Ideas for profit: Slow but steady growth is what's reassuring about Infosys' Q1 show

Stability in senior leadership, well chalked out execution strategy, better demand environment, generous payout and opportunities from a weaker rupee-dollar protects downside for the stock

Madhuchanda Dey

Moneycontrol Research

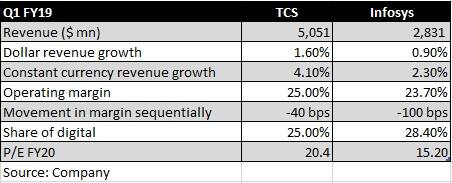

Infosys had a soft start to the year as it stepped up investments to be future ready, which resulted in a dent in operating margin. Momentum in large deal wins was strong with the commentary on order pipeline and financial services vertical comforting. While the Q1 result by no means had the spark of its peer Tata Consultancy Services, we took comfort from stability in the senior management and step up in investment (albeit delayed) to be ‘digital ready'.

In the past 3 months, while the stock has outperformed the Nifty, it has performed in line with the IT index. Its large discount to TCS is unlikely to narrow in the near future unless the virtuous cycle kicks in. At 15.2 times FY20e earnings, the stock leaves enough headroom for upside should the strategy yield expected results. The generous payout policy protects the downside while the rupee's appreciation versus the dollar could be a surprise upside going forward.

Quarter at a glance

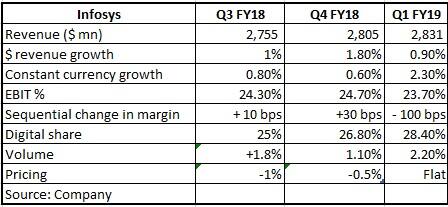

Infosys reported revenue of $2,831 million, a sequential (quarter-on-quarter) growth of 0.9 percent in reported currency and 2.3 percent in constant currency. In line with its peers, the digital business grew much faster at 8 percent sequentially and 25.6 percent year-on-year (YoY) in constant currency and constituted 28.4 percent of revenue.

In terms of geographies, while the rest of the world business handsomely outperformed the company average on a smaller base, its core market of North America (share of over 60 percent) also showed a sequentially higher growth in the quarter gone by.

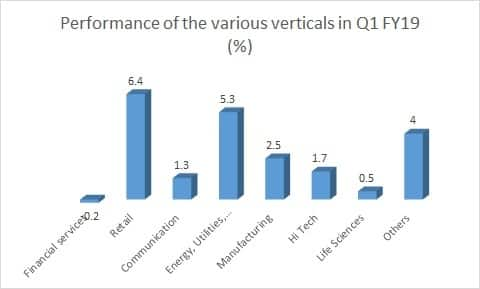

In terms of verticals, the performance of retail, energy, utility, manufacturing and insurance were strong. While reported growth of its key vertical - financial services - was lacklustre, the management sounded confident about its revival in the next couple of quarters. It reported 40 percent of large deal wins from this vertical in Q1.

Source: Company

What's wrong with margins?

The management had guided at a lower operating margin band of 22-24 percent on account of a step up in digital investments. The 100 basis points QoQ decline in operating margin to 23.7 percent wasn't a surprise altogether.

Infosys hiked wages for about 85 percent of its employees, which impacted margins negatively by 100 basis points (bps). The latter was offset by currency opportunities. Reduction in onsite mix, which fell to a 12 quarter low of 28.6 percent, and higher share of digital and utilisation contributed to a 40 bps margin improvement. But this was totally negated due to increased investments that shaved off 140 bps from margins, resulting in a net reduction of 100 bps.

Lower headline profitability was contributed by a reduction in the fair value of Disposal Group (Panaya) that has been held for sale amounting to Rs 270 crore.

Strong deal wins

Despite the rather uninspiring headline performance, what we liked in the earnings report was the management's commentary on a positive environment. While TCS has already turned the corner with respect to BFSI (banking, financial services and insurance), Infosys' management too guided at a revival in this vertical. Of the 8 large deal wins, it said 7 were from the US, 2 were from financial services and 3 from retail.

Source: Company

While we are concerned about the all-time high attrition of 20.6 percent, net employee addition remains strong and points to a better demand environment. Although the high utilisation rate limits the near term margin upside, especially since planned investments would continue, we see structural upside to margin from the higher share of digital (with higher gross margin) and deployment of the onsite pyramid structure (with stepping up of local hires). Cyclically, further weakening of Indian currency could act as a tailwind.

We are taking a note of the revenue per employee inching up. But the same is not yet suggestive of a level expected from a pure digital company. We would like to monitor this metric closely.

Infosys has integrated its latest acquisition: WONGDOODY (the US-based full-service creative and consumer insights agency). Despite this, the management retained its FY19 revenue guidance at 6-8 percent and operating margin guidance at 22-24 percent. It remains to be seen if it turns out to be a year of ‘under promise and over delivery'.

What to expect from the stock?

We expect a slow and steady trajectory for the company which will certainly be devoid of the spark seen in TCS. The valuation gap with TCS is unlikely to narrow in a hurry. However, its payout policy is now well-defined (at least 70 percent of free cash flow) and remains generous at a pre-tax yield of 4.7 percent. Incidentally, Infosys announced a 1:1 bonus issue commemorating its 25th year of listing.

Stability in senior leadership, well chalked out execution strategy, better demand environment, generous payout and opportunities from a weaker rupee-dollar protects downside for the stock. Valuation too looks undemanding at 15.2 times FY20e earnings. Hence, Infosys is an ideal entry in a portfolio with an eye on the long term.

Original Source: https://www.moneycontrol.com/news/business/moneycontrol-research/ideas-for-profit-slow-but-steady-growth-is-whats-reassuring-about-infosys-q1-show-2715361.html