IDBI Bank: Time to revisit its vision

IDBI Bank has exited the PCA framework with its brand value intact. But it needs to restart its growth engine to succeed as a turnaround bank, and make money for primary investor LIC

Rakesh Sharma, MD & CEO, IDBI Bank Image: Neha Mithbawkar for Forbes India[br]

Rakesh Sharma, MD & CEO, IDBI Bank Image: Neha Mithbawkar for Forbes India[br]

What does a turnaround bank need to do right to ensure sustainability in earnings? This is the critical issue that the management of re-classified private sector lender IDBI Bank faces, after emerging from an arduous four-year period, during which its endurance was tested by the Reserve Bank of India (RBI).

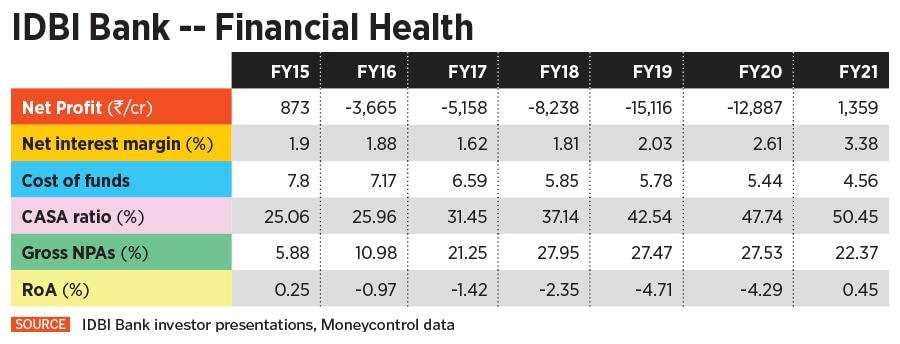

For nearly four years, profitability and managing asset quality were major challenges for IDBI Bank, which forced the RBI, in May 2017, to place it under the Prompt Corrective Action (PCA) framework. This meant restrictions in lending, business expansion and accessing costly deposits. In March this year, the bank was freed from these restrictions, and also showed full-year profits for the first time in five years, in its latest March 2021 earnings. All the IDBI group subsidiaries reported profits.

These are massive kudos for the bank’s management team, led by its managing director and CEO Rakesh Sharma, which succeeded in lowering costs, sale of non-core assets, increasing interest income and recoveries in non-performing assets, thus boosting the bank’s financial health.

But bigger challenges for the bank—in which Life Insurance Corporation (LIC) holds a majority stake–are appearing now. It will be in a position to grow its business, but is looking into a future that is uncertain, and yet resourceful.

The next 12 to 18 months will also determine whether LIC will be able to reap any benefits from the investments it has made in IDBI Bank since 2018. Any exit at current levels will only result in losses for the insurer.

“Now the bank’s business will be as usual, and we will be able to grow the business," says Sharma. When the bank was under PCA, it had no option but to focus on retail banking, considering the restrictions on taking high-cost bulk deposits. IDBI Bank’s percentage of bulk deposits to total deposits has been consistently falling, to 11.62 percent in March 2021 compared to 33.3 percent three years ago.

On the asset side, the bank focussed on growing its current and savings account (CASA) book—it is now at a healthy 50.45 percent—which it had been strengthening systematically even between 2013 and 2016 (see table), after being hurt in previous years from exposure to massive corporate lending.

Thanks to legacy, when IDBI, the development finance institution, was transformed into a bank in 2004-05, its work culture was still geared to assist entrepreneurs or restructure debt of troubled companies it had lent to, rather than “call in advance". Even after the global recession, IDBI was seen as a sound corporate lender to companies that had moved into high growth areas of roads, power, infrastructure, telecom and aviation expansion. The problem was that IDBI Bank’s lending limit per corporate was always very close to the regulatory cap.

Sluggishness in the economy and the inability to repay loans saw a rise in non-performing assets (NPAs) in the books of lenders, and the then RBI governor Raghuram Rajan called for an asset quality review (AQR) of banks in 2016, which revealed under-reporting of NPAs in some cases. IDBI Bank was later downgraded by ratings agencies due to a high gross NPA level of 27.9 percent by March 2018, by which time it was already placed under the PCA.

From the Archives | RBI announces fresh liquidity measures for banks, aid for small borrowers

Calibrated expansion…

Now that the restrictions on the bank have been lifted, its focus will continue to be on corporate lending. “We will go forward in a calibrated way," says Sharma. The bank has formalised its risk management policies in recent years, to indicate that there will be no high exposure in a particular unit, and fresh advances will be determined by the ratings allocated to the firm by external credit rating agencies.

In the past, IDBI Bank’s concentrated exposures in corporate lending, particularly power generation and roads, had caused it grief. “Now we have granualised our risk weightages further. For a new AAA-rated customer, the bank can take an individual borrower exposure of Rs 800 crore [as per the RBI’s risk weightage norms for corporate loans], and a maximum exposure of Rs 160 crore [1 percent] for a BBB-rated customer," says Samuel Joseph, deputy managing director, IDBI Bank. The bank’s tier 1 capital was at Rs 20,570 crore in March 2021.

To avoid indiscriminate exposure within sectors, it has divided lending opportunities based on grades and ratings. Engineering, procurement and construction (EPC), shipping, gems and jewellery, are placed as a ‘highly cautious’ category commercial real estate, power generation and mining as ‘cautious’ NBFCs, textiles, trading and paper as ‘selective’, and pharmaceuticals/drugs, cement, power transmission and distribution as ‘normal’.

To avoid indiscriminate exposure within sectors, it has divided lending opportunities based on grades and ratings. Engineering, procurement and construction (EPC), shipping, gems and jewellery, are placed as a ‘highly cautious’ category commercial real estate, power generation and mining as ‘cautious’ NBFCs, textiles, trading and paper as ‘selective’, and pharmaceuticals/drugs, cement, power transmission and distribution as ‘normal’.

Exposure will also be based on credit ratings: A ‘highly cautious’ category requires a minimum rating of A+, ‘cautious’ a minimum rating of A-, ‘selective’ a rating of BBB, and ‘normal’ category of BBB (-). All these categories and ratings are data-driven, and redrawn each quarter by the risk management team. Joseph is confident that the bank will not make “concentrated exposures in companies", going forward.

Though the bank’s gross NPA levels are still high, at 22.37 percent in March 2021, slippages have been kept under 2 percent, at Rs 2,382 crore. In the lending book, IDBI Bank’s retail:corporate ratio in gross advances improved to 62:38 in March 2021, from 56:44 a year earlier.

The bank now targets an 8 to 10 percent growth in its both mid-corporate and large-corporate loan book, and around 10 to 12 percent growth in its structured retail assets, 94 percent of which is concentrated on home loans and loan against property. The balance, 6 percent, comprises auto, education and personal loans.

...but pressures remain

One of the critical issues for the bank will be to grow the asset side of the balance sheet, through the loan book. Much of IDBI’s retail lending is concentrated on mortgages and loan against property (LAP). “It will not be able to survive on a single-type product," says SKV Srinivasan, a former executive director at IDBI Bank who helped strengthen its retail banking focus in recent years. “The bank will need a strategy, since on the cost side, income side, and asset side there are pressures."

Kranthi Bathini, equity strategist at WealthMills Securities, says IDBI will need to re-visit its vision. “They will need to structure their business strategies better to become a customer-preferred bank. This will mean increased spending on technology to compete with rivals, and the ability to stay nimble to utilise evolving business conditions better."

There will always be an appetite for credit in India. How well IDBI Bank will take advantage of the timing remains to be seen. “The bank is in a transformational stage at the moment, and needs to enhance product positioning and take advantage of interest rates cycles," Bathini adds. This would mean not just evaluating newer products in the space of commercial vehicles, personal loans and credit card loans, but also raising rates on existing products.

From the Archives | Tech & small towns: StanChart"s India game plan?

Srinivasan believes that the bank’s net interest margin (NIM) might not remain at the current level of 3.38 percent, and might come under pressure in coming quarters. The bank’s NIM is close to that of other private sector lenders, such as Axis Bank and ICICI Bank, but lower than HDFC Bank and Kotak Mahindra Bank. Srinivasan suggests that even a lower NIM of 2.5 percent to 2.8 percent would be acceptable in the current scenario.

The bank will be in a position to recommence lending to BBB- and higher-rated corporates, backed by the presence of LIC. This has also helped the bank maintain a ‘sticky’ CASA, which would help to ensure that NIM levels do not fall drastically. “Partnering with channel partners to sell third-party products such as general, life and health insurance for LIC, Tata AIG and Max Bupa have helped the bank ramp up business," says Suresh Khatanhar, deputy managing director, IDBI Bank. He adds that products are being developed in the auto, gold and SME segments also.

To ensure stickiness, a bank must ensure that it retains accounts from which customers pay for their home loans or EMIs. But analysts say IDBI Bank’s liability customers are not their asset side customers. The bank’s CASA—which is impressively high at present—is likely to remain stable at the 45 to 47 percent range, which would be in line with the management’s perception.

One of the areas the bank will need to focus on is its digital presence. It has lost ground over the past three years, having been unable to enhance its portfolio to service micro- and small businesses. This will need to be done through digital lending, where some private lenders and several fintech companies such as Capital Float, Clix Capital or LendingKart have built their presence. “IDBI needs to assess whether it is going to use digital banking as a channel or just a service it wishes to offer to customers," says another analyst with a private securities firm, on condition of anonymity.

LIC’s wait continues

Investors—and not just the bank’s management—will eye IDBI Bank’s growth story from here on. The government and LIC have indicated their wish to exit IDBI Bank and hand over management control to a new buyer. But this is unlikely to happen in a hurry, as the sell-off is likely to be done in phases. LIC has a 49.24 percent stake in the bank while the government has a 45.48 percent stake.

LIC’s total investment in IDBI Bank, through its various tranches in 2018 and 2019, is Rs 26,367.15 crore. It is estimated that these were done between Rs 55 and Rs 61 per share. With IDBI Bank stock priced at Rs 38.6 at the BSE (as on May 25, 2021)—a 96 percent jump from a year ago—the insurance giant’s investment value is still down 22 percent from the price it invested at, if it were to exit at this stage.

Chances are that it would sell a 5 percent stake ahead of its IPO, which, in all likelihood, will be in FY22. The insurer will also need to disclose at that time the roadmap it has in mind for exiting IDBI Bank. LIC declined to comment on the matter when Forbes India contacted it.

From the Archives | LIC IPO: No assurance ahead

“I don’t think the government or LIC will be in a hurry to dilute their stakes in IDBI Bank in the current fiscal. They will obviously seek a better valuation from their investment, which could gain as the macro-business conditions improve," says Bathini of WealthMills.

Investors such as International Finance Corp, the investment arm of the World Bank, and CDC Group, the development finance institution of the UK government, had done their due diligence for IDBI Bank prior to LIC’s decision to pick up the stake, but is not clear if they are still interested in buying a stake in the bank. The names of India’s largest lender, State Bank of India, and fintech giant Paytm are doing the rounds as interested suitors for IDBI.

Even as LIC might exit the bank in phases, it is unclear whether the new buyer may be able to acquire management control in the coming years. The new buyer will also need to bring in fresh capital for growth. The RBI will decide on the ‘fit and proper’ criterion for a new buyer. The government and the Department of Investment and Public Asset Management (Dipam) will decide on the divestment structure and timing.

Sharma is clear that his role is to take care of the bank’s performance, stakeholders and staff. “My role is to improve the performance of the bank," he says. Sharma and his team have done one half of the job well by bringing the bank out of trouble. He has nearly 10 more months—his tenure as MD and CEO of IDBI Bank ends in March 2022—to tie up other loose ends, which include ensuring that the bank’s bad loans situation improves and creating strategies to drive income higher.

Then only will its parent LIC be satisfied.

First Published: May 26, 2021, 09:04

Subscribe Now