Sanjay Agarwal: Building ground up for the hinterland

With a net worth of $1.3 billion, Sanjay Agarwal debuts on Forbes's list of world's billionaires. His AU Small Finance Bank aims to be counted<br />among its larger peers over the next decade

Image: Mayur Teckchandani

Image: Mayur Teckchandani

By 2017, Sanjay Agarwal had spent two decades handing out automobile loans. While he admits the first decade had been slow, the venture grew rapidly in the next and was on its way to carving out an enviable niche as a non-banking finance company (NBFC). But the 50-year-old first generation entrepreneur who founded the company in 1996 as AU Financiers had seen first-hand the problems firms like his face when raising money. A lack of financing (and poor quality loan book) had proved to be a death knell for several peers.

At the same time, the mandarins at Mint Street wanted to further their pet cause—financial inclusion. Banking needed to be taken much deeper to small-town India, and while scheduled banks had pitched in over the last four decades, large swathes of Indians were still dependent on moneylenders and their usurious rates of interest. Enter small finance banks that were regulated by the Reserve Bank of India (RBI).

“We knew that NBFCs could never be a main platform as raising money is a challenge, professionals prefer to work for banks and borrowers will always go to banks first," says Agarwal. At the same time, AU Financiers had a two-decade track record of making loans and collecting on them. Agarwal raised his hand for consideration in 2017. In all, ten banks were licenced with AU Small Finance Bank being the largest (AU is the periodic symbol for gold). It was the only NBFC out of 72 applicants chosen by the RBI. “Suddenly a much larger field opened up for us," he adds.

Since it received its licence, AU has continued to prove its mettle and provided a case study in how smaller banks with the right systems and processes can grow rapidly. At a time when there is fierce debate on whether corporates should be allowed to run banks, it is entities like AU Finance and peers like Equitas, Suryoday and Jana, among others that have shown how it is possible to get more people under the banking net without increasing systemic risk. Importantly, these banks are modelled on raising liabilities from urban India and deploying them in an asset base in smaller towns and cities.

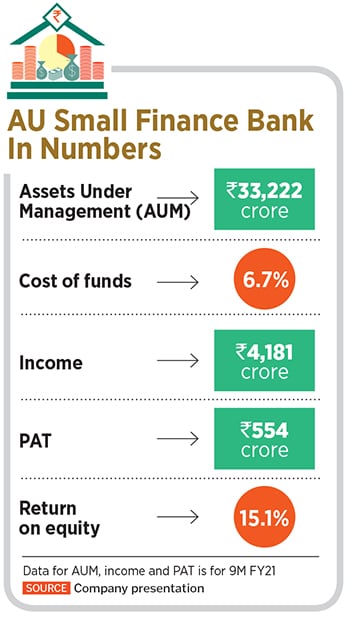

Since it was given a small finance bank licence in 2017, AU’s loan assets have more than trebled from ₹10,734 crore to ₹33,222 crore, and revenue has moved up from ₹1,280 crore to ₹4,286 crore, an annual growth rate of 35 percent. For now, bad loans are under check with net non-performing assets (NPA) of 0.2 percent. While this could rise once the moratorium ends [the RBI moratorium has ended, but NPAs will be disclosed only during the quarterly results that haven’t been announced yet], the bank insists the numbers are under control. In fact, the resilience of its book has given it the confidence to grow equally rapidly once the pandemic is behind us.

The potential for growth has catapulted AU Small Finance Bank to a market capitalisation of ₹33,700 crore ($4.4 billion), with Agarwal’s 28.8 percent stake worth $1.3 billion, making him a new Indian entrant on the Forbes Billionaires List. With 6 percent of the bank owned by employees, he’s also shared his wealth and recently set up a foundation donating 25,00,000 shares worth ₹260 crore. But Agarwal, who colleagues describe as a constant thinker and innovator, is not done. He has a vision to grow the bank to at least a ₹100,000 crore loan book in three to five years. Without taking names, he says he’s keen to be counted among his much larger peers.

The potential for growth has catapulted AU Small Finance Bank to a market capitalisation of ₹33,700 crore ($4.4 billion), with Agarwal’s 28.8 percent stake worth $1.3 billion, making him a new Indian entrant on the Forbes Billionaires List. With 6 percent of the bank owned by employees, he’s also shared his wealth and recently set up a foundation donating 25,00,000 shares worth ₹260 crore. But Agarwal, who colleagues describe as a constant thinker and innovator, is not done. He has a vision to grow the bank to at least a ₹100,000 crore loan book in three to five years. Without taking names, he says he’s keen to be counted among his much larger peers.

Starting Small

In 1995, after he became a chartered accountant, Agarwal decided he did not want to work for anyone else. The finance business was the closest to his qualification and after raising money from a few high net worth individuals, he started AU Finance in Jaipur. The initial years were tough and, after the CR Bhansali scam (in which lakhs of depositors and creditors were taken for a ride), funding dried up and several NBFCs ended up shutting shop.

Agarwal chose to stick it out and spent the next decade understanding the nitty gritties of the vehicle business. Credit behaviour fascinated him and he would look for patterns as to why people in certain regions or income segments paid their loans. Borrowers who used their cars, trucks and two-wheelers for their business were more likely to pay their loans.

As the loan book grew, systems and processes were set up and the organisation formalised. In 2012, Narendra Ostawal, now a managing director at Warburg Pincus, spent a day in Jaipur evaluating the company’s investment potential. The penny dropped when he saw the systems and processes that AU as a small firm had put in place. “Even back then, its execution and processes were geared to drive scale," he says.

For starters, it didn’t have senior management approving loans. Files were sourced from auto dealers and approved at the branch level itself. It would disburse the loan and make sure it collected the registration certificate from the vehicle owner in 30 days to reflect its name as a financier. The senior management kept a watchful eye, but didn’t get into individual loan decisions.

For starters, it didn’t have senior management approving loans. Files were sourced from auto dealers and approved at the branch level itself. It would disburse the loan and make sure it collected the registration certificate from the vehicle owner in 30 days to reflect its name as a financier. The senior management kept a watchful eye, but didn’t get into individual loan decisions.

On the other hand, it was more interested in market intelligence. Ostawal recalls a conversation with Uttam Tibrewal, executive director of AU Finance, who explained that he would never fund a General Motors model for the taxi aggregator segment. Those cars would be in the garage every few months on account of heavy usage, making the loans potentially turn bad. Warburg put in $50 million (about ₹300 crore) for a 27 percent stake in the company.

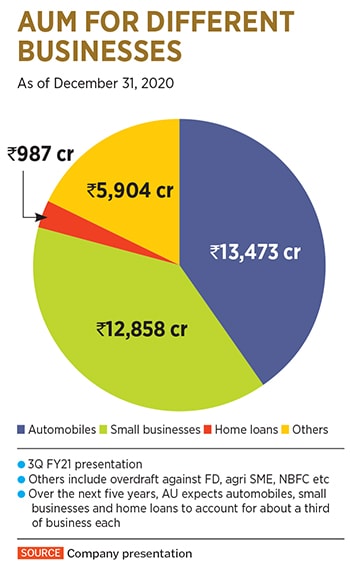

As the loan book grew to ₹4,000 crore in 2013, Agarwal noticed his existing customers asking for loans to fund their small businesses. These were small business owners with an annual turnover of ₹1 crore who earned between ₹10 lakh and ₹20 lakh a year. The problem for AU Finance was that they lacked information on the cash flow. Plus the collateral with AU, in the form of a depreciated vehicle, was not enough to finance another loan. But Agarwal knew the potential was immense and if owners were willing to offer security, AU was willing to lend. While its rates were higher than banks, they were lower than those charged by moneylenders and other informal networks these businessmen would otherwise borrow from. A third line of business in the form of home loans was also set up.

Becoming a Bank

As AU Finance grew, the assets on its books performed well. Loans were being doled out at north of 15 percent and collections were strong. Net interest margins were in the 5-6 percent range. There were times when the vehicle finance market went through a cyclical downturn, but bad loans never surged.

But Agarwal was aware of his constraints on the liability side. He knew that it was only NBFCs, with strong corporate parentage like Bajaj Finance or Mahindra Finance, that had managed to scale their book beyond ₹50,000 crore. Others had tried and fallen flat on their faces on account of expensive cost of capital that dried up during a crisis.

In 2017 when RBI invited applications for small finance banks, AU knew a new growth window had opened up. There were three conditions to meet. First, 25 percent of branches had to be in villages with no branches. Second, half of all loans should be lesser than ₹25,00,000. And priority sector lending requirements were hiked to 75 percent instead of the 40 percent that universal banks have to meet.

In 2017 when RBI invited applications for small finance banks, AU knew a new growth window had opened up. There were three conditions to meet. First, 25 percent of branches had to be in villages with no branches. Second, half of all loans should be lesser than ₹25,00,000. And priority sector lending requirements were hiked to 75 percent instead of the 40 percent that universal banks have to meet.

Most importantly, these banks could raise deposits with no conditions attached. Not only is the cost of deposits lower, but it is also easier to convince people to deposit money in a bank as compared to an NBFC. “Earlier we would start business from the asset side, now we start from the liability side," says Tibrewal. “We get customers to open accounts, understand their behaviour and then lend to them." AU’s low-cost current account savings account deposit base is 22 percent of the total deposits, taking its cost of funds down from 9.6 percent in 2017 to 7.2 percent in 2020 and opening up a potentially wider set of customers and businesses that it can lend to.

As things stand, AU plans to move pan-India from the 15 states it is present in to grow the three lines of businesses. Financing vehicles can be scaled up nationally as can lending to small businesses, which will be a major thrust. The ministry of micro, small and medium enterprises (MSME) has counted 634,000 MSMEs in India. Most of them lack access to formal credit. But as they start paying taxes, claiming GST input tax credit, they come into the formal economy and it becomes possible for bankers to make an assessment on their creditworthiness.

Recently, AU started installing QR code meters at the premises of businessman it lends to and said it could provide collateral free loans if their cash flows matched their declarations. Agarwal sees this as a huge growth area and has 100 chartered accountants analysing small business creditworthiness. Home loans, the third line, also has the potential to become big. In total, each of these businesses could account for a third each of the ₹90,000-100,000 crore loan book the bank expects to have three to four years.

As it prepares to apply for a universal banking licence in 2022, AU Small Finance Bank has moved quickly to offer products that are de rigueur at larger banks—credit cards, personal loans, UPI, tax filing and insurance, among others. Once customers open accounts, it plans to get them hooked on to a suite of lending products. A key thrust area will be digital banking. This would allow it to expand faster than the traditional branch-led model. Everything from opening accounts to speaking with relationship managers would be done over a secure banking channel. Customers are more accepting of transacting virtually due to the pandemic.

The challenge the bank has is in the rates it offers, which are higher than say, a State Bank of India or ICICI Bank, but as the cost of funds moves to 6 percent over the next year, Tibrewal believes it would be able to compete with the rates offered by larger banks while maintaining a net interest margin of over 5 percent. The bread and butter business would still come from vehicle financing, small businesses and housing finance, but here too it is clear that it won’t get into unsecured lending or microfinance in order to grow. “If we find the quality of growth lacking, we will slow down," says Agarwal. who is unwilling to sacrifice profitability for scale.

The Pandemic Test

In the last year, the bank and Agarwal faced their sternest test. In March 2020, AU was on track to clock ₹900 crore in profit for that year. But the loss in business in March reduced profitability by ₹200 crore. This coupled with a strict lockdown in April and May meant that collections suffered and there were questions on how many loans would turn bad.

In April and May 2020, the bank lost two-thirds of its market capitalisation and Agarwal admits that he was shaken. While he knew the bank would survive (it had survived the 2008 crisis), he realised that he needed to derisk his personal balance sheet. He had taken ₹200 crore as loan to fund his stock options and found that he had access to lower profits as well as no dividend payout for 2020 on account of an RBI stipulation to conserve capital. He decided to get rid of his loans in one fell swoop. He sold ₹200 crore worth of stock at close to the bottom of the market and is relieved that he is debt-free. “I don’t even have a home loan or car loan anymore," he says.

This period has also got Agarwal to think about how the bank needs to endure beyond his generation. He gets wistful as he talks about Italian banks from the Renaissance era or the 208-year-old Citibank. Similarly, Agarwal wants AU to endure and put in systems and processes to make it a board-governed bank that lasts for the next several centuries.

It is these systems and processes that could take AU Small Finance Bank to the next level. At its present multiple of seven times book value, the market believes it can continue to keep growing rapidly and has probably priced in too much. Ostalwal of Warburg Pincus who exited the stock in late 2020 hit a home run with a 40 percent annualised return in dollar terms. While there is reason to believe there will be no let-up in growth, returns for new investors may be lower from here on. Agarwal, who counts Deepak Parekh among his mentors, has no plans to take his foot off the pedal. “If we can’t do in 10 years what others did in 20, then this speed and agility that we have demonstrated over the last two decades will be of no use," he points out.

First Published: Apr 30, 2021, 10:41

Subscribe Now