Why the used-car market has become central to luxury carmakers’ strategy

What began as a side business is now the fastest way for carmakers to woo first-time luxury buyers who gradually move on to the new-car market

At a Gurugram workshop run by Big Boy Toyz, an Audi RS Q8 was stripped down and rebuilt with Tiffany-blue leather interior, carbon-fibre detailing and a restrained exterior chrome finish. The buyer wasn’t chasing flash, nor replacing the car. He was making it his own, says Ritika Jatin Ahuja, chief operating officer of the pre-owned luxury car dealership chain.

“Customers these days get bored easily and a modification is the easiest and cheapest way to add some change plus a personal touch to your old car,” says Ahuja.

Old, in this case, is a misnomer—most luxury vehicles enter the secondary market after just three to four years of ownership. The project underscores the aspirations of a younger India which wants to express individuality, no matter the price point. And with the used-car market providing an entry point to luxury brands, millennial and Gen Z consumers are increasingly opting for pre-owned luxury over new mass market models.

The used luxury-car market is expanding primarily because it offers an accessible entry point into premium brands, supported by stronger warranties, organised retail platforms and improving resale values.

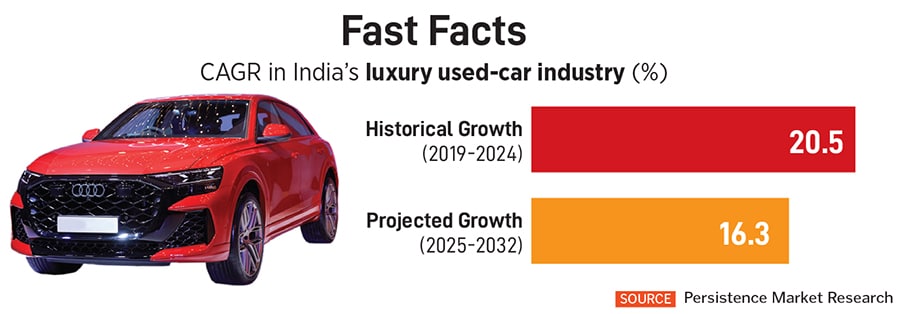

India’s used luxury car market was valued at about $4.2 billion in 2025 and is projected to nearly treble to $12.1 billion by 2032, growing at an annual pace of more than 16 percent, according to data from UK-based Persistence Market Research. Growth in new-car sales, on the other hand, is estimated to have slowed to 7-8 percent in 2025—after having seen a significant surge after the pandemic—amid geopolitical uncertainty, a volatile stock market and falling rupee.

“The 2x spike in new-car sales from 2021 to 2024 is expected to generate a substantial wave of used luxury inventory as these buyers sell their vehicles after the average shelf life of four years (slightly longer than the 2.8 to 3 years for regular cars),” says Himanshu Ratnoo, CEO of Cars24, an ecommerce platform for pre-owned vehicles.

This fresh inflow of inventory, coupled with increased buyer confidence and liquidity, is driving the current growth.

The used luxury segment is split between carmakers (they run their own certified pre-owned programmes), specialised dealerships such as Big Boy Toyz and Luxury Cart, and a growing number of online platforms such as Cars24.

Original Equipment Manufacturers (OEMs) form the backbone of the market, accounting for an estimated 34 percent of total luxury used-car sales, according to Persistence. Buyers in this segment place a high premium on brand assurance, vehicle certification, warranty coverage, and transparent ownership history.

Specialised dealers have a 23 percent share, while digital platforms is the fastest-growing channel with an 18 percent share. Unorganised local dealers (15 percent) and consumer-to-consumer transactions (10 percent) make up for the rest of the market.

BMW says its used-car business, BMW Premium Selection, has seen a 146 percent uptick compared to 2019. “In 2024, the business grew 47 percent YoY,” according to Hardeep Singh Brar, president and CEO, BMW Group India. First-time luxury buyers often enter the segment through certified pre-owned programmes, he says.

For Audi too, its pre-owned car business is a key growth driver in its business strategy. “We now have 27 Audi Approved Plus facilities operational across India, up from just seven in 2020,” says Balbir Singh Dhillon, brand director of Audi India. The business registered 5 percent growth in the first nine months of 2025.

Players across the board say customer attitudes shifted decisively after the pandemic, as buyers became more comfortable with online discovery, pricing transparency and doorstep logistics even for high-value transactions.

Rising disposable incomes and the aspirational nature of purchases, specially in Tier-2 and -3 towns, are supporting demand. A boom in entrepreneurship and social-media-driven visibility is also drawing more buyers to the segment.

“As the luxury market expands beyond metros and digital discovery increases, the certified used-car business is becoming an important growth driver, inducting more customers into the BMW family who eventually move up the ladder,” says BMW CEO Brar.

The business is increasingly seeing demand from Gen Z and millennial consumers. In terms of region, it’s a 50:50 split between the metros and Tier 2-3 cities. “In cities like Jaipur, Kochi, Chandigarh, Lucknow, more and more people are opening up to owning pre-owned luxury vehicles,” says Brar.

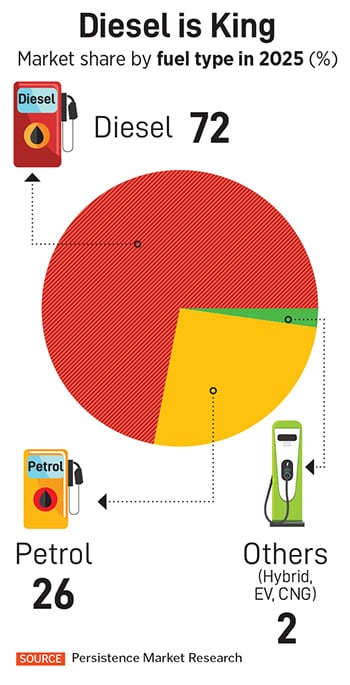

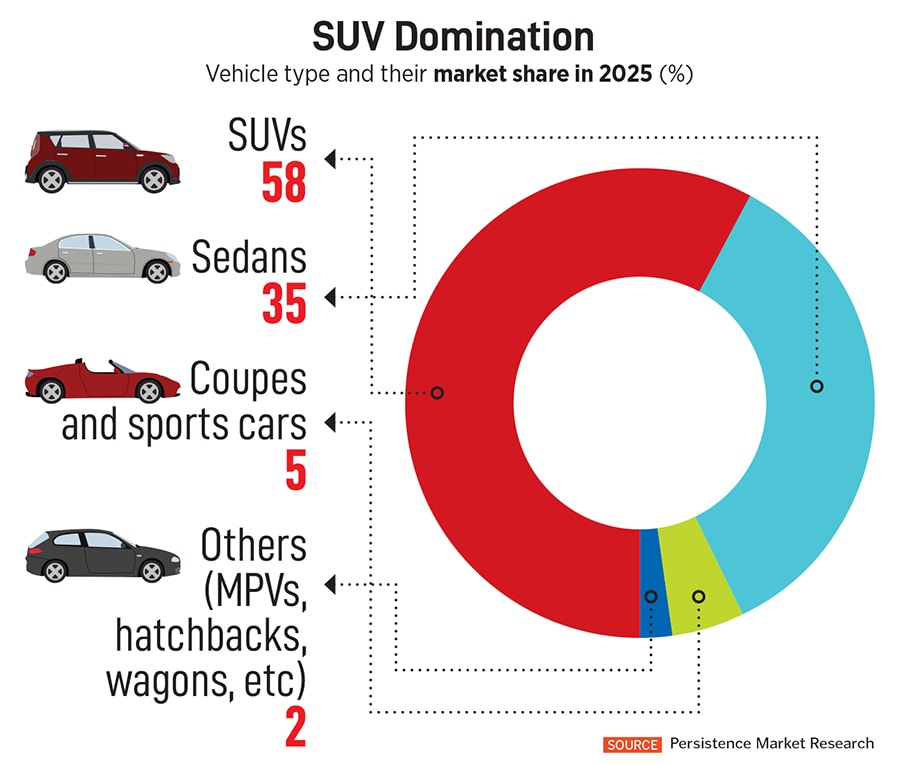

The industry is dominated by SUVs while diesel continues to account for a majority share due to its historical dominance in luxury models, according to Persistence Market Research.

What matters more than fuel type, however, is the increasing confidence, which comes from the supply side having undergone a massive transformation, feels Aditya Khandelia, managing director and partner at Boston Consulting Group (BCG). “The used-car market is now far more organised, with digital platforms, greater transparency, and trusted intermediaries. Combined with changing attitudes, this has driven the growth of the used-car market overall and the luxury segment as well.”

That confidence is showing up in the form of faster inventory churn. At Mercedes-Benz India, average holding periods for certified pre-owned vehicles have fallen to about 10 days, from as long as 35-45 days earlier, says Santosh Iyer, the company’s managing director and chief executive. “Mercedes-Benz continues to enjoy strong residual (resale) values, which is a key brand strength. We are seeing increased participation from first-time luxury buyers in their 30s, as well as customers from Tier-2 and Tier-3 cities. At the same time, demand from metro markets remains robust,” Iyer adds.

Warranty, once an afterthought and now the centrepiece, also plays a huge role. Jaguar Land Rover India offers a three-year warranty plus an additional two years, which is longer than most peers.

“This assurance directly translates into higher residual values—up to 60 percent after three years—making our vehicles among the most desirable in the pre-owned luxury segment,” says Rajan Amba, managing director, JLR India.

“Through our Approved Programme, customers can easily exchange their existing vehicles for new ones at current ex-showroom prices, ensuring a seamless upgrade experience,” he adds.

Also Read: India-EU FTA could reshape luxury carmakers’ India strategy

Traditionally, there was a stigma attached to owning a used car but that’s changing with the younger generation. Now, there is far less hesitation around buying used products in general.

What also appeals to this section of buyers is the access to a wide range of products and faster introduction of new features and technology.

The availability of financing options is another big factor. “The availability of financing for vehicles in the ₹40-50 lakh+ bracket has improved liquidity,” says Cars24 CEO Ratnoo. A broader buyer pool now accesses easy, competitive financing, largely due to new non-banking financial companies (NBFCs) and banks entering the used luxury-car loan market.

Furthermore, the extension of warranty programmes provides a vital trust marker, feels Ratnoo. It is probably why demand has been outstripping supply in the used-car market even though prices have surged over the past few years.

Prices for 10-year-old luxury cars have risen 25-30 percent (from ₹4.2-4.5 lakh pre-Covid to over ₹5.5-5.75 lakh now), says Cars24. It is driven by a significant hike in new luxury car prices and the increased social acceptance of luxury ownership. “Demand for more affordable pre-owned luxury vehicles currently exceeds supply, as recent new car sales haven’t yet replenished the 10-year-old used car market,” says CEO Ratnoo.

Customers in the used luxury-car market, while inherently price-sensitive, are increasingly prioritising trust and value. Programmes like extended warranties, detailed service history, and pre-delivery inspections are vital, often tipping the decision balance, says Ratnoo.

A clear trend, he notices, is people trading up. As customers browse a wider assortment across brands, average selling prices typically rise 10-15 percent between initial search and final booking.Consequently, key factors in the purchase decision are the ease of discovering options across geographies, securing the best price, and simplified financing.

For carmakers, the implications run deeper than volumes. Harshvardhan Sharma, who heads the auto retail practice at Nomura Research Institute, feels the used luxury market is no longer a residual outlet but a strategic lever bringing first-time luxury buyers into OEM-certified ecosystems. “Strong warranties, predictable buyback values and easier financing stabilise resale prices, lower the perceived cost of ownership and encourage faster upgrade cycles,” he says.

When certified used cars come with extended warranties, transparent buyback values, and easier financing, resale prices stabilise. Customers gain confidence that their car will retain value after three-five years.

If a buyer knows they can exit predictably via OEM-backed buybacks or exchange programmes, the effective cost of owning a new luxury car declines, even if the sticker price is higher. Also, easier resale and financing encourage customers to upgrade sooner. “This increases repeat purchase rates and reduces OEM dependence on first-time buyers, allowing firmer pricing on new models,” says Sharma.

And when used-car prices are firm and liquid, OEMs face less pressure to discount new cars to “clear the gap”. A healthy used market acts as a buffer, he says, absorbing price sensitivity that would otherwise spill into new-car negotiations.

Once a side business, the used-car ecosystem is no longer just supporting the luxury market—it is helping shape it.

First Published: Jan 29, 2026, 17:29

Subscribe Now