The company’s exit from India is part of the group’s plan under a new CEO to direct investments and resources to businesses in four key locations where it foresees huge scale and growth potential. That includes Singapore, Hong Kong, the UAE and London, and as a result it will exit its consumer banking business in 13 markets including Australia, Bahrain, China, India, Indonesia, Korea, Malaysia, the Philippines, Poland, Russia, Taiwan, Thailand and Vietnam.

The exit is also rather reflective of the intense competition which even giants such as Standard Chartered and HSBC face in India, while taking on domestic heavyweights such as HDFC Bank, ICICI Bank or even Bajaj Finance, in the consumer banking segment, with a range of products to offer across its massive retail franchise nationwide.

“As a result of the ongoing refresh of our strategy, we have decided that we are going to double down on wealth,” Jane Fraser, the newly appointed CEO of the company said in a statement. “We believe our capital, investment dollars and other resources are better deployed against higher returning opportunities in wealth management and our institutional businesses in Asia.”

![citi graphics1 citi graphics1]()

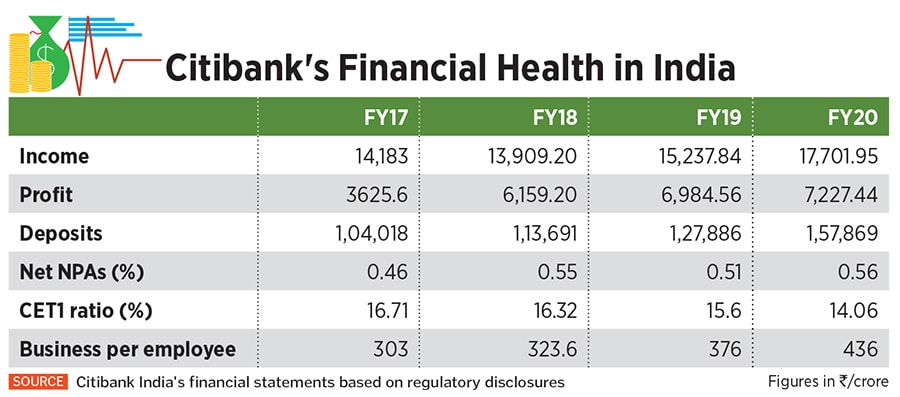

The banking giant will meanwhile not sell its wealth management and institutional business which earns the bank significant income in fees. For the fiscal year ended March 31, 2020, Citibank India reported a net profit of Rs 4,918 crore.

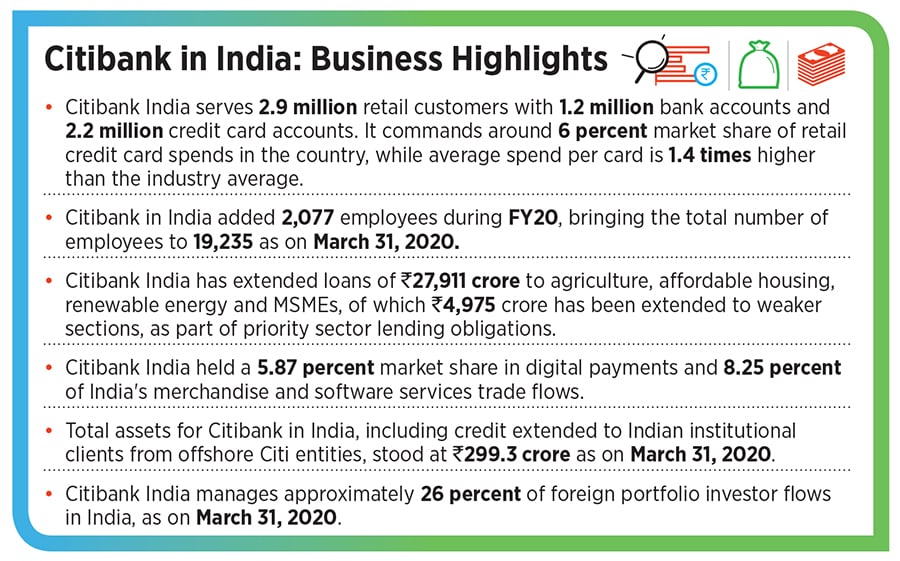

“India is a strategic talent hub for Citi,” Ashu Khullar, the CEO of Citi India said in a statement. “We will continue to tap into the rich talent pool available here to continue to grow our five Citi Solution centers which support our global footprint. There is no immediate change to our operations and no immediate impact to our colleagues as a result of this announcement.”

So why the pull out?

A fair question to ask. But the debate of how foreign banks face up in consumer banking has been an ongoing debate for many years.

In 2013, when consultancy firm PwC surveyed 32 foreign banks on the market environment, strategy and growth and the pace of technology, which had not reached where it has today, it had found out that there was no level playing field for foreign banks with its Indian counterparts unless they adopted the wholly-owned subsidiary route.

That would have helped them increase the depth of business and branches in India. “Due to the local branch regime and the operating model of choice, foreign banks have, for the large part, remained niche players, focussing on trade finance, external commercial borrowing, wholesale lending, investment banking and treasury activities,” the PwC report had said. “Some large foreign banks have focussed on capturing the retail market but have remained confined to the high end of private banking and wealth management, while a few others have created valuable niche offerings in the areas of transaction banking, cash management and remittance products.”

While Citibank and others did not do that, Singapore-based DBS did that, and is today one of the fastest growing Asian banks in India, notwithstanding its recent acquisition of Lakshmi Vilas Bank.

In contrast, Citi has been seeing its business slide, even though its balance sheet numbers have been growing. In 2012, Citibank had a 21 percent market share in the Indian credit card market, in addition to a 30 per cent share in e-commerce spend. Back then, the company was the second largest in the credit card market, a position that fell to sixth by 2020, while market share slipped to around 6 per cent.

“Citibank has innovated a lot for the Indian banking industry,” Harshil Mathur, co-founder and CEO of fintech unicorn Razorpay, told Forbes India in an interview. “They were among the first to offer online banking in a big way in India. Their credit card product has been one of the best in the market for a while. Many of their initiatives changed the Indian banking ecosystem.”

While Citi began operations in India in 1902, the company forayed into consumer banking in 1985 and built up a portfolio of credit cards and loans. “Citi is among the pioneers of India’s retail banking,” says Srinath Sridharan, independent markets commentator and an expert in the Banking and Financial Services Industry. “But somewhere along, they stopped developing new retail products which could cater to the larger middle-class segment. That meant that the India business did not grow to the scale they had aspired to.”

![citi graphics2 citi graphics2]()

Along the way, the early 2000s also saw the rise of India’s private sector banking, led by companies such as HDFC, ICICI Bank and even government-owned State Bank of India. “Even though the bank had remained an aspirational one for Indian customers, the rise of Indian banks meant that Citi turned its focus to the higher end of the customer spectrum. Even there it faced stiff competition from the other foreign players like Standard Chartered or DBS, and home-grown banks like Kotak and HDFC,” adds Sridharan.

Then, there is also concerns in the global business that may have led to the bank to shift focus away from the Indian market. Last year, Federal banking regulators fined Citigroup some $400 million and ordered Citigroup to fix its risk-management systems, citing “significant ongoing deficiencies”.

"As far as the India business goes, we have seen similar situations being played out in the past with other foreign banks," says Sreedhar Vegesna, Partner and Leader - Financial Services at professional services firm, PwC India. It is difficult to structure a scalable business in retail. Even when it comes to the rural customer, it has rarely been the forte for the foreign players.”

Citi’s plan to exit its retail business also follows a similar trend involving foreign banks who have been busy exiting their business in India. Much of that has to do with the high capital and regulatory requirements in India. Among others, over the years UK-based Barclays, Deutsche Bank, BNP Paribas, HSBC and Standard Chartered have curbed their operations in India, while UBS, JPMorgan, ING and Goldman Sachs have surrendered their banking licences. Only DBS has been an exception with the Singapore-based company having found success in penetrating the Indian market largely due to their ability to focus on small ticket retail banking.

“It is a smart decision where resources and capital can be better used, to give better results,” a former senior executive at Citibank told Forbes India. “If I were in Jane Fraser’s place I would have done the same. It makes a lot of sense.”

Vegesna adds: ”Could things have been different if foreign banks would have taken the wholly-owned subsidiary (WOS) route, rather than the branch route? Perhaps not, because it would have meant a lot more stipulation on priority lending and rural lending. But agricultural lending is generally not in their DNA."

What happens now?

This can be answered in two parts. For Citibank, the focus will shift entirely towards their corporate book. The question will be what stipulations the Reserve Bank of India might want them to have, in rural banking, to stay fully licenced in India. That will also mean other foreign banks such as Standard Chartered Bank and HSBC will likely try to consolidate their position as foreign banks in India. The opportunities arise for the smaller banks–both Indian and foreign–who are looking to scale up their retail business.

That means, from the consumer banking side, Citi’s exit from the business is expected to raise the floodgates for Indian banks and NBFC’s who are looking to expand their business in India.

There will be players which could gain in terms of market share. Possible suitors are also being identified by bankers and auditors for Citibank India’s consumer banking business. “Private banks and credit card companies like SBI Cards can be key beneficiaries of market share gains in the credit card segment. Some smaller private banks might be interested buyers of the India portfolio as they are looking to scale up in the segment. Foreign banks might also look to expand their presence,” wrote Prakhar Sharma, Parameswaran Subramanian and Bhaskar Basu of Jefferies in an April 16 note.

The names of some Indian banks such as IDFC First Bank, IndusInd Bank, Kotak Mahindra Bank and DBS, which operates through a WOS in India, are also emerging as suitors. “I feel that either an Indian bank or DBS will buy this portfolio. It will have to be a smaller bank which has ambitions to grow big," says a former HSBC banker, on condition of anonymity.

“This could be a fantastic opportunity for DBS India. They have a similar clientele. If I am on the buy side of the deal, that is the first bank I would go to,” another industry insider says.

DBS has fared well in India, operating with similar values as Indian banks. In addition, the acquisition of Lakshmi Vilas Bank has also highlighted the focus which it has towards retail banking in India. “Being well capitalised and having a strong Singapore-based parent, DBS India also brings the advantage of a strong digital footprint–all these factors are what Citibank and its team of bankers and lawyers will evaluate closely,” the insider adds.

Citi meanwhile is likely to finish off the sale by the end of the calendar year, which will be in line with the financial year in the US. However, it won’t be an easy one, especially since they wouldn’t want any regulatory concerns. That would mean at least six more months before a deal is signed.

“What these banks have is fantastic assets and there may be a lot of interest," adds Vegesna. With their remarkable customer experience, and a good customer base along with a decent online capability. It is likely to be a portfolio sale, but since buying these assets will not be the way for a license, the aspirants may be limited. We could also see interests from private equities.”

For a buyer meanwhile, the sale provides a massive opportunity. India’s retail loans are estimated to double up to Rs 96 trillion in the next five years as per a joint report by ICICI Bank and CRISIL. According to the report, the low cost housing and loan against property sector is expected to double to Rs 46.1 trillion in the next five years (FY24) while the unsecured lending sector is also expected to see substantial growth with personal loans and credit cards estimated to touch Rs 13.8 trillion in FY24.

“The era of large, centralised globalised banks is declining, and that’s not just Citi but across the world. It’s not just in India, it’s across the world,” Mathur of Razorpay says. “Fintech companies and local innovation are taking a share in serving the local customers much better, and this is just a reflection of that. Every market will see a lot of local players competing and building finance products ground up for the local ecosystem and that is the direction in which the world is going.”

With additional inputs from Harichandan Arakali

Pedestrians walk by a Citigroup Inc. bank branch in Mumbai, India. Image: Kuni Takahashi/Bloomberg via Getty Images

Pedestrians walk by a Citigroup Inc. bank branch in Mumbai, India. Image: Kuni Takahashi/Bloomberg via Getty Images