Tiger Global Management’s $25 million investment in BitCipher Labs last week marked the first investment in an Indian crypto startup for the New York-based investment firm, which is famous for its early backing of Flipkart, India’s most successful startup. Bengaluru’s BitCipher operates one of India’s most popular cryptocurrency buy-and-sell exchanges, CoinSwitch Kuber.

While Tiger Global is known for backing many big tech names including Facebook, Uber, Airbnb, Stripe and Coinbase, in India, it is known for its investments in companies including Flipkart, Ola, Zomato and Byju’s. It has now added an Indian crypto startup to its portfolio. With Tiger’s investment, CoinSwitch’s valuation jumped five-fold to more than $500 million in just four months.

"As they build India’s leading cryptocurrency platform, CoinSwitch is well-positioned to capture the tremendous growing interest in crypto among retail investors. We are excited to partner with CoinSwitch as they innovate in this emerging asset class," Scott Shleifer, partner at Tiger Global, says in a press release on April 22.

CoinSwitch will use the money in three ways. First, to spread awareness about what crypto is and why it could be useful, because there are still many misconceptions about cryptocurrencies, Ashish Singhal, co-founder and CEO of the company tells Forbes India in an interview on April 24. Second, the company, which has about 135 employees today, is looking to go up to 300 by adding top-notch product development talent. Third, it will invest much more in its security infrastructure and in ensuring its operations are stable.

![]()

Ashish Singhal, Co-founder & CEO, CoinSwitch

The company is adding 1-1.5 million users every month, which means it must ensure that its platform can handle the influx. It expects to more than double its users to 10 million this year. “CoinSwitch provides a one-click solution for people to get into crypto, as easy as ordering food online. So they can simply come to our platform, select the currencies that they"re looking for and they can start as low as Rs. 100," says Singhal.

CoinSwitch is “highly profitable," but Tiger Global’s investment brings high-profile global recognition and validation, the entrepreneur says, who founded the company about three-and-a-half years ago with his college mates Govind Soni and Vimal Sagar Tiwari. They had previously worked at Amazon, Microsoft and Zynga, respectively.

“I think Tiger coming in with a big cheque, and valuing the company at over 500 million dollars, is not just good news for CoinSwitch, but it"s good news for the industry," Singhal says. “These are the giants who backed companies like Coinbase and paved the path for crypto in different countries."

The Coinbase Effect

Singhal’s reference to America’s largest cryptocurrency exchange Coinbase is because of its recent blockbuster public listing on the Nasdaq stock exchange. With its listing, Coinbase became a $100 billion role model for other crypto startups, and entrepreneurs like Singhal are totally pumped about it. “Getting these giants to back us, to back the India crypto story, is a very big deal for the industry," Singhal says.

“Even in the times when regulations aren’t clear, this is a stamp (of recognition) that people outside the country who have built this industry believe in where crypto is headed in India."

A publicly listed company goes through the checks and balances that every startup strives to live up to someday, so Coinbase is showing the way for others to follow. For the last ten years, it went through the same scenarios that CoinSwitch and other crypto companies in India are going through today, working to convince regulators, Singhal says.

“They have paved the path for other companies like us in delivering value, setting up the right processes and making sure that the crypto industry is accepted around the world," he says. “Now we can look up to someone and say that there is a path for legitimising this industry, creating value for your users, for innovators and for governments alike."

Coinbase gives traditional financial investors a chance to take an indirect exposure to cryptocurrencies by buying its stock on the Nasdaq, Kumar Gaurav, founder and CEO of crypto-friendly neo-bank Cashaa, tells Forbes India in an interview on April 25. Nobody was paying attention so far, but before Coinbase got listed, there have been hundreds of other crypto companies that have been listed on the Toronto Stock Exchange in Canada, for example, Gaurav says. And many Chinese investors — barred by the People’s Bank of China from directly investing in crypto — have been buying these stocks for some three years now, he says.

However, as prominent companies like Coinbase get listed, small, individual investors will also be encouraged to buy these stocks. Gaurav himself has invested in companies like Hive and Block. One. He had also considered taking Cashaa public in Toronto in 2017, but eventually decided to stay private.

Other experienced and well-known global investors are also backing Indian crypto startups. CoinSwitch itself counts Sequoia Capital as an early investor, and firms such as Ribbit Capital and Paradigm—founded in 2018 by former Sequoia Partner Matt Huang and Coinbase Co-founder Fred Ehrsam—joined the Bengaluru startup’s cap table in its $15 million Series A round announced in January. These investors have taken early bets on crypto startups worldwide and—leading up to their crypto investments in India—in most of the best-known fintech companies in India, Singhal says.

![]()

"We are very excited to invest in CoinSwitch, which we believe can become a generational technology brand in India," Nick Shalek, general partner at Ribbit Capital says in a press release when CoinSwitch announced its Series A funding. “While the crypto landscape in India remains nascent, it has been an exciting past 12 months and over time we believe India could be one of the largest global crypto markets," Matt Huang, co-founder and managing partner at Paradigm and Arjun Balaji, investment partner at Paradigm says in the same release. According to them, CoinSwitch could become the market leader in a challenging market.

“Any investor who understands the Indian market will be naturally bullish," Sumit Gupta, co-founder and CEO of Mumbai-based CoinDCX, a crypto exchange, tells Forbes India in an interview on April 25.

While local investors are concerned about the lack of regulatory clarity, international investors have seen the story play out in the US, China, Europe, Japan and Australia. They know that India will eventually favour regulating crypto, says Gupta, who is also a member of the Blockchain and Crypto Assets Council (BACC) of the Internet and Mobile Association of India, a lobby.

Global investors “see that India wouldn’t want to miss out on Internet 3.0," Singhal says. “India could be one of the global giants leading this industry rather than outright banning it." With Aadhaar, India’s unique ID system, and its unified payments interface (UPI), the country is already much ahead of many others in terms of the digital infrastructure. Crypto and its underlying technology, blockchain, “can take this infrastructure to the next billion people," he says.

Crypto plus IndiaStack

Entrepreneurs like Singhal are not the only ones talking about the value that could come out of connecting cryptocurrencies to IndiaStack, which, in addition to Aadhaar and UPI, has several other application programme interfaces that can facilitate many different services between governments and citizens, and also between private companies and individual consumers.

“How does India become a $5 trillion economy? We’ll need to close the $250 billion financing gap for India’s small businesses by attracting global, risk-tolerant pools of capital—and as iSpirt details, the rapidly growing crypto economy may be one of the key ways," Nandan Nilekani, co-founder of Indian IT services giant Infosys and former chairman of the country’s unique ID authority, wrote on the microblogging site Twitter recently.

Nilekani was adding his support to an opinion piece by iSpirt, a lobby comprising software product companies in India. India has a chance to close the small and micro-enterprise financing gap by attracting the new class of global crypto investors, the authors of iSpirt’s opinion say. By using everything the IndiaStack team has helped build over the last decade — particularly UPI, Aadhaar, GST, and the data these networks generate—India can connect the trillion-dollar crypto economy to the country’s capital-hungry entrepreneurs, they say.

“Connect crypto to IndiaStack" reads the title of a companion article to the iSpirt opinion, by Balaji Srinivasan, an investor and tech futurist, highly respected in tech and investment circles around the world. He explains that adding crypto functionality to IndiaStack alongside the digital rupee aids India’s interests in two distinct ways.

First, it helps Indians domestically, by giving them direct access to both Indian and international pools of capital. Second, it helps India internationally, by developing an open-source software stack that any country can use for both domestic and foreign transactions, without dependence on either American or Chinese corporations, he says. Srinivasan was formerly chief technology officer of Coinbase. He is also a former general partner at Andreessen Horowitz, a $16 billion venture capital firm.

The market capitalisation of all the cryptocurrencies, including the two most popular ones, bitcoin and ethereum, is more than $2 trillion today. And there are some 100 million crypto holders around the world. iSpirt and Srinivasan argue that many of them might be interested in lending to India’s small and micro-enterprise sector.

Cryptocurrencies have given rise to a world of ‘defi,’ or decentralised finance, Srinivasan says, that “is making huge pools of capital newly available to any Indian with a digital wallet, in the same way the internet made huge swaths of information available to any Indian with a cellular phone".

“If someone in the US wants to give a loan to an Indian farmer, it should be allowed. It will grow the economy," Gupta at CoinDCX says.

Gupta graduated as an electrical engineer from the Indian Institute of Technology Bombay, in 2014. CoinDCX went live in 2018 and offers spot trading, an app for individual investors to buy crypto, which has about 400,000 customers and growing, a margin trading product and a lending product. CoinDCX also facilitates more involved transactions like ‘Ethereum staking.’ Gupta is also building DCX Learn, a set of online learning modules for people to learn about cryptocurrencies — from the basics all the way to doing jobs on crypto networks.

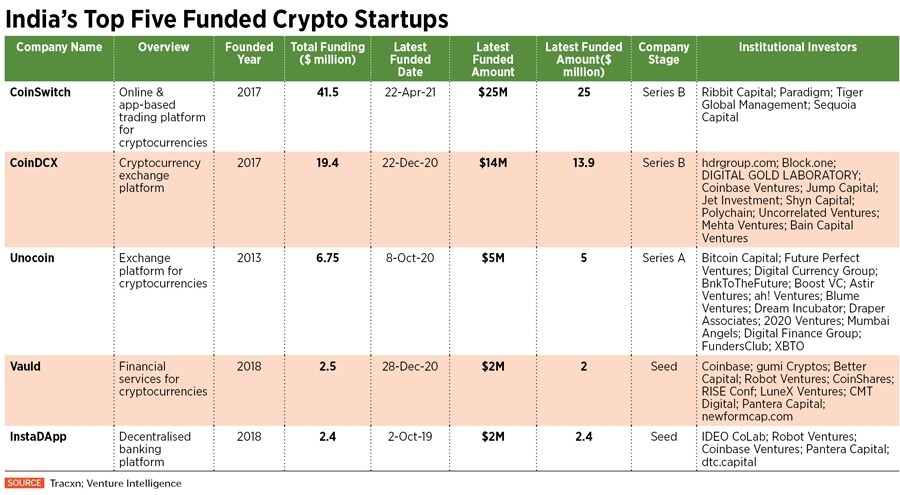

CoinDCX too has raised money from global investors. It has about $20 million in funding from seed to Series B from investors including Coinbase, Polychain Capital, Bain Capital, Temasek and Jump Capital.

India is an economy where cryptocurrencies can impact the unbanked on a very large scale, Gupta says. Blockchain-based solutions linked with Aadhaar-based identities, will help deliver multiple services to people—from tracking public distribution of ration or direct benefit transfers or even Covid-related services.

Even stock market transactions can change drastically—moving from T+2 days (trading plus two) of waiting for credit of shares or money to near-instant settlement. This is because blockchain-based solutions can disintermediate such transactions. “With blockchain, there is no party involved in the middle and you can make the entire financial system much more efficient," Gupta says.

The Unicas Experiment

One experiment in crypto-friendly banking is already underway in India, courtesy of Cashaa’s Kumar Gaurav. His banking platform is mostly aimed at businesses looking to use cryptocurrencies, with operations in Britain, Europe, Canada, US and UAE. The company serves about 1,800 customers and moved about $2 billion worth of cryptocurrencies on its network last year.

Cashaa has just started offering personal banking services in the US and India, after acquiring United Multistate Cooperative Society, a ten-year-old cooperative with 17 branches in Rajasthan, Gujarat and Delhi. The idea is to “experiment" with crypto-friendly banking services. These will include a MasterCard facility, conversion of Indian rupees to crypto currencies, loans, deposits and so on.

Gaurav started out as an engineer at Wipro, where he built navigation systems for Ferrari and BMW. Later, he built a decentralised network in 2016 for money transfer using cryptocurrencies called BTC to Bid, which became very popular as a platform that saw millions of dollars moving across it.

Unlike most crypto businesses, Cashaa is looking to open physical branches where people can go and learn about using cryptocurrencies. It has opened three so far. “If people know they can go to someone at a branch if there is a problem, there will be more trust," Gaurav says.

Connecting the real-world financial systems with cryptocurrencies, which are on a parallel infrastructure that does not talk to one’s groceries supermarket for instance, will bring crypto to everyone, Gaurav says. He is building “a solution that can bridge these two networks." For example, Cashaa offers a new type of bank account in the US, where customers can deposit dollars as well as bitcoins into the same account. And a user can have a credit card that can be used to spend both the fiat currency and the cryptocurrency on the same card.

Cashaa is looking to offer similar services in India under the name Unicas. Customers will be able to keep both Indian rupees and cryptocurrencies in the same bank account. They will be able to transfer money to other banks through a bridge that will convert the crypto into the Indian rupee and vice versa. They can take loans against their crypto holdings as collateral.

Unicas has been launched in beta mode for now. The lending service isn’t live yet. For now, people can access this service in the three crypto-friendly branches that Cashaa has opened, while an automated online version will go live in less than a month from now.

Because there isn’t regulatory clarity yet and no specific government regulatory institution dealing with crypto, “the space is like the wild wild west," in India, Gaurav says. And that’s also the problem that Cashaa is trying to solve as a banker for retail users in India.

A $10 trillion Opportunity?

The total market value of all the cryptocurrencies out there today is over $2 trillion, and Gupta believes it could jump five-fold over the next five years, “which is a long period in the world of crypto." India can “easily" capture 10-15 percent of this value, he says, with its 45 million engineers, and companies such as TCS and Infosys as a breeding ground for developers.

"‹Right now, the regulation isn’t there yet. India’s government might face some delay in bringing The Cryptocurrency and Regulation of Official Digital Currency Bill, 2021, before lawmakers for debate as other finance ministry-related bills may be prioritised, according to newspaper reports in March.

Entrepreneurs like Gupta are unfazed. “Just imagine," he says. “If the government gives the go-ahead, India can produce many multibillion-dollar businesses in cryptocurrencies."

Tiger Global"s investment in CoinSwitch Kuber big nod to the Indian crypto industry: Ashish Singhal

Scott Shleifer, Partner, Tiger Global. Image: Ben Gabbe/ Getty Images

Scott Shleifer, Partner, Tiger Global. Image: Ben Gabbe/ Getty Images