjab and Maharashtra Co-operative (PMC) Bank, which has been stuck in a quagmire for over two years after the RBI stepped in, following large-scale fraud at the bank, affecting some 9 lakh depositors. The RBI took control of the bank in September 2019 after serious allegations of money laundering, involving fictitious assets that funneled more than Rs 6,700 crore in the form of loans to Mumbai-based HDIL. Over 150 people have reportedly lost their lives after deposits came stuck, as the RBI imposed restrictions on withdrawals following a liquidity crunch.

“I think I"ve had sufficient experience over the years," says Bindra, about his decision to return to the banking sector. “I felt like it was something I could do, and for the right reason. Many of the mergers and acquisitions around the world get done for ego satisfaction because you want to have a bigger empire under your leadership."

In Centrum’s case, however, Bindra knew that an acquisition, and eventually growing into a bank, was the only way out. Set up in 1997 by Chandir Gidwani and Khushrooh Byramjee, Centrum is an integrated financial services firm, with a presence in corporate finance, wealth management, equity capital markets, debt execution, institutional broking, NBFC, and investment banking services. The company is present in 142 cities in India and counts over a million retail customers.

“The only debate we were having was whether we were doing this just because we want to be a bank," Bindra says. “But, actually, we"re doing it for survival. And, when you can pinpoint that reason and say, if we don"t do this it would be quite difficult for us to scale, then it makes sense. We could have been happy as a small NBFC also, since our intent was always to scale but we realised this is a necessity."

Apart from Bindra and Centrum, other bidders for the beleaguered PMC Bank included British businessman Sanjeev Gupta"s Liberty Group and Surinder Arora of Ideal Group. PMC Bank had invited Expressions of Interest from investors for equity participation for its reconstruction in December 2020.

Building his legacy

For Bindra, the opportunity to set up a small finance bank provides an opportunity to rewrite his legacy and, of course, expand Centrum into newer frontiers.

Soon after moving to Mumbai for good, Bindra had two choices ahead of him: He could either lead a semi-retired life at 55—much like many of his colleagues who had joined boards of companies that allowed them to travel—or swing back into action, thereby looking to cement his legacy. But a semi-retired life was never on the cards, and Bindra met with some of India’s top bankers, including KV Kamath, the former chairman of ICICI Bank, Deepak Parekh the chairman of HDFC, and Uday Kotak, the managing director and CEO of Kotak Mahindra Bank. “That’s when Centrum came along," he says. “Centrum, I felt would provide me with an opportunity to leave a legacy, which I couldn’t at an HDFC or an ICICI. I knew I had to be in financial services."

This meant partnering with Chandir Gidwani, the founder and chairman emeritus of Centrum Group, where he went on to buy a significant stake to become executive chairman. Today, along with Gidwani and the Byramjee family, Centrum"s founder promoters, Bindra owns a combined 60 percent of the holding company Centrum Capital, through various companies. Late Khushrooh Byramjee"s wife Mahakhurshid and son, Rishad are also on Centrum Capital"s board.

“We were very clear back then that banking was the future, and I told Chandir that if he wasn’t open to lending, then obviously there was no merit in me being his partner," Bindra says. “If you don’t have a growth momentum, you don’t get the best results, best motivation, or the best talents. We agreed on day one that we are going to introduce lending at the right time. But to get the capital for that, the money change business was something we could not sustain for too long at the margins that we were used to."

A few years later, the group sold its money exchange business, Centrum Direct, to US-based Ebix Inc, for Rs 1,200 crore, and used the proceeds for the lending business that it was busy building. Centrum entered the lending businesses in 2017, and was focussed on providing affordable housing finance, microfinance, and loans to SME’s and MSME with an asset size of over Rs 2,000 crore.

“So three and half years ago, when we initiated lending, we were very clear that we would like to one day be licensed as a bank," Bindra says. “In that process, we aimed to build organically to some size and scale before we would tap RBI for a license." At that time, NBFCs were a lucrative business and were flush with funds. The company also acquired L&T Financial Services’ supply chain-lending business that had a Rs 1,220-crore loan book to ecommerce companies, among others.

“At that time, it was kind of a good space to be in," Bindra says. By mid-2018, however, the scenario changed, and NBFCs weren’t lucrative anymore, as the country’s NBFC crisis unfolded as a result of defaults at IL&FS and DHFL, triggering a wider slowdown of the economy over the next few months. “Once that happened, we realised that scaling up as an NBFC might be a bigger challenge than we had anticipated when we started."

But, even then, Bindra wasn’t ready to let go of his ambitions. “By mid-2019, we concluded that a pure NBFC play won"t get us very far," he says. “And the missing piece was the deposit franchise. Without that, the aspiration or objective that we had in mind was going to be quite far away." To get a deposit license, the company did look at acquiring some NBFC’s that already held a deposit license, before Covid-19 derailed its plans.

Around the same time, Mumbai-based PMC Bank—it had 137 branches across seven states, of which 81 were in Mumbai, Navi Mumbai, Thane, and Palghar regions of Maharashtra—was neck-deep in trouble. Of its total loan book of Rs 8,383 crore, as of March 31, 2019, over 70 percent was given to real estate firm HDIL. Investigations later found that the bank had been allegedly running fraudulent transactions for several years, through fictitious accounts, to help HDIL. Soon, the RBI imposed restrictions on deposit withdrawals and superseded the board. At that time, PMC Bank had Rs 11,600 crore in deposits.

PMC Bank depositors protest outside PMC bank at Poonam Nagar, Andheri, on October 9, 2020 in Mumbai, India. Photo by Satyabrata Tripathy/Hindustan Times via Getty Images[br]

PMC Bank depositors protest outside PMC bank at Poonam Nagar, Andheri, on October 9, 2020 in Mumbai, India. Photo by Satyabrata Tripathy/Hindustan Times via Getty Images[br]

The crisis at PMC went on for a little over a year, when the RBI invited Expressions of Interest to acquire the bank, following which the new promoters could convert the bank into a small finance bank (SFB). SFBs are a specific category of banks that provides banking activities to underserved sections, including small business units, small and marginal farmers, micro and small industries, and unorganised entities. Like other commercial banks, they can undertake all basic banking activities, including lending and taking deposits.

“It was quite messy, the way they were running the institution," says Bindra, about the crisis at PMC Bank. “But, we realised that the RBI was really serious about the plan and not bureaucratic about it. They wanted an outcome. That’s why, when the restructuring opportunity presented itself, we said we"ll take a harder look at it than maybe some others did."

On their part, Bindra says, the speed at which Centrum responded to the situation was critical in clinching the deal. The group had three weeks to make a bid. “We made a binding bid, which the RBI appreciated and we also had a 24-hour turnaround time, “ he says. “There was no query that didn"t go unanswered, and then some things took a little longer just because of the nature of the requirement. But everything was answered within 24 hours. Most things were delivered in a matter of days, not even weeks."

Centrum partnered with BharatPe largely because the latter can divert a significant portion of its business to the bank, apart from the technology platform, and capital “Since our larger objective was to scale, this was a wholesome complement to what we were planning to do," Bindra says.

All this means Bindra is quite clear about where he wants to be in the near future. “The eventual plan is to go the full distance," he says “Directionally, an SFB is still a logical [step forward]," he says. This means, over the next few months, his new bank will be in direct competition with larger players such as AU Small Finance Bank, led by new billionaire Sanjay Agarwal, Ujjivan Small Finance Bank, led by Nitin Chugh, and Equitas Small Finance Bank, led by PN Vasudevan.

AU Small Finance Bank’s loan book now stands at Rs 33,000 crore and the market has priced its stock at nearly seven times the book value, taking its market capitalisation to around Rs 33,000 crore. AU plans to continue to grow aggressively across its three business lines—lending for vehicles, small businesses, and home loans.

But FY21 has been rough for SFBs, where the acceleration of growth in the loan book slowed by March 2021 and gross NPAs increased. But this is expected to improve in the coming quarters, as business activity normalises further and loan disbursement improves.

Bindra, meanwhile, will have the advantage of seeing how 10 other SFBs fare in the coming years, before being eligible to apply for a universal bank license. The RBI mandates that an SFB completes five years of operation before applying for a full banking license. AU and Ujjivan have already made public their intentions of doing so soon.

“We will see how the other SFBs fare while graduating to acquire a universal banking license," Bindra says. “We will have somebody to learn from by the time our turn comes. But we will take it. A universal bank in India can offer retail, wholesale, and investment banking services to a range of customers. The main advantage of being a full-fledged bank is that the cost of funds for a bank is much lower than that for an NBFC like Centrum Capital, in its current state.

Gearing up for the fight

Bindra is conscious of the fact that the new bank will need to acquire a “regulatory culture". An SFB has a few more regulations, such as the cash reserve ratio (CRR) and the statutory liquidity ratio (SLR) to maintain, in compliance with RBI guidelines. “Over the past three to four years, we built in a credit culture from just having a fee-focussed culture. Now we will acquire a regulatory culture," he says.

A new technology platform will be acquired for the new bank, which goes just beyond “creating an internal IT group". The new bank is likely to adopt the Infosys Finacle platform for digital banking processing—which is what PMC was already using—for the liability side of the business. Partner BharatPe also has a proprietary platform for the asset side of the business and MSME lending. At some point, the bank might consider merging the two platforms or shifting to a cloud-based platform.

Centrum is financially strongly placed as it moves to create the new bank. Once the bank is ready to operate, on day one, it will bring in Rs 250 crore in cash and an additional Rs 250 crore in non-cash forms. As the NBFC’s business shuts down and gets incorporated into the new bank, Bindra is confident of continuing to bring in additional capital through the valuation of the NBFC business into the bank. With a current 100 percent holding in the new bank, the promoters’ contribution will—as per RBI’s guidelines—need to be diluted to 40 percent, after one year of the bank’s operations. “So we will have enough liquidity, once we make this divestment of around 60 percent," Bindra says.

The biggest challenge will be to allay the fears of many irate PMC old-time depositors’ who desperately seek access to their money. Bindra hopes to have the bank operational in the next 120 days, after notification of the amalgamation scheme from the RBI and approval from the government thereof. “PMC merging with Centrum will only take a few weeks then. Once merged, we can give depositors access to their money. But access to one’s full deposits will not be possible on day one it will be staggered," he says. The limitations on access to deposits will depend on what the RBI scheme dictates.

“We completely understand that there is a trust deficit between the PMC depositors and the PMC bank. And I don’t blame them, because of the past irregularities. Some may pull out funds to deposit into other banks," Bindra says. “We will offer our candidature—that we are different, have a strong track record, and no burden of the old PMC management." Reports say that the PMC administrator AK Dixit has received 1,229 applications for withdrawal of deposits. As the amalgamation scheme gets approved and the new bank is set up, depositors are expected to appeal to a court for claims and relief.

Bindra will need to attract depositors by offering high-interest rates on deposits, as other SFBs have done recently. Jana Small Finance Bank offers 7 percent interest for a one- to three-year fixed deposit, and 7.25 percent for a three- to five-year deposit. Suryodaya Small Finance Bank offers 6.75 percent for a three- to five-year deposit.

Bindra may not acquire centrestage in the new SFB, but will be a whole-time director and board member. The bank will appoint an independent chairman, and managing director and CEO from outside the Centrum-BharatPe partnership. The name for the new SFB is also being worked out, and is expected to be fixed in the next three to four weeks.

Analysts tracking Centrum say the stock is likely to get rerated soon, once valuations for the Centrum businesses are clearer. “The PMC business has come in handy for Centrum," says Kranthi Bathini, chief market strategist at WealthMills Securities. There are benefits for both parties: Existing PMC customers will be reassured by the change in the bank structure the new banking license will give Centrum the extra edge to grow at a much faster pace and increase their reach, while offering new innovative products. “Centrum has the tools but not the raw material. Now they will acquire the reach through PMC," adds Bathini.

After all, Bindra knows a thing or two about running a bank, and that too rather successfully. And, India’s global poster boy for banking will definitely be looking to make his homecoming count.

First Published: Jun 22, 2021, 14:29

Subscribe Now